Why Are People Still Using Debit Cards Without Rewards, and Worse Security When Cash Back Cards Are An Option?

One of the biggest questions anyone in their young financial life has to decide is how much influence a credit card will have on how you shop. While everyone has a debit card, thanks to the fact that they have opened a checking account, far too many people are focused solely on spending with a […] The post Why Are People Still Using Debit Cards Without Rewards, and Worse Security When Cash Back Cards Are An Option? appeared first on 24/7 Wall St..

One of the biggest questions anyone in their young financial life has to decide is how much influence a credit card will have on how you shop. While everyone has a debit card, thanks to the fact that they have opened a checking account, far too many people are focused solely on spending with a debit card, even with all the negatives.

Very few protections are offered with a debit card, no matter how many are in circulation.

Cash-back credit cards offer far more protection, like purchase protection, extended warranties, and even price-matching.

Credit cards are believed to be a vastly better card type to have in your wallet than a debit card.

The right cash back credit card can earn you hundreds, or thousands of dollars a year for free. Our top pick pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply now (Sponsor)

Key Points

This is one of the questions posted in a Quora thread as someone asks why people prefer debit cards to credit cards. When you consider that debit cards are less secure, offer less protection, and don’t offer any actual benefits, it begs the question of why they still exist at all.

Debit Card Downsides

When you look at the downsides of a debit card, there is almost a universal belief that they are less secure than credit cards. At the very top of the list is its limited fraud protection. Unlike a credit card, you must notify your bank within two days if you detect a fraudulent transaction, and if valid, you are only responsible for up to $50 of the charges.

If you notify your bank after two days, your responsibility goes up to $500, and after 60 days, you could be on the hook for everything. This is decidedly not the case with a cash-back credit card or any credit card, as the Fair Credit Billing Act doesn’t allow your liability to go beyond $50 for any fraudulent transactions.

Alternatively, you are limited in how much you can spend as your balance depends entirely on your checking or savings account balance. While many might argue this is good to prevent overspending, it also means you can’t make large purchases, which can be a real downside. If you go over your balance anytime, you also have to contend with overdraft fees, which banks take very seriously.

Lastly, debit cards don’t build up your credit history, and while some experts say credit history isn’t as important as it once was, you have to know that if you want to buy a car or a home, it requires a credit check, so building up credit is a necessity.

There’s one more downside: Debit cards don’t offer any rewards, while cashback credit cards give you “free” money every month.

Why Credit Cards Are Better

The Quora user puts it best when they suggest why credit cards are better. In many cases, it comes down to real-world examples. Consider what happens when you check into a hotel with a credit card versus a debit card.

With the debit card, the “incidental” hold the hotel places on your account will immediately withdraw “real” money from your account and keep it during your stay. You now have less buying power than before you checked in, as you can’t spend this “incidental” hold money.

Compare this to a credit card, where the incidental money only uses your credit limit. While it also reduces your spending power, it’s money you never have to change with the hotel. Ultimately, a debit card hold can take up to 10 days to see the funds return from a hotel, while a credit card is generally returned within a day or two.

Between this and other considerations like purchase protection, extended warranties, auto rental coverage, and cash-back rewards, there is every reason to examine credit cards more closely.

