$15k a Month, or $2.9m Once? Which One Makes More Sense for Us Right Now?

When you think about the different ways you can earn money for retirement, pension plans don’t come up nearly as often as they used to. Sadly, pensions were far more common during the baby boomer era, when people tended to stick with one company for decades. However, in the case of one Redditor posting on […] The post $15k a Month, or $2.9m Once? Which One Makes More Sense for Us Right Now? appeared first on 24/7 Wall St..

When you think about the different ways you can earn money for retirement, pension plans don’t come up nearly as often as they used to. Sadly, pensions were far more common during the baby boomer era, when people tended to stick with one company for decades.

Key Points

-

It can be life-changing if you are fortunate enough to have a substantial pension.

-

This individual and her spouse must choose between monthly payments or a lump sum.

-

The lump sum is often the smart move to protect against a company going bankrupt.

-

Over 4 Million Americans set to retire this year. If you’re one, don’t leave your future to chance. Speak with an advisor and learn if you’re ahead, or behind on your goals. Click here to get started.

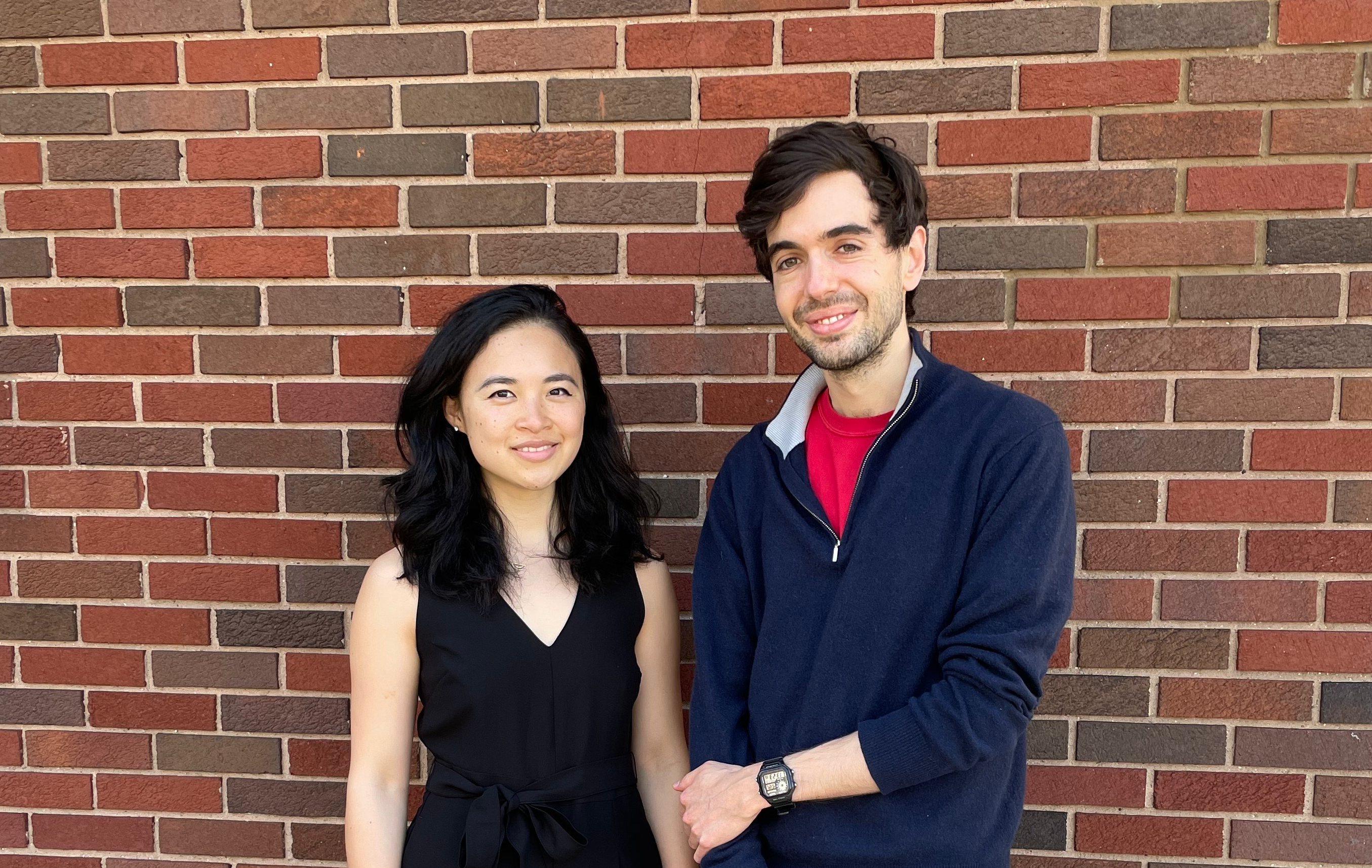

However, in the case of one Redditor posting on r/ChubbyFIRE, there is a question about how to take the husband’s pension. He can either take a lump sum of $2.9 million or a monthly payment of $15,600 with 100% spousal survivor benefits. So, what’s a Redditor to do?

The Scenario

Ultimately, no matter how you look at this, it’s easy to see why this couple posted in the r/ChubbyFIRE subreddit. With a net worth of around $4.8 to $5 million, the couple is already in a good place to leave the workforce.

However, the real question is focused on this pension plan, which can again be received as a lump sum payment of $2.9 million or broken into monthly payments of $15,600 with a 100% spousal survivor benefit. It’s important to note that no matter how this money is received, there is no cost-of-living increase.

In addition to everything this female (52) and male (51) have put away, they will also have a combined $65,000 in Social Security payments due annually starting at 67. Wait, there’s more as this couple will also receive “retiree healthcare” from the husband’s job, so they won’t have to pay any other insurance when the husband retires at 60, and then when they transition to Medicare, the retiree medical plan becomes secondary so no need for a supplemental plan.

Two Paths Forward

