Don’t be fooled by deescalation, says UBS, Trump’s ‘surgical increases’ on specific sectors are yet to come

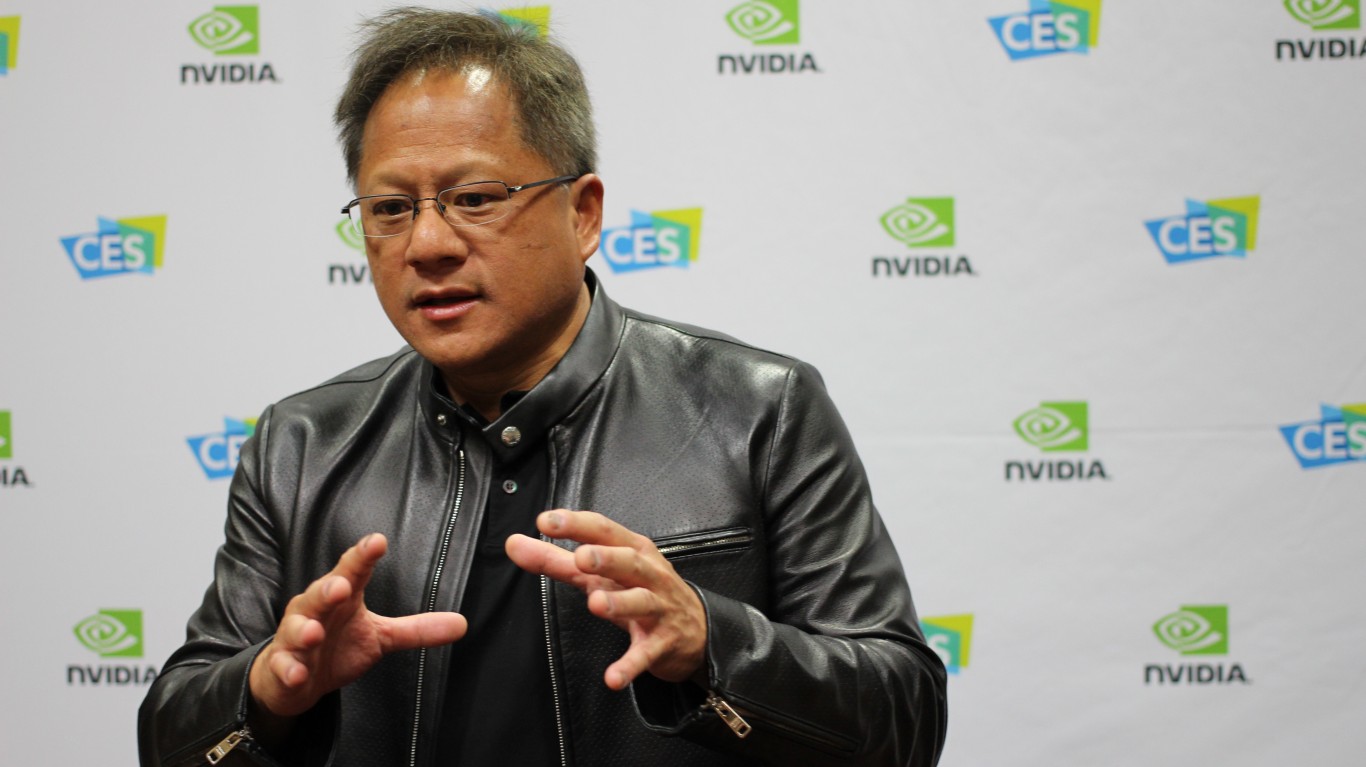

UBS's chief investment officer, Mark Haefele, wrote the White House may still make some cutting moves.

- UBS chief investment officer Mark Haefele warns that despite recent signs of de-escalation, the Trump administration is laying the groundwork for a new wave of targeted tariffs in strategic sectors like pharmaceuticals, semiconductors, and critical minerals.

The worst-case scenario arising out of Trump's tariff policy is hopefully in the rearview mirror, but analysts are warning that the White House may still make some cutting moves.

Thus far, Trump's tariffs have been fairly broad, with a 10% hike applied to the majority of the world, with a few exceptions in China and Canada.

