Will Stablecoins Kill Visa's Cash Cow?

Legislation is scaring investors out of the stock.

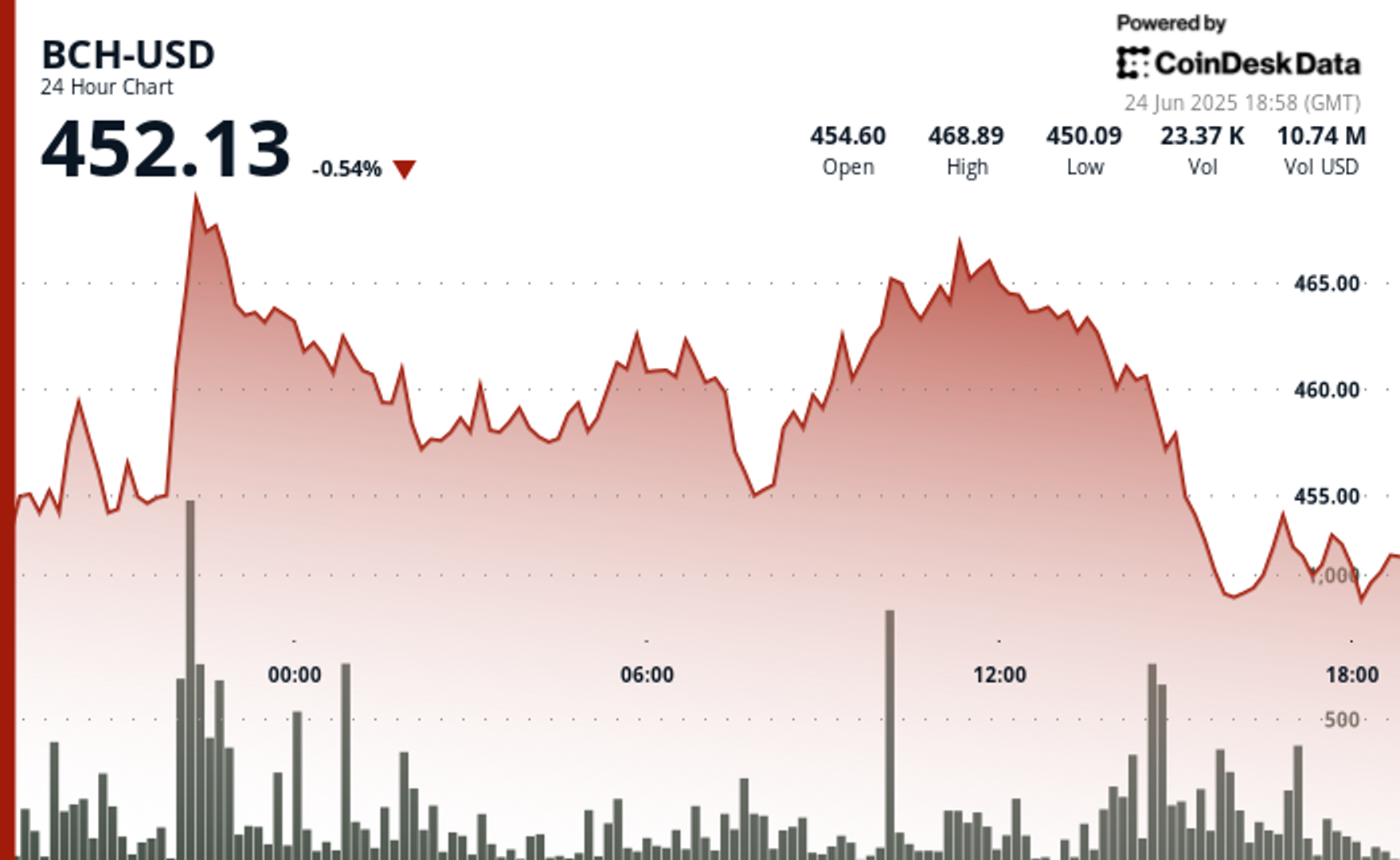

Cryptocurrency is threatening Visa's (NYSE: V) business again in the form of stablecoins -- at least, that's today's narrative. The payments-network giant is down almost 10% from all-time highs, likely due to new stablecoin legislation that's working its way through Congress. Merchants and financial technology players are building acceptance of these cryptocurrencies as a way to pay for goods and services, perhaps circumventing Visa altogether.

