2 "Magnificent Seven" Stocks Down 19% and 25% You'll Wish You'd Bought on the Dip

The stock market is off to a shaky start to 2025, with the S&P 500 (SNPINDEX: ^GSPC) index down nearly 12% from its recent all-time high. With that said, it's coming off back-to-back annual gains of more than 25% in both 2023 and 2024, which is something it has only achieved on one other occasion in its history dating back to 1957. Markets don't move up in a straight line, so periodic weakness is a completely normal part of the investing journey.In fact, the recent sell-off is giving investors a rare chance to buy some of America's highest-quality stocks at a discount. There is a particular group of stocks called the "Magnificent Seven," which earned their nickname for their size, their leadership positions in their respective industries, and their tendency to lead the broader market higher. The group has a combined value of $14.3 trillion, and it includes:The two Magnificent Seven stocks I want to focus on today are Microsoft and Amazon, which are currently down 19.7% and 25.8% from their all-time highs, respectively. Investors can buy both of them at the cheapest level in years based on one traditional valuation metric, and considering their leadership positions in hypergrowth industries like artificial intelligence (AI), here's why that might be a great idea for the long term.Continue reading

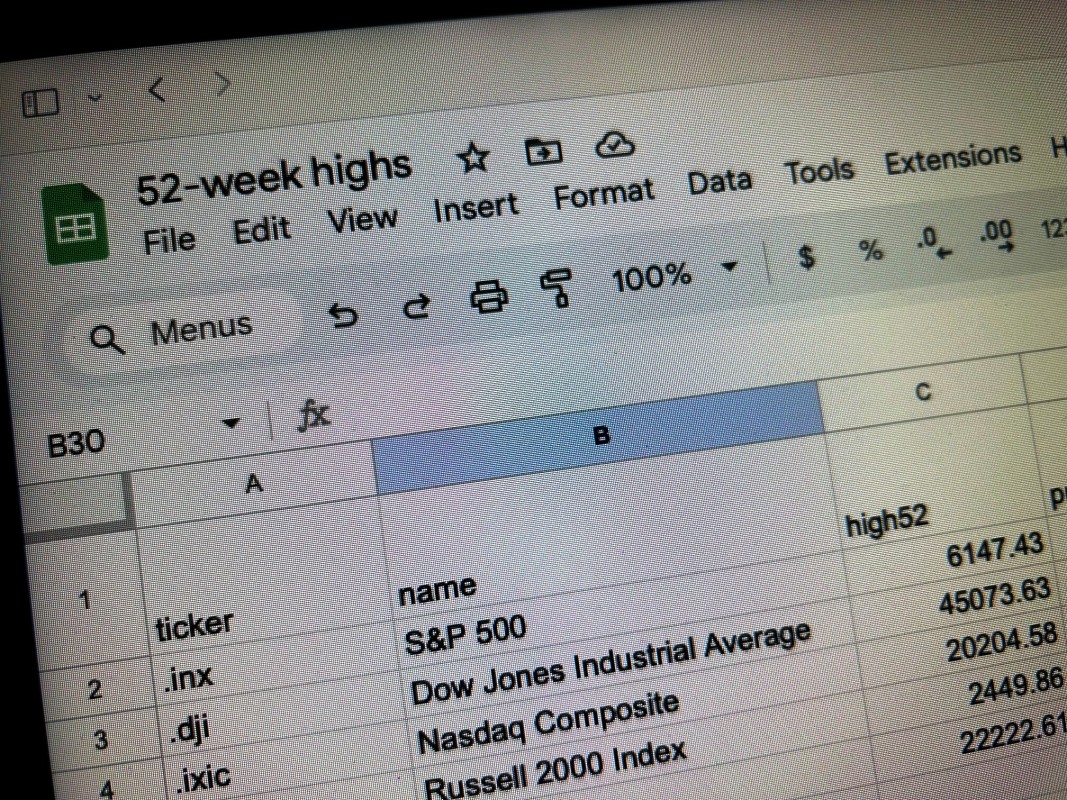

The stock market is off to a shaky start to 2025, with the S&P 500 (SNPINDEX: ^GSPC) index down nearly 12% from its recent all-time high. With that said, it's coming off back-to-back annual gains of more than 25% in both 2023 and 2024, which is something it has only achieved on one other occasion in its history dating back to 1957. Markets don't move up in a straight line, so periodic weakness is a completely normal part of the investing journey.

In fact, the recent sell-off is giving investors a rare chance to buy some of America's highest-quality stocks at a discount. There is a particular group of stocks called the "Magnificent Seven," which earned their nickname for their size, their leadership positions in their respective industries, and their tendency to lead the broader market higher. The group has a combined value of $14.3 trillion, and it includes:

The two Magnificent Seven stocks I want to focus on today are Microsoft and Amazon, which are currently down 19.7% and 25.8% from their all-time highs, respectively. Investors can buy both of them at the cheapest level in years based on one traditional valuation metric, and considering their leadership positions in hypergrowth industries like artificial intelligence (AI), here's why that might be a great idea for the long term.