3 ETFs that Could Outperform the S&P 500 (SPX) Over the Next Three Years

The S&P 500 is the U.S. benchmark that most investors pay closest attention to. An amalgamation of the 500 best (and largest) companies America has to offer, this index is one that is worth using as a benchmark for those with a long-term investing time horizon. That’s mainly because this particular benchmark has produced double-digit […] The post 3 ETFs that Could Outperform the S&P 500 (SPX) Over the Next Three Years appeared first on 24/7 Wall St..

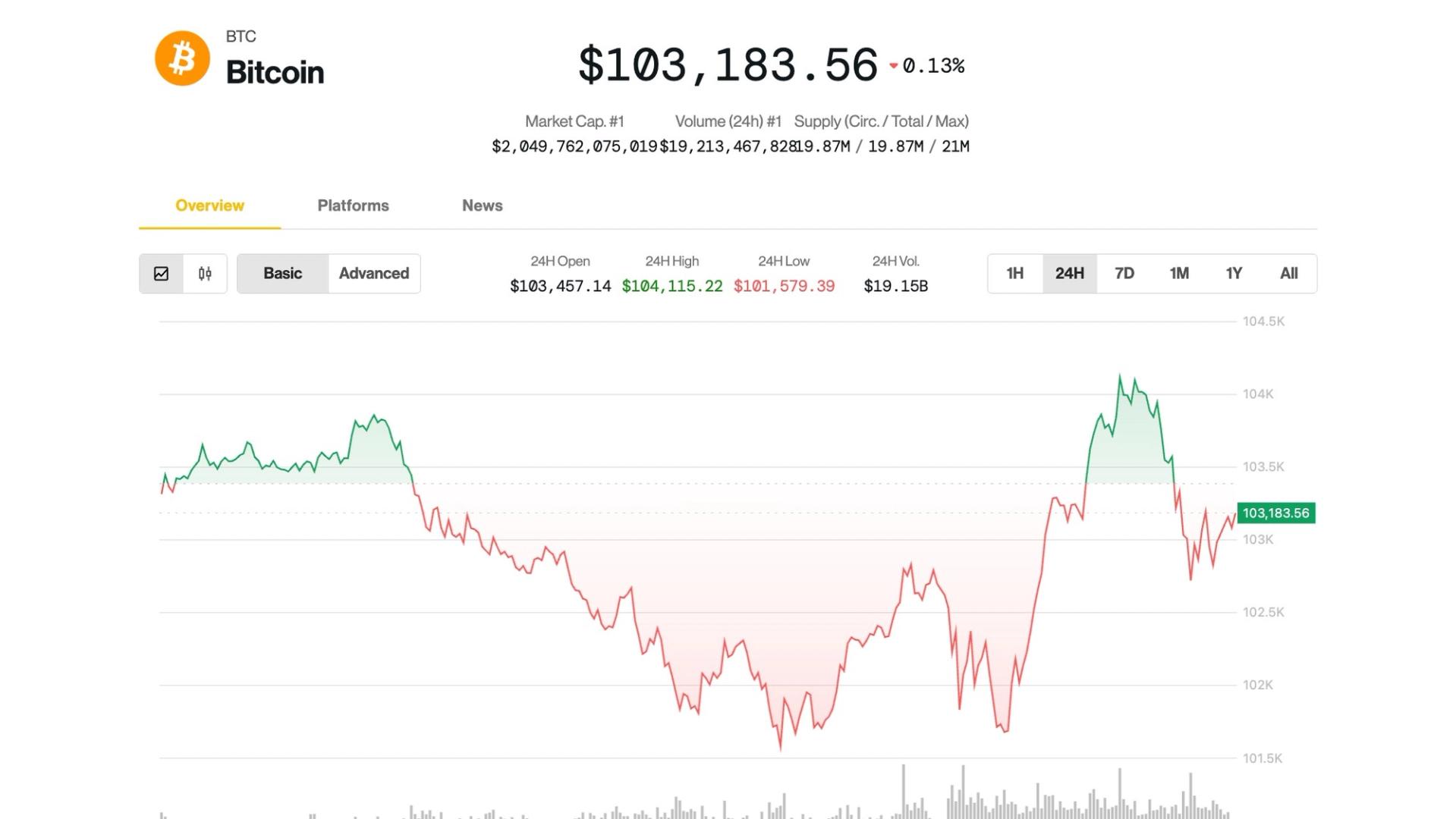

The S&P 500 is the U.S. benchmark that most investors pay closest attention to. An amalgamation of the 500 best (and largest) companies America has to offer, this index is one that is worth using as a benchmark for those with a long-term investing time horizon.