If a decision had to be made right now, the wife and original poster indicate that the husband is leaning toward the monthly payments. He believes that this would allow them to avoid touching other assets, which would continue to grow, and instead rely on the pension as a source of income.

Unfortunately, the original poster disagrees and wants the lump sum payment because there is no COLA, which would mean losing out to inflation as time goes on. With the lump sum, the original poster wants to put this money into their portfolio and allow it to grow, which means more money that could be left to their child, who will be a college graduate by the time the parents turn 60.

What Is the Right Decision?

Thankfully, the Redditor adds more color by indicating that she has done some homework. With a lifespan of 85-90, the lump sum would allow a 5.03% market return. However, if the lifespan increases to 90-92 years of age, the rate of return rises to 5.33%.

Better yet, the Redditor also indicates that if they roll the lump sum directly into an IRA, they can avoid paying taxes on the whole amount at once. However, they would then have tax liabilities when they start making withdrawals.

Things become more apparent when the Redditor remarks the couple only needs around $120,000 to live on during retirement, which means that either solution would work.

The Math

If you take the monthly payment scenario with $15,600 x 12, you end up with $187,200, which is more than enough net (after taxes) to cover the couple’s $120,000 needs. Of course, this is also before a $65,000 Social Security bump at 67.

On the flip side, if you have close to $8 million invested (current savings + lump sum), you could see more than $320,000 annually coming out (4% SWR), or $243,000 net (after taxes), and again, before Social Security and earning even more interest over the next 30 years. Ultimately, because there is no cost-of-living bump, the smart math says to take all the money upfront, switch it to an IRA, and start taking it out as a 4% safe withdrawal.

If this were me, I would take the lump sum and never look back, something the Redditor fully acknowledges when she says all of her calculations “point to the lump sum with modest market returns being the better option.”

No Easy Answer

The bottom line is that there is no easy answer here, as both scenarios paint a picture of this couple’s super comfortable retirement. Both options give them enough money to cover their bills and travel more, have a cushy emergency fund, and take care of their son’s 529 without worrying about touching much of the principal.

The post $15k a Month, or $2.9m Once? Which One Makes More Sense for Us Right Now? appeared first on 24/7 Wall St..