Warren Buffett Made $2.5 Billion Today. Here’s How He Did It

As Warren Buffett settles into his lunch-time meal, the sixth-richest person on the planet with a $156 billion fortune, is already pocketing a hefty $2.6 billion. Berkshire Hathaway (NYSE:BRK-A)(NYSE:BRK-B) stock is climbing 1.6% in midday trading on Thursday, Feb. 27, allowing this midday surge to fatten his wallet. Buffett likely doesn’t notice if his net […] The post Warren Buffett Made $2.5 Billion Today. Here’s How He Did It appeared first on 24/7 Wall St..

As Warren Buffett settles into his lunch-time meal, the sixth-richest person on the planet with a $156 billion fortune, is already pocketing a hefty $2.6 billion.

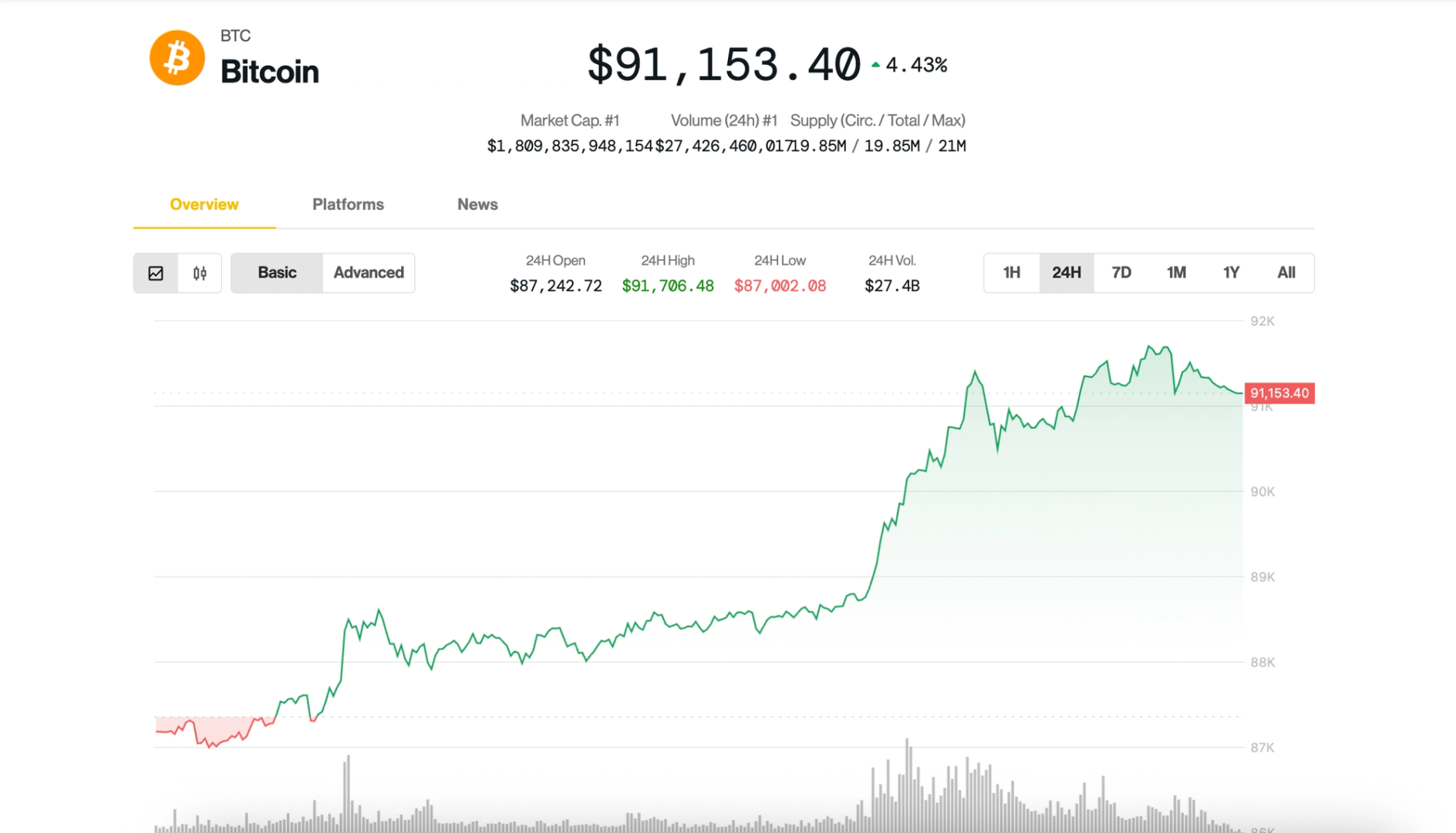

Berkshire Hathaway (NYSE:BRK-A)(NYSE:BRK-B) stock is climbing 1.6% in midday trading on Thursday, Feb. 27, allowing this midday surge to fatten his wallet.

Buffett likely doesn’t notice if his net worth is a billion or so larger or smaller, because he prefers to take the long view. So let’s unpack why this is happening, what it means for the Oracle of Omaha, and why it’s really just noise in his grand plan.

Warren Buffett owns 216,637 shares of Berkshire Hathaway‘s (BRK-A) Class A shares.

BRK-A shares trade for over $750,000 while the Class B shares trade for more than $500.

Even just a small increase in their price can add millions of dollars to his net worth.

If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

24/7 Wall St. Insights:

Post-earnings bounce

Buffett’s wealth is anchored in Berkshire Hathaway, where he holds 216,637 shares of Class A stock and 344 shares of Class B stock, according to last year’s proxy and recent SEC filings. Class A shares pack more voting power than Class B stock (the latter has 1/10,000th fleas than Class A.

With BRK-A stock trading near $747,485 per share (up from $735,750 yesterday), and BRK-B stock at $498.42, that 1.6% jump adds about $11,920 per Class A share and $8 per Class B share. For Buffett’s stake, that’s roughly $2.58 billion in paper profits.

Berkshire Hathaway hit an all-time record high on Tuesday as the market continued reacting to its fourth-quarter earnings report, and the stock is challenging those highs again today.

