Why retail credit cards could cost you big time

You may want to think twice before signing up for store credit cards.

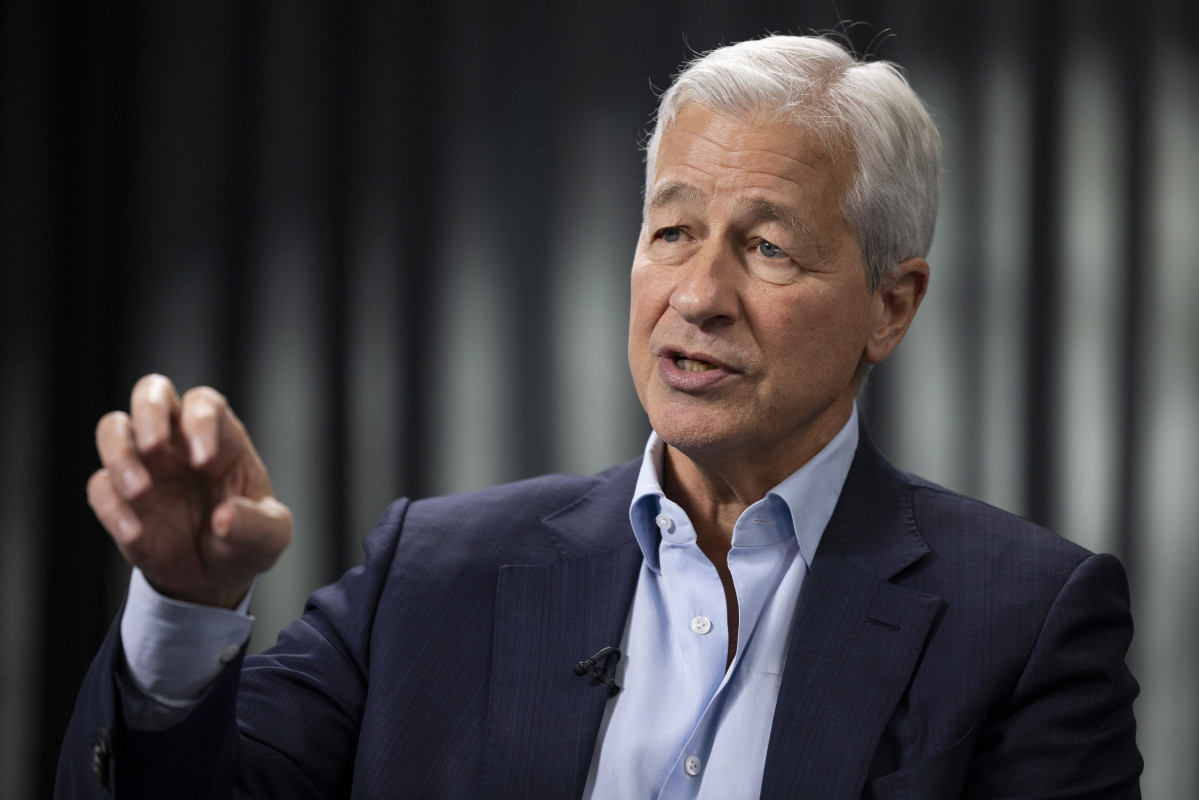

Store credit card offers can seem tempting, but they often come with hidden risks that can quickly turn costly. Ted Rossman, Senior Industry Analyst, Bankrate, joined TheStreet to explain why consumers should exercise caution before signing up.

Related: This common credit card mistake is costing you more than you think

Full Video Transcript Below:

TED ROSSMAN: The fourth quarter is when most of these store card signups take place. And there is a big buyer beware here, which is if you get offered one of these at the checkout, the pitch may sound compelling. They may say, hey, do you want to save 20% off today's purchase. It's not worth it if you carry a balance because these interest rates are sky high. Many store cards charge anywhere from 30 to about 36% All credit card rates are high, but these are especially high. So you just want to be really, really careful.

The only two times it works really are both involve paying in full. One would be if you pay in full and you get a big discount off a big initial purchase. The sign up bonus is often something like 20% off. So if you're buying a bunch of appliances or furniture and you can pay it off before interest hits, then it works. The other time is if you're loyal to the store and every time you use your Amazon card or your target card or your Best Buy card, you're getting 5% back at their stores.

And again, if you can pay it off in full before interest hits, well then you're getting ahead relative to other payment methods. But other than that have to be aware of how high these interest rates are and be especially wary of deferred interest promos. A lot of store cards may say 0% interest for 12 months, but when they frame it as deferred interest as many do, that means if you don't pay the full amount by the time the clock runs out, then they go back and they charge you retroactively, retroactively for all of the interest that would have accumulated. That can really hurt.