While some sector-specific tariffs—on autos as well as steel and aluminum, for example—have been announced since Trump won the Oval Office, far more have been announced on individual nations.

While the countries that were subject to higher rates, such as the EU, Japan and Taiwan, have been granted some brief reprieve in the form of a 90-day pause of Trump's 'Liberation Day' tariffs, economists suspect this does not mean the end of announcements for good.

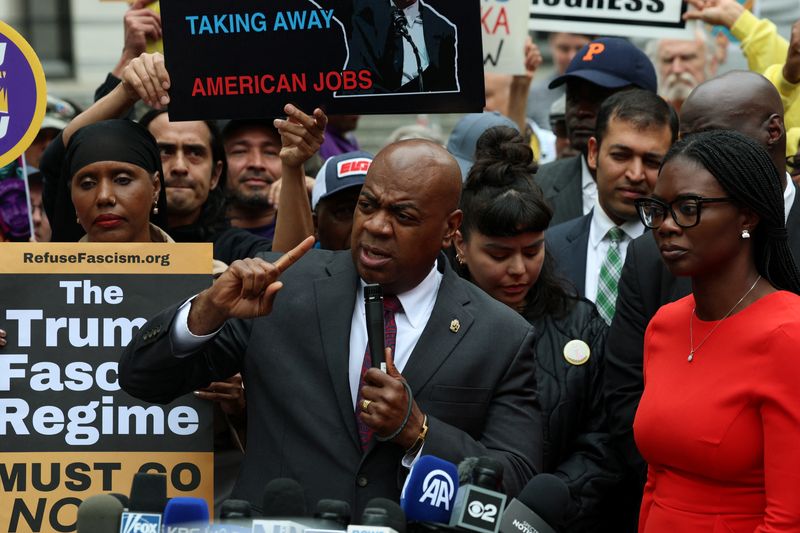

UBS's chief investment officer, Mark Haefele, wrote today in a note seen by Fortune that there are many downward pressures on tariffs, including "a growing docket of legal challenges and the steady erosion in the president’s job approval."

"Republican lawmakers could also fear that high tariffs may actually reduce tax revenues by slowing economic growth and diverting trade ... [and] in the event of an escalating trade war, elected officials could come under pressure to provide fiscal support for industries harmed by retaliatory tariffs from other nations," he said.

But despite the myriad reasons to continue de-escalating, which analysts interpreted as beginning with the announcement of a U.S.-China agreement, UBS is unconvinced that the only path is downward.

"Despite these pressures to lower tariffs, the Trump administration is also preparing the groundwork for a more surgical increase in tariffs beginning this summer following trade investigations into strategic industries like pharmaceuticals, critical minerals, lumber, copper, and semiconductors," Haefele wrote.

What has Trump's 'groundwork' entailed?

So, what do those clues look like? When it comes to pharmaceuticals, it's been less about what Trump has said and more about what he has done.

Pharmaceutical products have been exempt from tariffs so far, but this week the president signed an executive order pushing action to lower drug prices.

While the notion may be more of a concern for domestic producers, it also signals to large European businesses like Ozempic-maker Novo Nordisk and coronavirus-test maker AstraZeneca that they face further pressure even if national agreements are reached.

In a press event on Monday, Trump said: “Basically, what we’re doing is equalizing. We are going to pay the lowest price in the world. We will get whoever is paying the lowest price, that’s the price that we’re going to get.”

On semiconductors, Trump has openly said he wants to encourage chipmakers to produce in America.

He wrote on Truth Social, his own social media site, last month: "We are taking a look at Semiconductors and the WHOLE ELECTRONICS SUPPLY CHAIN in the upcoming National Security Tariff Investigations.

"What has been exposed is that we need to make products in the United States, and that we will not be held hostage by other Countries, especially hostile trading Nations like China, which will do everything within its power to disrespect the American People."

At the moment, Canadian lumber is exempt from tariffs, though Trump has accused the neighboring nation of "ripping us off" over the goods.

Trump has also ordered an investigation into the threat copper importing poses to national security, and similar action on critical minerals.

