Uncle Sam’s biggest creditor faces a fiscal crisis ‘worse than Greece’ as its borrowing costs hit 20-year high

Japan's prime minister warned members of parliament the country cannot afford any tax cuts funded through the issue of new debt as calls grow for stimulus ahead of July elections to the upper house.

- Japan's prime minister warned members of parliament the country cannot afford any tax cuts funded through the issue of new debt as calls grow for stimulus ahead of July elections to the upper house. The country holds $1.13 trillion in U.S. Treasury debt, even as its own debt-to-GDP ratio runs at roughly 250%.

Japan, the single largest foreign financier of the U.S. federal government, faces its own mountain of debt just as its economy is beginning to shrink.

Prime Minister Shigeru Ishiba, elected last year as a fiscal hawk, has been facing calls for fresh stimulus ahead of an election for the upper house of parliament in July. On Monday, he warned MPs that Japan could not afford any tax cuts paid for with more borrowing.

“Our country’s fiscal situation is undoubtedly extremely poor,” he said, “worse than Greece’s.”

Outstanding debt already exceeds the size of its gross domestic product by nearly 2.5 times. The lower the denominator—in this case the economy—the greater the ratio and the less sustainable a nation’s debt burden becomes, experts say.

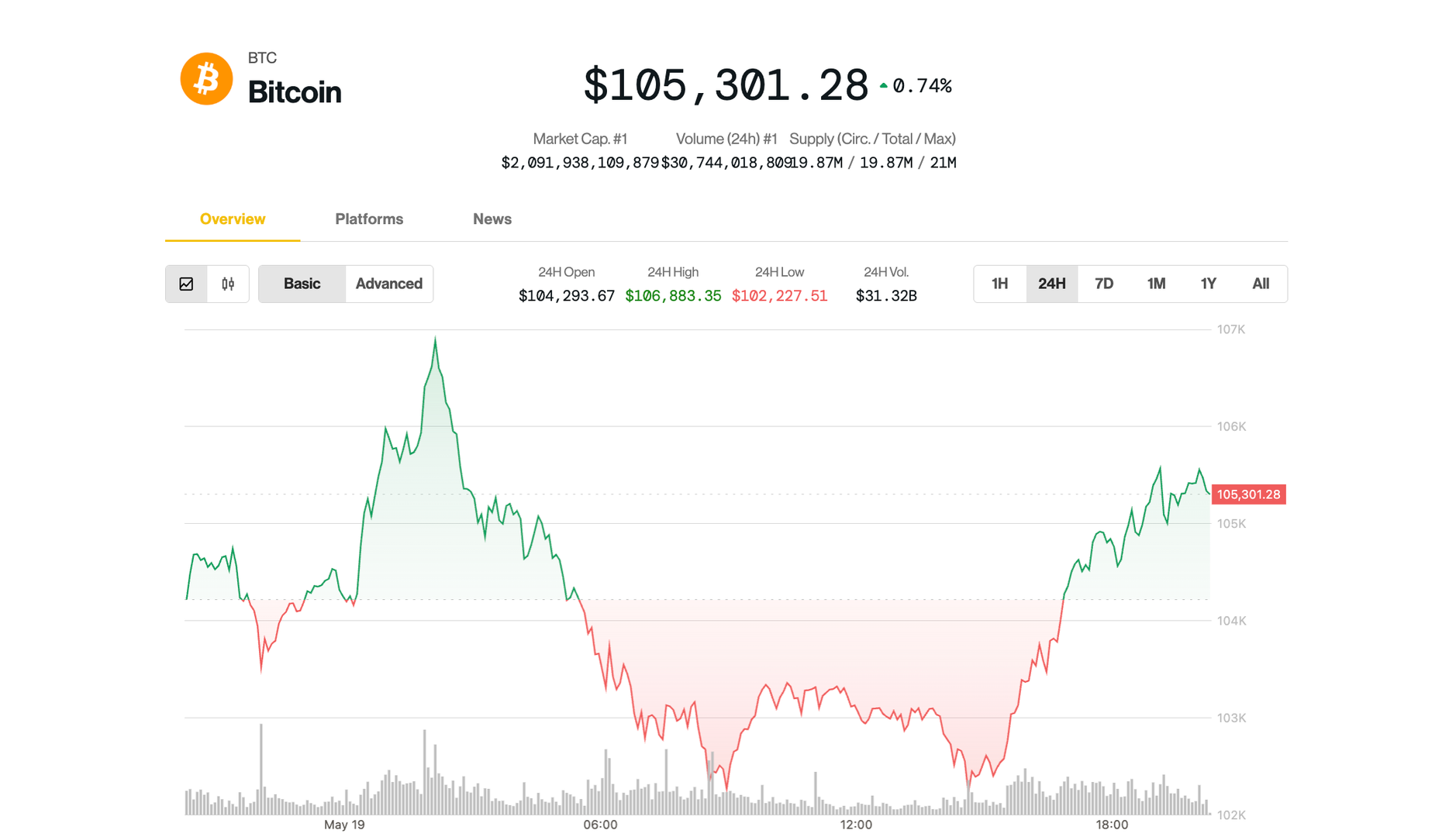

Unfortunately for Japan, it just reported last week that GDP shrank in the past quarter, with investors arguing a recession is a concrete risk. On Monday, the cost of borrowing rose after yields on its 40-year bond hit highs not seen in some 20 years.