Key Points

-

Simply earning the market return, at more than 10% a year, may be enough for most investors.

-

But for those looking to beat the index over the next three years, here are three top options that may be positioned to do just that.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

That’s mainly because this particular benchmark has produced double-digit annualized returns for decades, and is likely to continue to do so over time. With various factors from a loss in value of the U.S. dollar to inflation (and other natural forces), companies are generally able to increase their earnings over time by roughly this amount. So, for those looking to protect their wealth from the negative forces of inflation and the inevitable loss of value in the dollar, buying the market is a great way to go.

I’ve long been a proponent of such a strategy, and there are a number of index ETFs I’ve discussed that may assist passive investors in achieving these still-remarkable returns over the long-term. But for investors looking to beat the benchmark over the next three years, there are specific ETFs I do think are positioned for near-term outperformance that may be worth considering.

Here they are.

Vanguard Utilities ETF (VPU)

As its name very obviously connotes, Vanguard Utilities ETF (VPU) is a top option for investors looking to add exposure to the U.S. utilities sector. This fund benefits from some very long-term growth trends underpinning utilities, which by and large are defensive in nature.

In my view, the defensive business models utility giants provide in this economic climate is one key catalyst in and of itself that’s worth exploring. Essentially, my bet would be that investors get more defensive, not less, over the course of the next three years. If there’s anything about the Trump administration’s current policies that investors can garner, it’s that a lack of predictability should be expected. In such an environment, many investors will opt for much more stable cash flow growth, and take a longer-term view of their holdings.

That’s what I’m doing at least. And with rock-solid holdings form NextEra Energy to Southern Company, Duke Energy and Dominion Energy, investors gain exposure to very high cash flow generation over time. As these utility giants raise prices in accordance with regulators and improve their operating efficiency further, I think market-beating returns are in store over the long-haul. The utilities sector as a whole has actually outperformed the S&P 500 over the past few decades, so if history is a teacher, this is an ETF that could really outperform over time.

Vanguard Growth ETF (VUG)

For investors looking for a bit more large-cap growth exposure, the Vanguard Growth Index Fund ETF (VUG) is a top option to consider. Tracking the largest U.S growth stocks in sectors, VUG has outperformed the S&P 500 for most of the past 15 years. So, for investors who are banking on a continuation of this bull market (and even more valuation expansion from higher-growth companies), this is a top ETF to consider.

I’m not sure I’d put myself in this camp, but I wanted to provide an option for every investor type. There are plenty of investors out there who may be willing and eager to take on more risk within their portfolio than me. And by and large, investors who have move out on the risk spectrum since the GFC have vastly outperformed more cautious investors such as myself.

The thing is, with Apple, Microsoft, Nvidia, Amazon and Alphabet as top holdings in this ETF, there’s an argument to be made that there’s actually better value in this fund today than at most points over the past 15 years. That’s because these companies’ valuation multiples have declined relative to where they were years ago, and their entrenched nature in key markets has provided an even wider moat for those thinking long-term. I’d be remiss to ignore this ETF as a potential outperformed over the next three years, if everything works out well.

iShares U.S. Aerospace & Defense ETF (ITA)

Moving away from more pure-play growth stocks to the defense sector, the iShares U.S. Aerospace & Defense ETF (ITA) is a way for investors to play for market-beating upside in rather depressing fashion.

As the go-to ETF for investors looking for exposure to the defense sector, companies held in this ETF tend to outperform when conflict is on the rise.

Unless you’ve been living under a rock, you know that geopolitical turmoil has picked up in recent years, and perhaps even more so under president Trump. These tariff policies are economic weapons which are being deployed now, with more conventional weapons still being used in the Ukraine and Middle East conflicts, among many others. For those betting that tensions won’t simmer down anytime soon, and defense spending will continue to pick up for many European countries (and others around the world), this ETF is certainly a way to play this trend.

I don’t like the idea of profiting off of death and destruction, and there’s good reason why plenty of investors would steer clear of such an ETF. But as a hedge against market uncertainty, and a way to express a thesis that global geopolitical conflict may continue to rise in the years to come, this ETF certainly has the potential to outperform the market. I kind of hope it doesn’t, but that’s neither here nor there.

The post 3 ETFs that Could Outperform the S&P 500 (SPX) Over the Next Three Years appeared first on 24/7 Wall St..