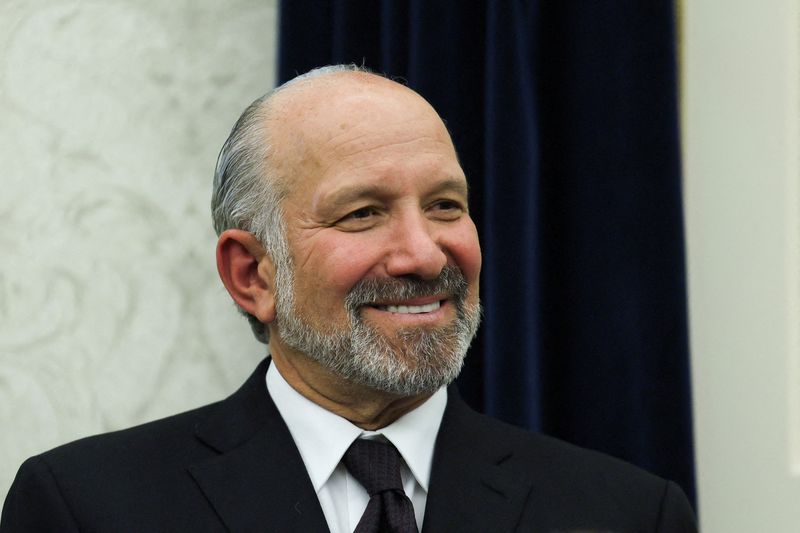

47% of Berkshire Hathaway's $276 Billion Warren Buffett-Led Portfolio Is Invested in 3 Dividend Stocks

When Warren Buffett steps down as the CEO of Berkshire Hathaway at the end of this year, he will leave behind a legacy as perhaps the greatest investor of his time. As of the end of 2024, Berkshire Hathaway stock had gained an astounding 5,502,284% since Buffett took it over, and one way he turned it into a trillion-dollar company was by investing not in hot growth stocks, but strong value stocks.One feature Buffett loves in a stock is a dividend. Paying dividends suggests a company is mature, stable, and committed to rewarding shareholders -- all attributes that reinforce an investment thesis. Not all of the stocks in Berkshire Hathaway's $276 billion equity portfolio pay dividends, but most do.Its top three holdings -- Apple (NASDAQ: AAPL), American Express (NYSE: AXP), and Coca-Cola (NYSE: KO) -- all do, and together, they account for almost half of the portfolio. Let's consider what makes them such winners by Buffett's standards.Continue reading

When Warren Buffett steps down as the CEO of Berkshire Hathaway at the end of this year, he will leave behind a legacy as perhaps the greatest investor of his time. As of the end of 2024, Berkshire Hathaway stock had gained an astounding 5,502,284% since Buffett took it over, and one way he turned it into a trillion-dollar company was by investing not in hot growth stocks, but strong value stocks.

One feature Buffett loves in a stock is a dividend. Paying dividends suggests a company is mature, stable, and committed to rewarding shareholders -- all attributes that reinforce an investment thesis. Not all of the stocks in Berkshire Hathaway's $276 billion equity portfolio pay dividends, but most do.

Its top three holdings -- Apple (NASDAQ: AAPL), American Express (NYSE: AXP), and Coca-Cola (NYSE: KO) -- all do, and together, they account for almost half of the portfolio. Let's consider what makes them such winners by Buffett's standards.