Uncertainty is here to stay

And unlike the flip-flopping tactics apparently used to get trading partners to the negotiating table, the CIO suspects the Oval Office will be resistant to tweaking such policies: "We think the product tariffs are likely to be more durable and feature fewer carveouts and country exemptions because they are focused on strategic sectors. We estimate a 25% tariff on these sectors could raise the U.S. effective tariff rate by an additional 4 percentage points."

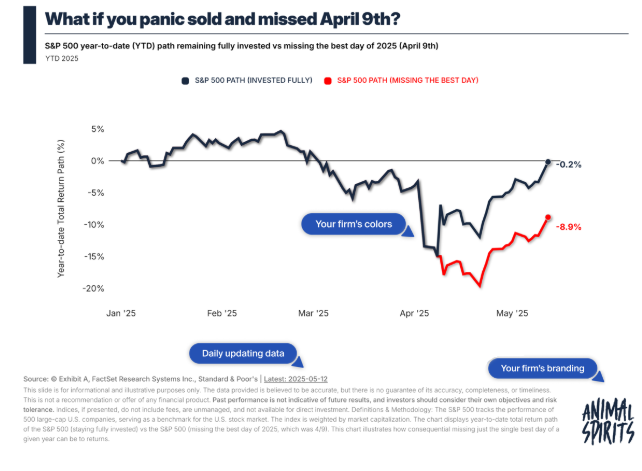

That means uncertainty in the economic outlook is not going away, and it is stalling everything from Fed interest rate decisions to business investments.

"While we continue to expect a range of trade agreements to be reached to sustain the tariff rate at roughly the level during the pause period, ongoing uncertainty could trigger further bouts of market volatility," Haefele adds.

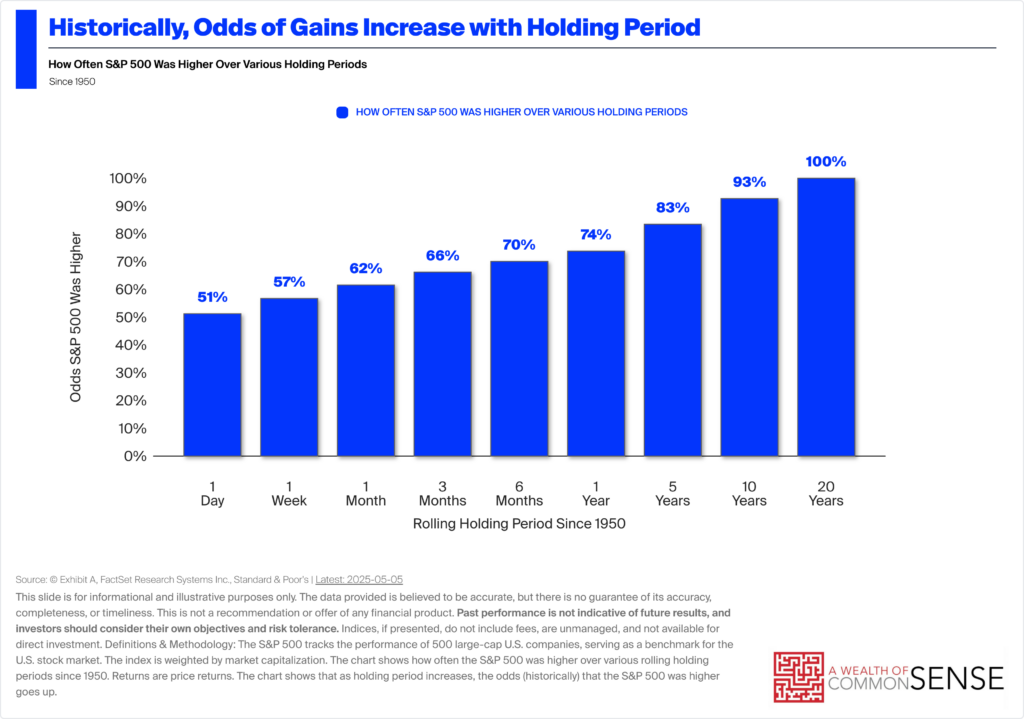

"Phasing into the market can be an effective way for underallocated investors to position for medium- and longer-term upside in U.S. equities, while capital preservation strategies can help manage near-term downside risks."

This story was originally featured on Fortune.com