Veteran fund manager unveils bold Nvidia stock price target after rally

Could Nvidia stock surge to a new high heading into earnings? Here's what's next.

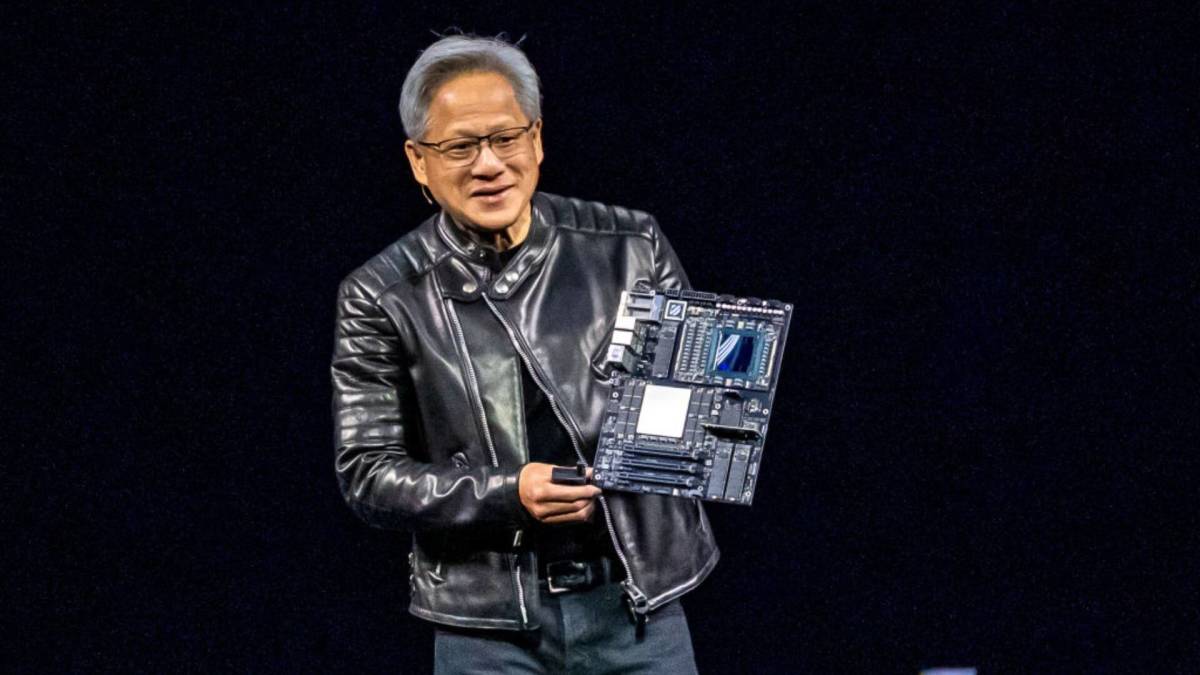

Nvidia (NVDA) shares have jumped nearly 15% over the past five days following a wave of positive news.

The chipmaker has announced a major deal with Saudi company Humain, owned by Saudi Arabia’s Public Investment Fund, to work on developing AI models and building data center infrastructure using Blackwell GPUs.

The multi-year initiative, estimated to be worth between $15 billion and $20 billion, speaks to the vision of “Sovereign AI” — countries developing their own AI using their data, resources, and workforce.

“National investment in compute capacity is a new economic imperative,” Nvidia CEO Jensen Huang said in 2023. “People realize that they can’t afford to export their country’s knowledge, their country’s culture, for somebody else to then resell AI back to them.”

Another lift for Nvidia stock this week came from reports that the U.S. and China agreed to temporarily lower tariffs, boosting the tech stock market.

In April, Nvidia was under pressure as it disclosed that it would take a $5.5 billion charge to export its H20 GPUs to China and other countries. The company also said that shipping those chips will require a government license.

Related: Nvidia CEO sounds the alarm on China

The H20 chip was developed to comply with U.S. export controls under President Joe Biden’s administration, which banned the sale of advanced AI processors to China in 2022 and tightened restrictions in 2023.

Last year, Nvidia was one of the top Nasdaq winners, up 171%. But the stock has lacked the same growth momentum this year, up just 0.4%, weighed by the rollout of China’s cheaper AI model DeepSeek, disappointing February earnings, and a market pullback amid tariffs and rising economic uncertainties.

Chris Versace, Wall Street veteran fund manager who manages TheStreet Pro's portfolio, shared his views on Nvidia stock this week after its recent rally. Image source: Morris/Bloomberg via Getty Images

Veteran fund manager bullish on Nvidia stock

Versace, a 30-year industry veteran, said that Nvidia's deal with Saudi Arabia is "blunting U.S restrictions on AI chips to China."

He also pointed to Foxconn Technology (FXCOF) , which reported record April revenue and more than 50% year-over-year growth in AI server sales during the first quarter. Foxconn expects its revenue to nearly double sequentially and year over year in the current quarter.

Foxconn is a key manufacturer of Nvidia, helping produce its AI servers. Still, the company trimmed its 2025 outlook from “strong growth” to “significant growth.” Versace sees this shift as "reflecting shifting U.S. tariffs and pending trade deals between the U.S. and Taiwan."

In early April, the U.S. imposed a 32% tariff on imports from Taiwan, but paused enforcement for 90 days to allow negotiations. Until a deal is finalized, Taiwan faces a 10% tariff when exporting to the U.S. If talks fail by early July, the 32% rate will be reinstated.

"Despite those tariffs, the message is that AI server demand for Foxconn, Taiwan Semiconductor (TSM) , and therefore Nvidia, remains strong," Versace wrote.

He raised his price target on Nvidia to $160 from $150 and maintained a "One" rating, indicating that he believes the stock is a compelling buy now.

Related: Veteran analyst unveils eye-popping forecast on Supermicro stock

Versace also pointed to upcoming catalysts, including Huang’s keynote at an industry event on May 18 and Nvidia’s earnings report on May 28.

Versace first added Nvidia to his portfolio in February 2024. The stock now accounts for 4.13% of his holdings, with an average return of 53.71%.

He added that other AI and data center-related names, including Marvell Technology (MRVL) , are also benefiting from rising infrastructure investment.

Bank of America raises Nvidia stock price target

Bank of America analysts led by Vivek Arya raised the firm's price target to $160 from $150 and reiterated a buy rating this week following the Saudi deal.

More Nvidia:

- Will Nvidia get hit hard by AI capex risk?

- Analysts revise Nvidia price target on chip demand

- Surprising China news sends Nvidia stock tumbling

The firm expects Nvidia to generate $3 billion to $5 billion per year from the deal, totaling $15 billion to $20 billion over a multi-year period.

"Sovereign AI could also help address limited power availability for data centers in U.S., plus offset headwinds from restrictions on U.S. companies shipping to China," the analyst wrote.

Nvidia closed at $134.83 on May 15.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast