With Many Upcoming Trade Agreements….INVEST TO WIN!

Investing is rooted in one’s assessment of what the future will bring. With the UK trade deal announced, and 17 others submitted for finalization, these are very positive indicators. However, this article involves educated guessing of US products that would have significantly reduced tariffs, and could be exported in significantly greater quantities. Since reciprocal tariffs […] The post With Many Upcoming Trade Agreements….INVEST TO WIN! appeared first on 24/7 Wall St..

Key Points

-

Qatar and the UK placed orders of over $100 billion with Boeing

-

The US could export nearly 600,000 more cars to the EU, to match European Imports

-

The US should be delivering huge quantities of natural gas to Europe and Asia

- Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Investing is rooted in one’s assessment of what the future will bring. With the UK trade deal announced, and 17 others submitted for finalization, these are very positive indicators. However, this article involves educated guessing of US products that would have significantly reduced tariffs, and could be exported in significantly greater quantities.

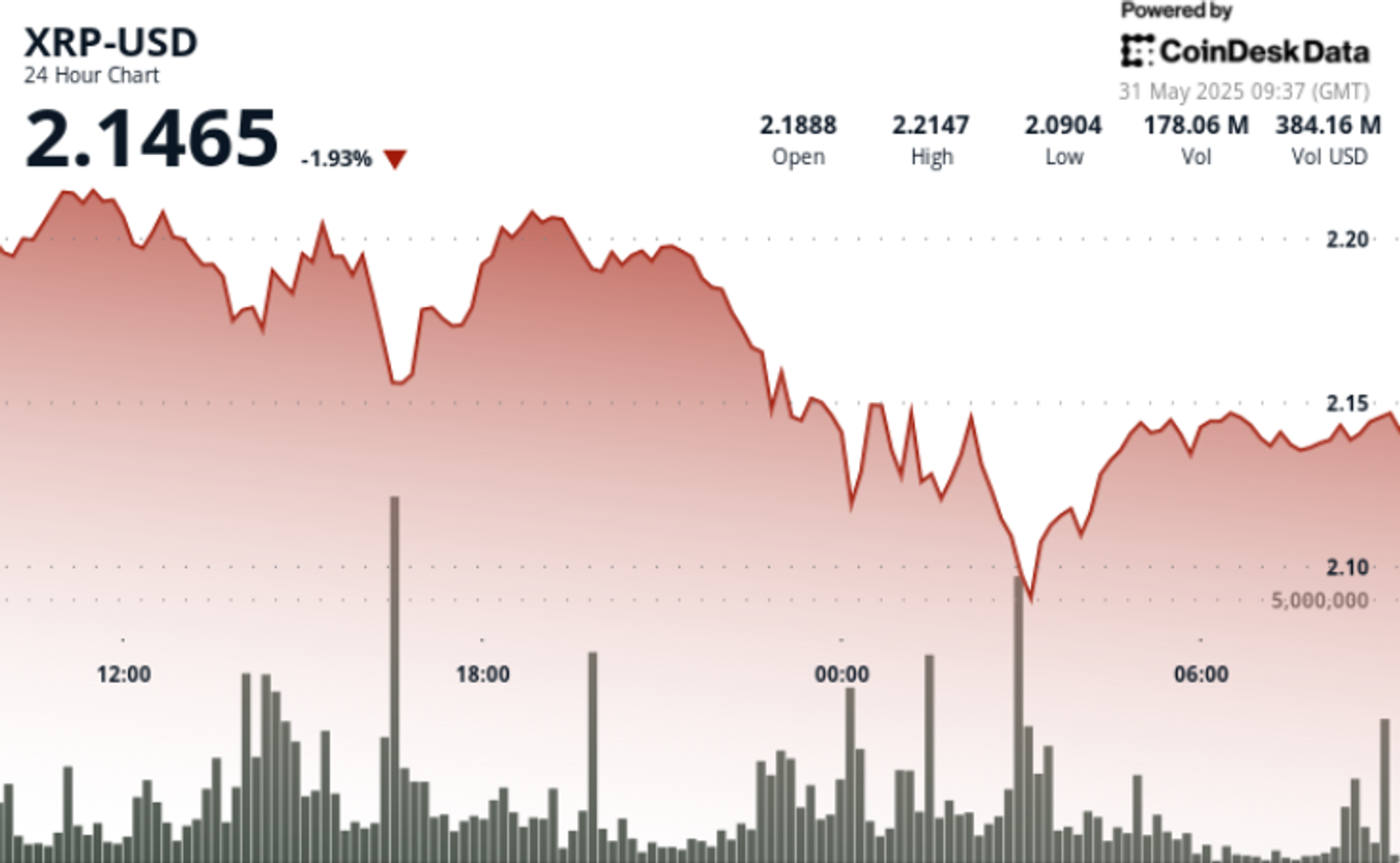

Since reciprocal tariffs were announced, the DOW has experienced great volatility. This is due not only to temporarily increased product costs, (although many tariffs were paused or reduced), but also to the uncertainty of delivering vital trade agreements. However, with the US consuming 36% of the world’s goods, we hold a pair of aces in the poker game of trade negotiation.

Although the EU, Vietnam, India, and Israel offered 0% tariffs, and 130 countries submitted new trade proposals (per the Director of the National Economic Council, Kevin Hassett); the most significant question is if the US will realize far greater penetration of large markets in China, India, Europe, which comprise a population of 3.5 billion people. Additionally, we seek to have a greater presence in many other countries that either blocked or severely restricted importation of American agricultural products and livestock, such as Australia, Japan, and the EU.

GROWTH STOCKS POISED TO BENEFIT FROM NEW TRADE DEALS

Boeing (NYSE: BA), procured $106 billion of orders in the last two weeks, and is up 47% since April 4. Morningstar has a 4 Star rating for Boeing, with a fair value estimate 19% above the current stock price. I am not a huge fan of ratings, but of common sense, simply thinking that with $106 billion of new orders, Boeing should be good for the long term. Yes, there are risks such as plane crashes or recalls, but with a backlog of 5 years of orders, I am with Morningstar on this.

EXPORTING NATURAL GAS TO EUROPE CHENIERE (NYSE: LNG)

All of us are aware that Europe unfortunately invested greatly in expensive and unreliable green energy, and became more dependent upon Russian oil.

LNG is much cleaner than oil or coal, and has helped the US become a world leader in reducing carbon emissions, which are down about 20% since 2007. Yet, the Biden administration had stopped US exports of natural gas to Europe, which Trump reinstated.

Cheniere Energy is the largest US exporter of liquified natural gas, and is the world’s second largest producer of LNG. Cheniere has been investing in plant expansion for exports, as the EU and many other nations need our LNG. I believe sales will be very high, particularly to the UK and other cold countries across the pond this winter.

GENERAL MOTORS (NYSE: GM)

Regarding trade with the EU, the key question is if American automobile manufacturers will be given greater access to European markets. In 2024 we imported 750,000 cars from the EU, but exported only 169,000. My financial assessment on this, is, “that doesn’t seem fair!”

Hopefully a new trade agreement with the EU would allow for the export of many hundreds of thousands of American vehicles, for which the EU’s offer of zero tariffs was an excellent start for negotiations. Regardless, I believe GM is an excellent long-term hold, with combined domestic and global investment of $10 trillion or more in the US, and with tax cuts likely to be legislated. Millions of jobs will be created in the US, stimulating auto sales.

American automakers had lost billions from environmental regulations requiring new vehicles to average around 50 mpg. The good news, those regulations and California EV mandates were just repealed. GM’s stock price is under $50, however, the Morningstar fair value estimate is $75. To me, that means buy.

TYSON FOODS (NYSE: TSN)

Tyson is down 13% since March 31, 2025, but is the largest exporter of American beef. Although we import $3 billion of Australian beef, non tariff barriers have wholly excluded US meat exports to Australia, and limited exports to Europe. With tax cuts and better trade deals looming, and trillions of dollars of investment flowing into the US, a prediction is that the US will do well, and Americans will eat more beef. Your honor, I rest my case!

With the best possible foresight, the blue chip stocks of world leading American companies producing aircraft, energy, automobiles, livestock and agricultural products should perform very well in the coming years.

The post With Many Upcoming Trade Agreements….INVEST TO WIN! appeared first on 24/7 Wall St..