What are stablecoins? Do they pose a threat to Visa's business? Here's why you can rest easy holding Visa stock in your portfolio today, despite these blustery headlines.

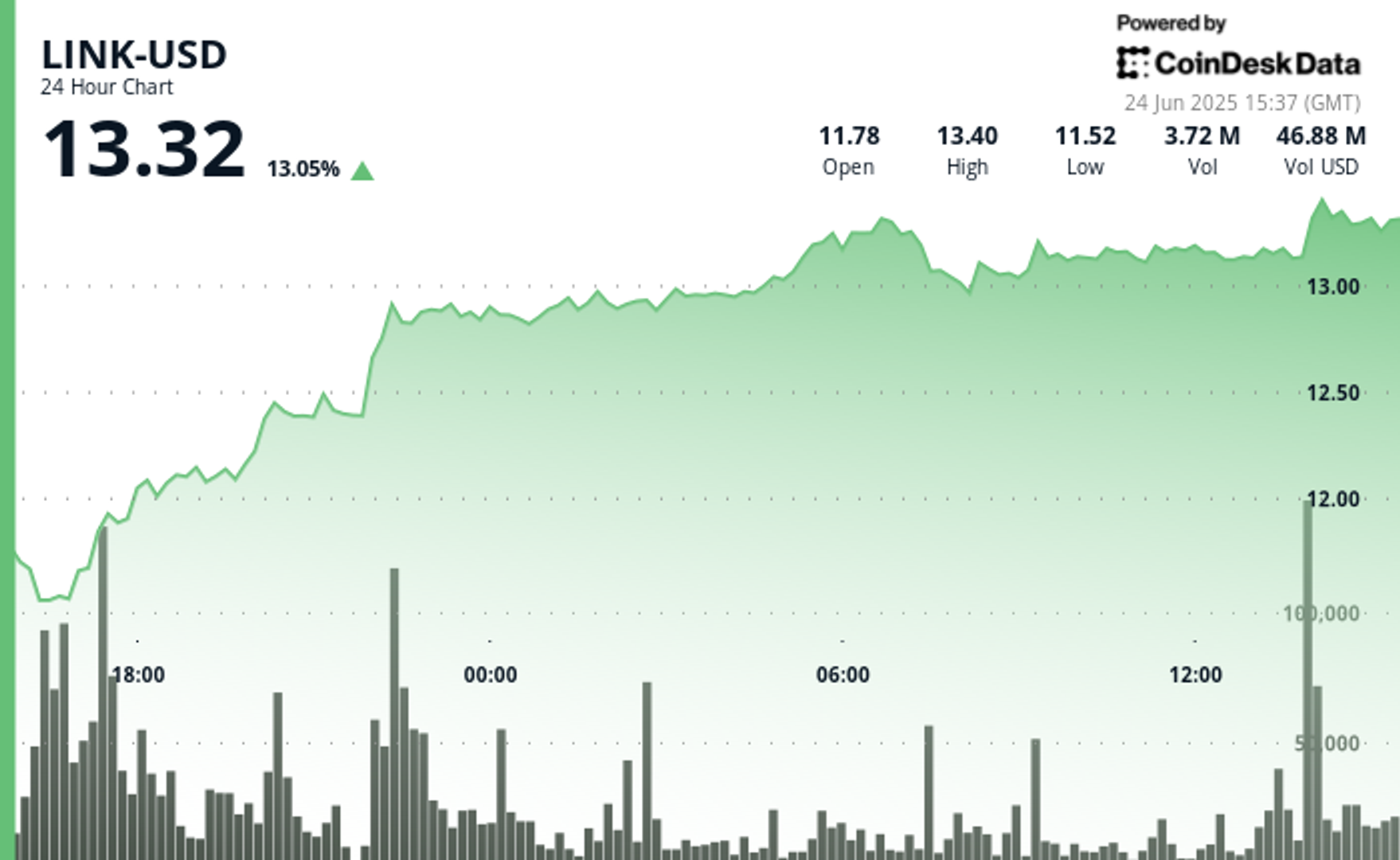

Stablecoins are cryptocurrencies with a value pegged against a fiat currency, such as the U.S. dollar. Circle's USDC stablecoin is (theoretically) always available to exchange 1-for-1 for U.S. dollars, making it a currency more reliable than Bitcoin.