Cashback Rewards Are Worth It

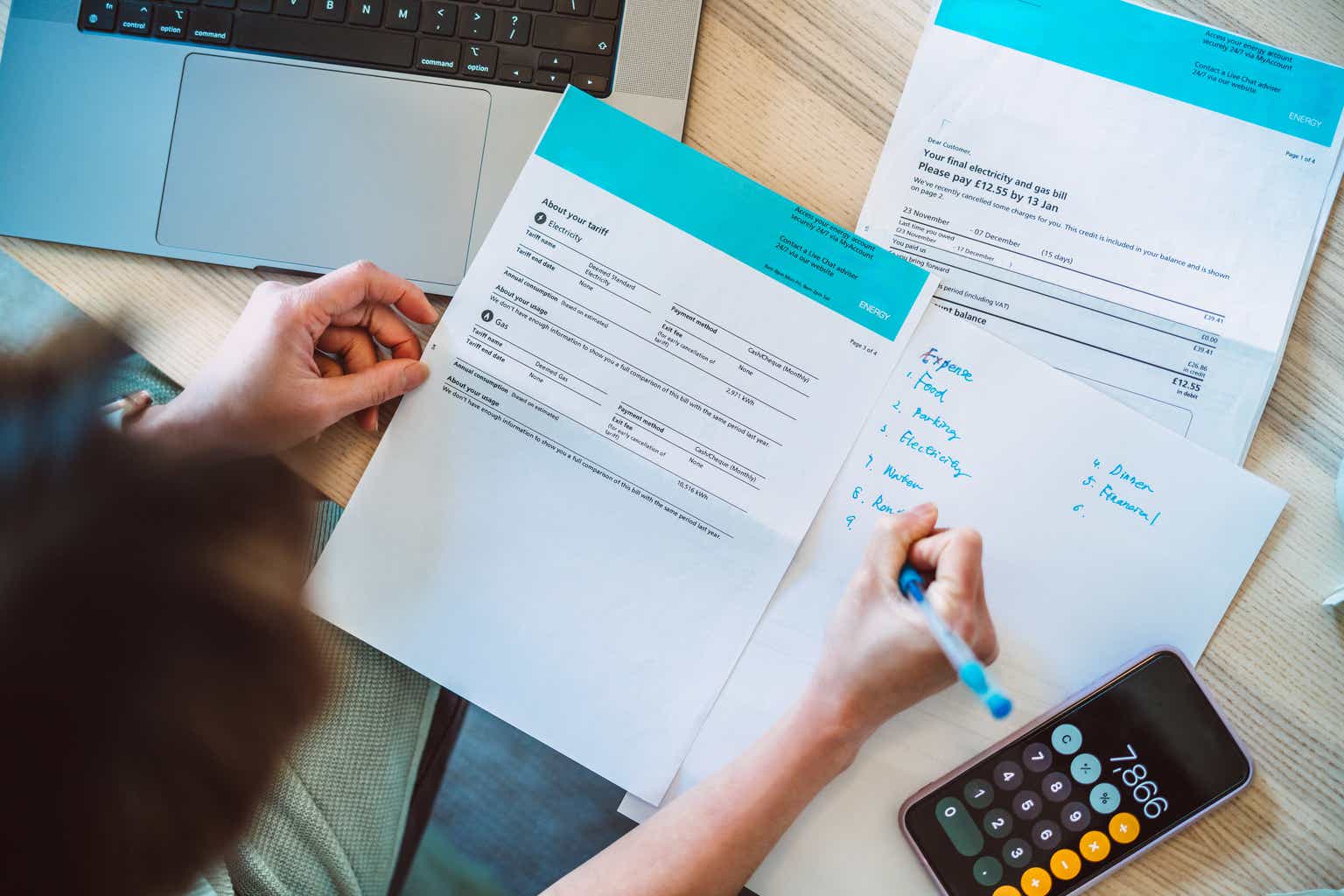

While the argument for a debit card is generally about helping you avoid overspending, you must also have financial discipline with a credit card. If you do, the rewards can quickly add up. For example, suppose the average American spends approximately $1,506 dollars monthly on a credit card, and you have a 2% cash-back credit card. In that case, you earn $30 monthly just for shopping as usual.

This means you will have earned $360 in yearly rewards if you start accumulating from January through December. This money can be used toward holiday gifts, your credit card balance, or purchasing gift cards for your favorite retailer.

Now consider that some people spend far more on credit cards every month, in some cases closer to $3,000 per month, so you have now doubled this reward amount to $720 per year in “free” rewards from your favorite cashback card. This is precisely why cashback cards are vastly more attractive than debit cards, especially when you add in all of the protections they offer.

The post Why Are People Still Using Debit Cards Without Rewards, and Worse Security When Cash Back Cards Are An Option? appeared first on 24/7 Wall St..