Why Wall Street Is Punishing Palantir, Tesla and MicroStrategy Today

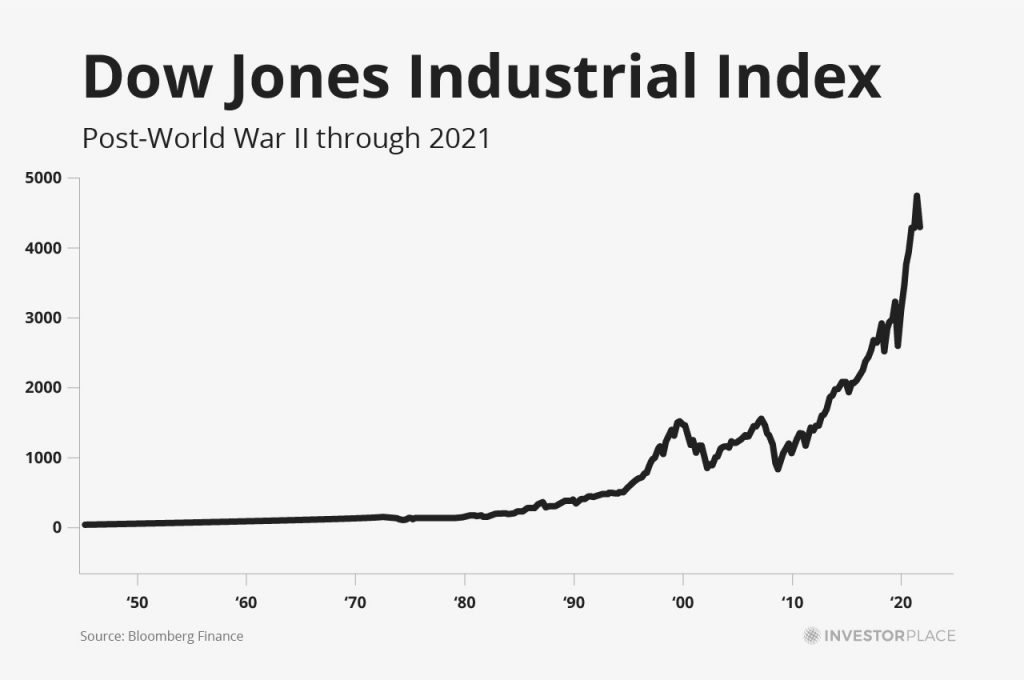

The tariffs-inspired stock market rout that began last week picked up steam on Monday, with the SPDR S&P 500 ETF Trust (NYSE: SPY) falling about 2.1% through noon ET, and the Nasdaq off 3.4%. Searching amongst the rubble, three stock selloffs stand out. Microstrategy (Nasdaq: MSTR) stock is down 11% at the mid-day mark as […] The post Why Wall Street Is Punishing Palantir, Tesla and MicroStrategy Today appeared first on 24/7 Wall St..

The tariffs-inspired stock market rout that began last week picked up steam on Monday, with the SPDR S&P 500 ETF Trust (NYSE: SPY) falling about 2.1% through noon ET, and the Nasdaq off 3.4%. Searching amongst the rubble, three stock selloffs stand out.

Key Points

-

Microstrategy stock follows Bitcoin price lower.

-

Palantir shares slump on worries over a too-high stock price.

-

Tesla is losing sales in China to archrival BYD.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

Microstrategy (Nasdaq: MSTR) stock is down 11% at the mid-day mark as the company’s “strategy” for turning itself into essentially a warehouse for Bitcoins (Crypto: BTC) proves a double-edged sword. Bitcoin’s value has been falling more or less steadily for a week, and is currently down 11.5% after losing another 3.5% today.

Since Microstrategy doesn’t really have much of a business of its own anymore (it reported losses of $1.2 billion on less than $500 million in revenue last year), the “stock” is really just a reflection of whether investors think Bitcoin is going up or down. Right now the answer to that question is: “down,” and so that’s where Microstrategy stock is heading as well.

Palantir (Nasdaq: PLTR) shares are down 6.5% today, too, which is a little strange since the only Palantir news today is good. This morning, space company Voyager Technologies announced it’s expanding its use of Palantir AI software to enhance “space domain awareness,” or tracking of orbital satellites and debris to reduce collision risk.

So what’s got investors upset about Palantir? It’s probably not that contract at all, but rather simple fear that the broader stock market decline makes it relatively riskier to hold onto a highly valued stock like Palantir. At more than 72 times trailing sales, and 447 times trailing earnings, Palantir stock is quite expensive. It’s also tripled in price over the past year, meaning investors have two good reasons to sell Palantir right now: (1) to avoid losing money, and (2) to lock in some of the impressive paper profits they’ve already accrued.

Tesla (Nasdaq: TSLA) stock is off about 9.8% as I write this, and you may be surprised to learn that Tesla’s decline in share price is the one with the most factual basis explaining it. In a report out on Bloomberg this morning, the news agency noted that Tesla shipments in China in February are down an astounding 49% year over year. In contrast, the company’s local archrival BYD (OTC: BYDDF) grew its sales 161% year over year.

BYD now owns nearly a 15% share of the Chinese market while Tesla’s share has shrunk to less than 5%. When you consider that at one time, Tesla considered China its biggest growth opportunity, the fact that BYD is kicking Tesla’s trunk in China explains why investors aren’t at all enthusiastic about owning Tesla stock right now.

The post Why Wall Street Is Punishing Palantir, Tesla and MicroStrategy Today appeared first on 24/7 Wall St..