Warren Buffett says he handing over Berkshire Hathaway reins after realizing how much more Greg Abel could get done in a 10-hour day

Berkshire Hathaway CEO Warren Buffett said it would be "unfair" not to let his successor, Greg Abel, take over the top job at the conglomerate.

- At 94, Warren Buffett announced he will step down as CEO of Berkshire Hathaway, emphasizing his strong support for successor Greg Abel, whom he praised for his energy, effectiveness, and leadership. Buffett called it "unfair" to hold Abel back any longer, reaffirming his confidence in Abel's ability while pledging to remain involved and continue supporting the company’s future.

At the age of 94, Warren Buffett said he finally began slowing down.

The Berkshire Hathaway CEO shocked shareholders earlier this month when he announced he would be stepping down from the investment giant's top job and handing the reins to his named successor, Greg Abel.

Buffett has now revealed that he decided to step down after he witnessed how much his successor could do in a working day compared to his own output.

“I didn’t really start getting old, for some strange reason, until I was about 90,” Buffett told The Wall Street Journal. “But when you start getting old ... it’s irreversible.”

The 'Oracle of Omaha' continued: “The difference in energy level and just how much [Abel] could accomplish in a 10-hour day compared to what I could accomplish in a 10-hour day—the difference became more and more dramatic.

“He just was so much more effective at getting things done, making changes in management where they were needed, helping people that needed help someplace, but just all kinds of ways. It was unfair, really, not to put Greg in the job.”

Abel was first identified as the unofficial successor by Buffett's former right-hand man, Charlie Munger, on a call in 2021 with the Berkshire chairman confirming the news a matter of days later.

At the May 3 annual shareholders meeting, Buffett announced that he would step down by the end of the year.

Speaking to a stunned crowd, Buffett, now 94, said neither Abel nor the board (bar his two children, Susie and Howard) had been aware of his intention to leave the CEO position.

Buffett added that the next step was proposing the move to the board the following weekend, who would then convene in a few months to take action.

“I think they’ll be unanimously in favor of it, and that would mean that at year-end Greg would be the chief executive officer of Berkshire and I would still hang around and could conceivably be useful in a few cases,” Buffett added.

Despite the investment legend's backing for Abel—and his promise to stay on at Berkshire—the conglomerate's share price dipped on the news and is now down 4.7% over the past month.

The man worth $156.6 billion, per Forbes, is one of Berkshire's largest shareholders but has reconfirmed his plans to slowly gift them away for philanthropic endeavors.

Buffett will still be on call if there’s a panic in the market

Buffett has also pledged ongoing investment in Berkshire, which he views as a sign of confidence in Abel, through financial backing and his time.

While he'll step down as CEO, Buffett will still come to work for the company with a market cap of $1.08 trillion.

“My health is fine, in the sense that I feel good every day,” he told the WSJ. “I’m here at the office and I get to work with people I love, they like me pretty well, and we have a good time.”

He continued, he could serve as a steadying hand in turbulent economic times: “I don’t have any trouble making decisions about something that I was making decisions on 20 years ago, or 40 years ago, or 60 years ago.

“I will be useful here if there’s a panic in the market because I don’t get fearful when things go down in price or everybody else gets scared. And that really isn’t a function of age.”

He added: "I’m not going to sit at home and watch soap operas. My interests are still the same.”

Abel will oversee Berkshire's investment strategy while Buffett is still at the company, the chairman added, having proved his investment chops while overseeing the business's push into infrastructure for generating electricity from green sources.

Under Abel's supervision, Berkshire now ranks as America’s largest regulated utility for wind generation, operating wind farms in Texas, California, and across the Midwest, particularly in Iowa.

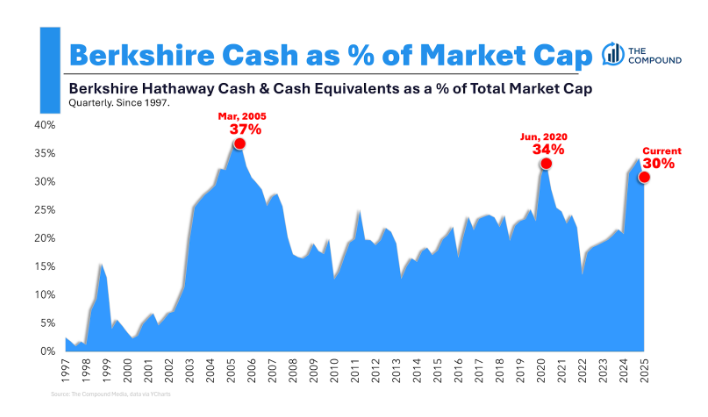

Berkshire's strategy under Abel remains to be seen, but the key question on spectators' lips is how the incoming CEO might spend a near-$350 billion cash stockpile.

"He will have ideas," Buffett said.

This story was originally featured on Fortune.com