Why stagflation may not be the biggest threat to the economy right now

Despite Fed warnings, stagflation risks may be overblown.

The Federal Reserve has recently warned about the possibility of stagflation hitting the U.S. economy, but some believe the threat may be overblown. Ted Thatcher, President of Bright Lake Wealth Management, joined TheStreet to discuss why stagflation may not be the biggest risk to the economy right now.

Related: Why the U.S. consumer may be reaching a breaking point

Full Video Transcript Below:

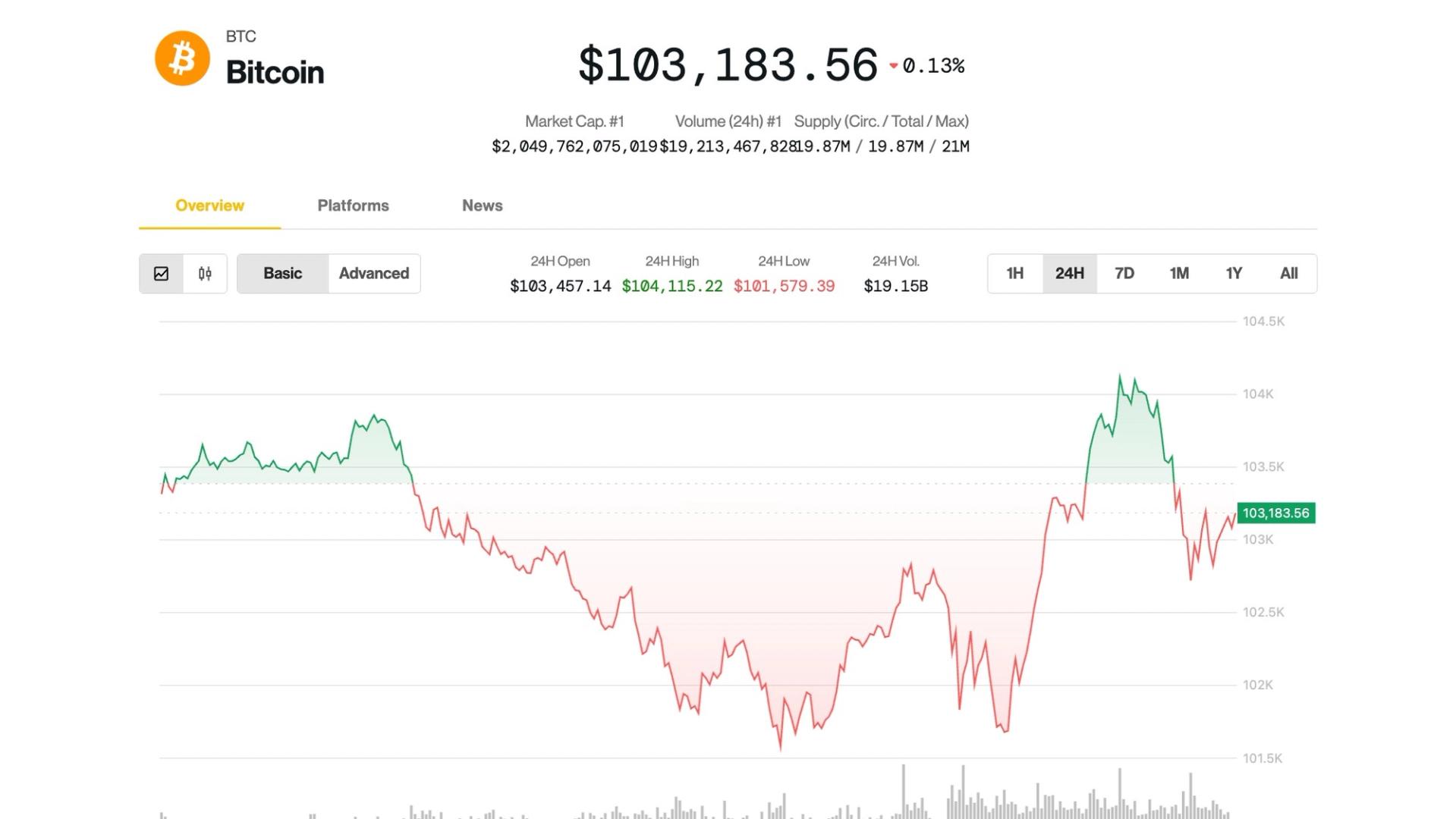

TED THATCHER: We've only seen one specific time in history where stagflation was a huge, huge problem. And so, of course, Powell, pointing to the concern of stagflation is a very big scary thing and certainly something the Fed should be watching out for. I don't know if we're seeing all the signs of stagflation yet. I certainly wouldn't go that far. I actually see a lot of concern in the marketplace. We've seen the consumer sentiment and consumer confidence numbers come down further and further. They've slid and slid since the beginning of the year.