Greece famously sparked the euro zone sovereign debt crisis some 15 years ago even though its debt-to-GDP ratio was less than 120%. Importantly, however, eight out of 10 euros in debt Greece had issued was owed to foreign bondholders who had no skin in the game and could move their capital elsewhere instantly. (Hedge fund legend Paul Tudor Jones once described this type of scenario as money with “wings on it”.) By contrast, Japan has been able to issue debt by tapping into its citizens’ own propensity to save.

Japan's holdings of Treasuries hit to $1.13 trillion in March

Ishiba's statements on Monday come as a group of U.S. House lawmakers allowed President Trump’s “big, beautiful bill” to leave committee and proceed to a floor vote. Expected to permanently extend President Donald Trump’s 2017 signature tax cut, which is due to sunset at the end of this year, the loss of revenue to the Treasury would add trillions to the budget deficit.

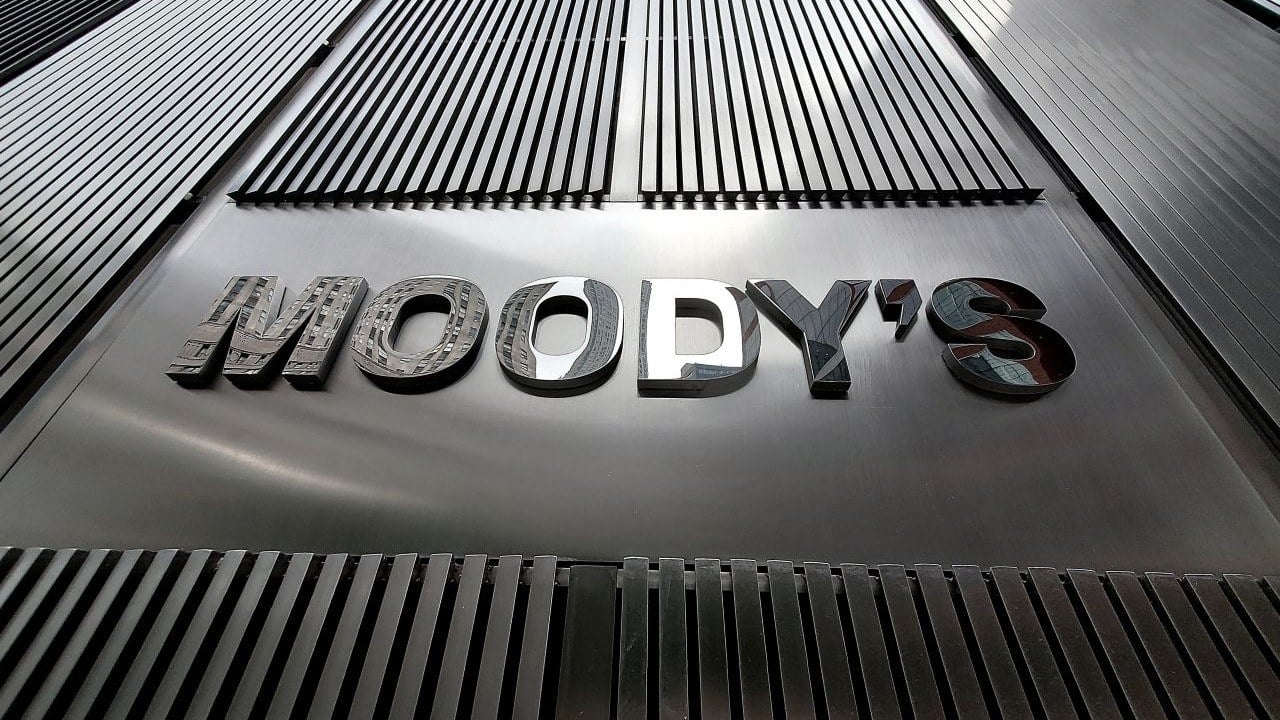

The bill advanced after Moody’s stripped the U.S. of its perfect AAA credit rating, citing the worsening fiscal outlook. The downgrade sparked an across-the-board selloff in government debt, with the U.S. 30-year yield spiking above 5%, close to its 5.18% multi-decade high from 2007.

The most voracious foreign buyer of Treasury bonds is the heavily indebted Japan itself. The latest official U.S. data show that Japan's holdings ticked higher to $1.13 trillion in March—roughly a quarter of its GDP—making it easily the largest overseas investor in the United States government.

Ishiba became prime minister by pitching himself as a hawk aiming to curb the excesses of “Abenomics,” a government policy of coordinated monetary and fiscal stimulus. Named after Shinzo Abe, Japan’s longest serving prime minister, it involved the Bank of Japan expanding its balance sheet to buy government debt and keep a lid on the yield curve.

His election last September briefly sent stocks in Tokyo reeling amid what economists called the “Ishiba shock”. At the time, markets had expected an ally of Abe, assassinated three years ago, to ascend to the post and maintain his course.

This story was originally featured on Fortune.com