Why Nvidia (NASDAQ: NVDA), Palantir (NYSE: PLTR) and Dell (NYSE: DELL) are Up Today

Markets were up substantially earlier today. All after President Trump exempted smartphones, chips, and computers from tariffs. “Smartphones, computers, flat panel TV displays, memory chips, semiconductor-based storage devices, and other electronics are among the items excluded from the Trump administration’s reciprocal tariffs, according to a bulletin from the U.S. Customs and Border Protection,” as noted […] The post Why Nvidia (NASDAQ: NVDA), Palantir (NYSE: PLTR) and Dell (NYSE: DELL) are Up Today appeared first on 24/7 Wall St..

Markets were up substantially earlier today.

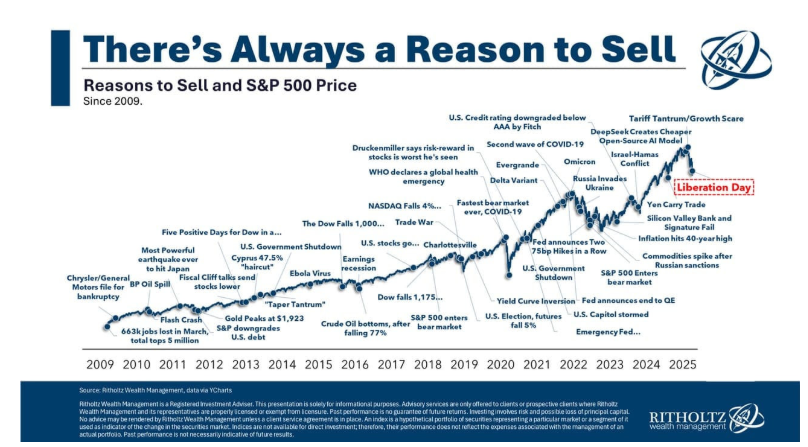

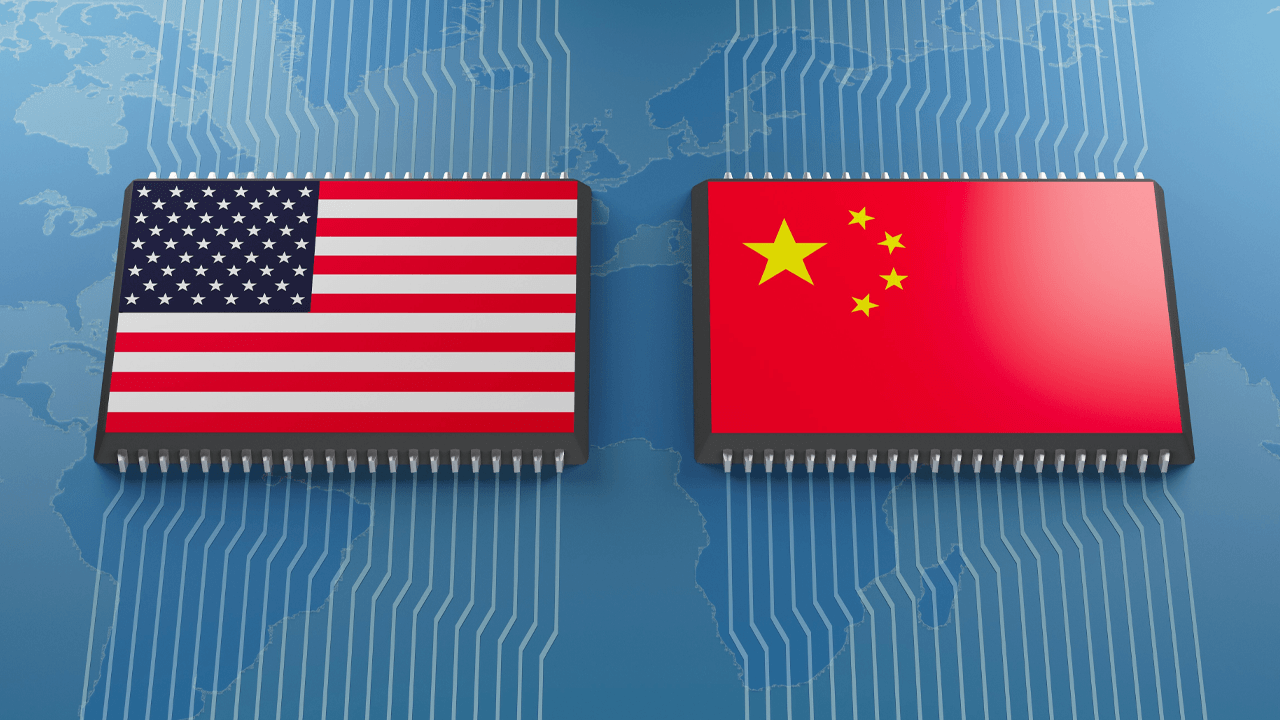

All after President Trump exempted smartphones, chips, and computers from tariffs.

“Smartphones, computers, flat panel TV displays, memory chips, semiconductor-based storage devices, and other electronics are among the items excluded from the Trump administration’s reciprocal tariffs, according to a bulletin from the U.S. Customs and Border Protection,” as noted by ABC News.

It all helped pull tech companies back from the cliff, including Nvidia (NASDAQ:NVDA), Palantir (NYSE: PLTR) and Dell (NYSE:DELL).

Nvidia

After plummeting to a low of $86.62, Nvidia is just starting to pivot higher again. Last trading at. $110.23, we’d like to see it retest $130 again near-term.

Helping, the company just said it would begin manufacturing and testing chips in the U.S. In fact, it secured more than a million sq. ft. of space in Arizona and Texas to produce its Blackwell chips and artificial intelligence supercomputers.

This also marks the first time Nvidia’s core AI products will be built in the U.S.

“The engines of the world’s AI infrastructure are being built in the United States for the first time,” said Nvidia founder and CEO Jensen Huang, as quoted in a Nvidia press release. “Adding American manufacturing helps us better meet the incredible and growing demand for AI chips and supercomputers, strengthens our supply chain and boosts our resiliency.”

Palantir

Oversold shares of Palantir are also on the move.

All thanks to a reiterated outperform rating with a $120 price target from analysts at Wedbush. This comes after Palantir received a contract to supply NATO with an AI-powered military system.

“Wedbush analyst Dan Ives views the deal as a significant win for Palantir, reflecting the company’s growing influence in the federal sector, particularly in AI-driven defense technologies,” as noted by Investing.com.

Dell

Oversold shares of Dell are also showing big signs of life thanks to tariff exemptions.

The exclusions, published by the U.S. Customs and Border Protection agency, follow President Trump’s moves to impose 145% tariffs on products from China and 10% tariffs on all others.

The company is also eying 50% AI server growth with its ties to Nvidia. “At the center of the Dell AI Factory with NVIDIA is industry-leading, end-to-end infrastructure that powers AI innovation across industries from startups, to governments, to the world’s largest enterprises and cloud service providers,” as noted in a Dell press release.

The post Why Nvidia (NASDAQ: NVDA), Palantir (NYSE: PLTR) and Dell (NYSE: DELL) are Up Today appeared first on 24/7 Wall St..