While there is likely still some carryover from Berkshire’s strong financials, broader market cheer could be helping lift Buffett’s investment vehicle. Both the S&P 500 and the Dow Jones Industrial Average are up as well in morning trading, though not rising as much as Berkshire Hathaway stock.

Watch what Buffett does

The three biggest movers in Buffett’s portfolio were Heico (NYSE:HEI-A), Nu Holdings (NYSE:NU), and Charter Communications (NASDAQ:CHTR). Yet despite the where Heico, and aerospace and defense stock, was up over 13% on strong fourth-quarter results, it only accounts for 0.1% of Berkshire’s portfolio. Nu and Charter are similarly situated, though they were up around 2%.

Apple (NASDAQ:AAPL) remains Buffett’s biggest position still at 24.4% of the total, so it would have the greatest impact on the portfolio, but its shares were up just 0.3%. Rather, like the market itself, it was a broad-based increase with most of the stocks in the portfolio in the green.

Most investors should be like Buffett, though and not care much whether his wallet is fatter or lighter one day to the next, even if they own Berkshire Hathaway stock. This isn’t a seismic shift for Buffett or Berkshire. The $1 billion net worth increase only represents a 0.6% rise in the total. This bump in Berkshire’s stock is mostly market-driven volatility as shares often move in tandem with the benchmark index.

What they should take notice of is what Buffett is doing. Berkshire Hathaway’s $334.2 billion cash hoard reflects the Oracle of Omaha is being cautious about the market. It doesn’t mean you should sell all of your stocks, but you might want to be more cautious about valuation and the quality of the businesses you’re buying.

Key takeaway

For Buffett, this $2.6 billion windfall is just pocket change. He’s not touching it and his eyes are fixed on Berkshire’s enduring value, not today’s tickers. For investors, Berkshire’s strength lies in its sprawling empire — insurance, energy, railroads — which beats the S&P 500 most years.

But today’s 1.6% jump? It’s a blip. Buffett is probably not even glancing at the screen.

The post Warren Buffett Made $2.5 Billion Today. Here’s How He Did It appeared first on 24/7 Wall St..