I think one measure was Americans are expecting more and more unemployment at the highest expected rate since 2009. Now, that hasn't borne out in the labor numbers yet, but that speaks to the uncertainty the average American has. And so, does that say stagflation to me. Not necessarily. Obviously, all the tariff stuff could cause rising prices. If those tariffs don't come to fruition, though, that might be a reprieve. And I do think Powell getting the criticism of Mr. Too late as it were is sort of an earned criticism. I think a lot of economists would point to how late the Fed started rate hikes and properly point out that he took too long.

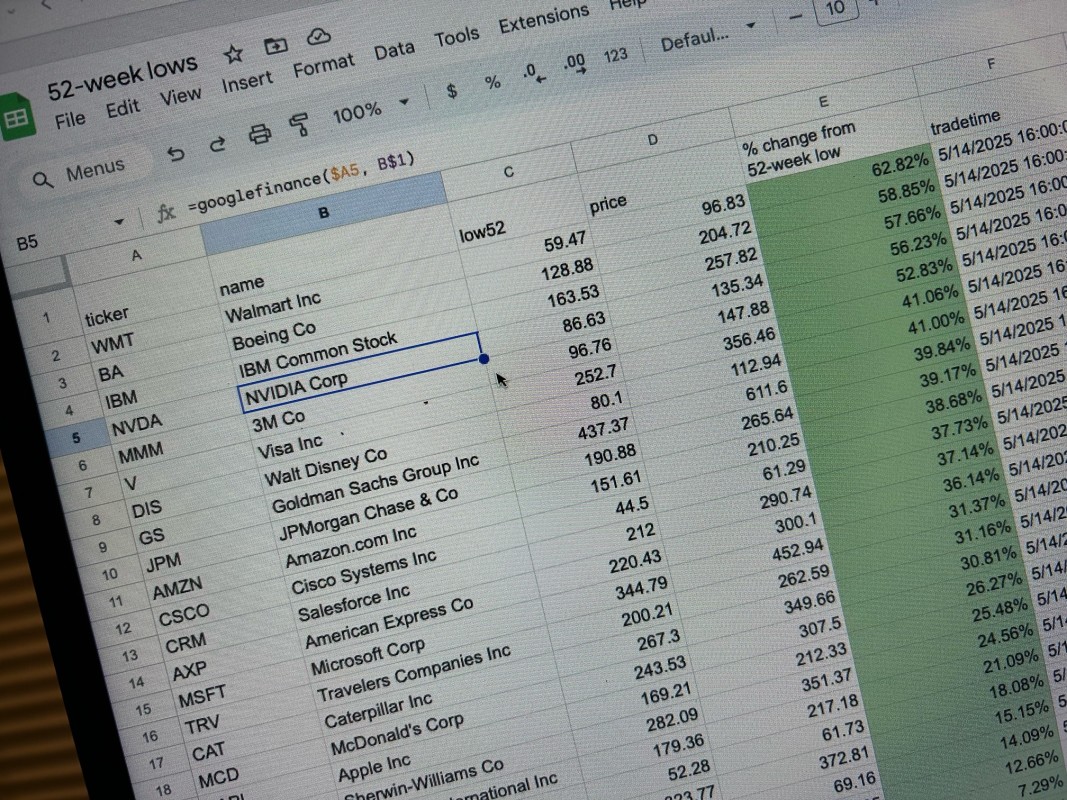

And the Fed has, of course, noted inflation and the labor numbers that they're watching, but they've also spoken about liquidity quite a bit and their focus on liquidity. I think when we look at liquidity, we look at that sub prime category for lending quite a bit, and we compare that to where credit wants are. And when we see that start to widen further and further, that starts to say that those on the lower end of the economic totem pole, as it were, don't have that liquidity. And that's something the Fed should watch too.