Warren Buffett's Annual Letter Shares 4 of the Most Chilling Words Investors Will Ever Witness

One of Wall Street's most unwavering long-term optimists just bluntly leveled with investors.

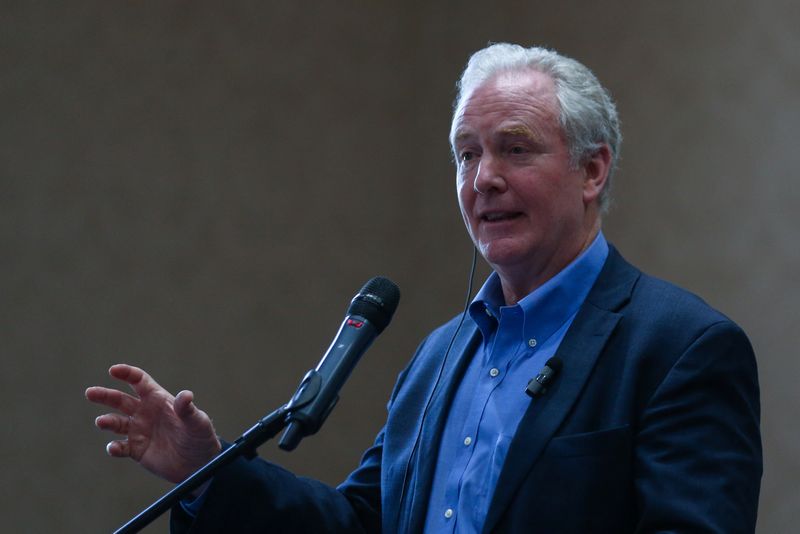

When Berkshire Hathaway's (NYSE: BRK.A)(NYSE: BRK.B) billionaire chief speaks, Wall Street wisely listens. That's because Warren Buffett has vastly outperformed the benchmark S&P 500 (SNPINDEX: ^GSPC) in his 60 years as CEO. The aptly dubbed "Oracle of Omaha" has overseen a cumulative gain in Berkshire's Class A shares (BRK.A) of 6,076,172%, as of the closing bell on Feb. 24.

Picking Buffett's brain happens a number of ways. Quarterly filed Form 13Fs allow investors to see which stocks he and his top advisors, Todd Combs and Ted Weschler, have been buying and selling. Likewise, Berkshire's quarterly operating results provide insight on whether Buffett and his team are net buyers or sellers of stocks.

Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.