Trump Media Group denies it’s raising $3B for crypto buys: Report

Update (May 26, 9:27 pm UTC): This article has been updated to include a statement from Truth Media and Technology Group.Trump Media and Technology Group, the company behind US President Donald Trump’s Truth Social platform, has rebuffed a report that it’s planning to raise $3 billion in a mix of equity and convertible bonds to buy Bitcoin and other cryptocurrencies.The Financial Times reported the company’s plan on May 26, citing six people briefed on the matter, but Trump Media told the outlet that, “apparently the Financial Times has dumb writers listening to even dumber sources.”Trump Media did not immediately respond to Cointelegraph’s request for comment.If Trump Media implements the reported plan, it would position the company to follow the footsteps of crypto-buying companies like Strategy.The Financial Times reported that Trump Media was planning to issue $2 billion in equity and $1 billion in convertible bonds, a type of asset that can be converted into equity at a later date and that the size of the raise may change.The equity was expected to be sold at market price as of the close on May 23. On that day, shares of Trump Media (DJT) closed at $25.72, marking a 4.6% increase on the day. Trump Media’s market capitalization was $5.7 billion as of May 23.Trump Media and Technology Group share price on May 23. Source: Google FinanceThe company’s reported plan follows a similar approach to that pioneered by companies such as Strategy, Metaplanet, Semler Scientific and others, allocating part of their funds to Bitcoin (BTC). Betting on crypto provides a hedge against inflation and keeps them from becoming “zombie companies,” some of the companies have said.Related: Strategy bags 4,020 Bitcoin as price briefly breaks $110KTrump Media’s move may increase scrutinyThe move could have also resulted in more scrutiny toward the Trump family’s growing crypto businesses. Democratic lawmakers have pushed back against bipartisan bills over the Trump family’s crypto dealings, with some staging protests against the memecoin dinner Trump hosted on May 22.Trump’s crypto ties include non-fungible token collections, the Official Trump (TRUMP) and Melania (MELANIA) memecoins, decentralized finance platform World Liberty Financial and a dollar-pegged stablecoin. Critics say that Trump’s crypto ventures pose a conflict of interest, especially as he could hold influence over an industry he stands to profit from.According to the report, Trump transferred his 53% share in Trump Media and Technology to a revocable trust managed by his son Donald Trump Jr. Magazine: Trump’s crypto ventures raise conflict of interest, insider trading questions

Update (May 26, 9:27 pm UTC): This article has been updated to include a statement from Truth Media and Technology Group.

Trump Media and Technology Group, the company behind US President Donald Trump’s Truth Social platform, has rebuffed a report that it’s planning to raise $3 billion in a mix of equity and convertible bonds to buy Bitcoin and other cryptocurrencies.

The Financial Times reported the company’s plan on May 26, citing six people briefed on the matter, but Trump Media told the outlet that, “apparently the Financial Times has dumb writers listening to even dumber sources.”

Trump Media did not immediately respond to Cointelegraph’s request for comment.

If Trump Media implements the reported plan, it would position the company to follow the footsteps of crypto-buying companies like Strategy.

The Financial Times reported that Trump Media was planning to issue $2 billion in equity and $1 billion in convertible bonds, a type of asset that can be converted into equity at a later date and that the size of the raise may change.

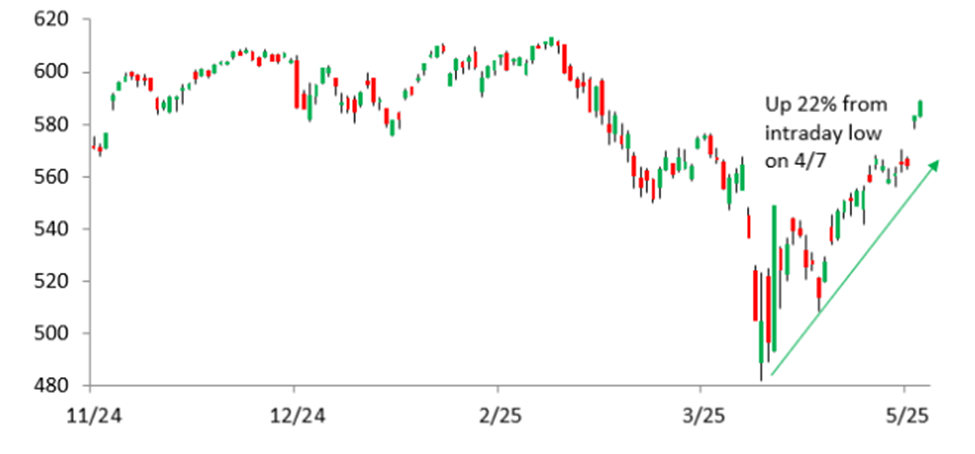

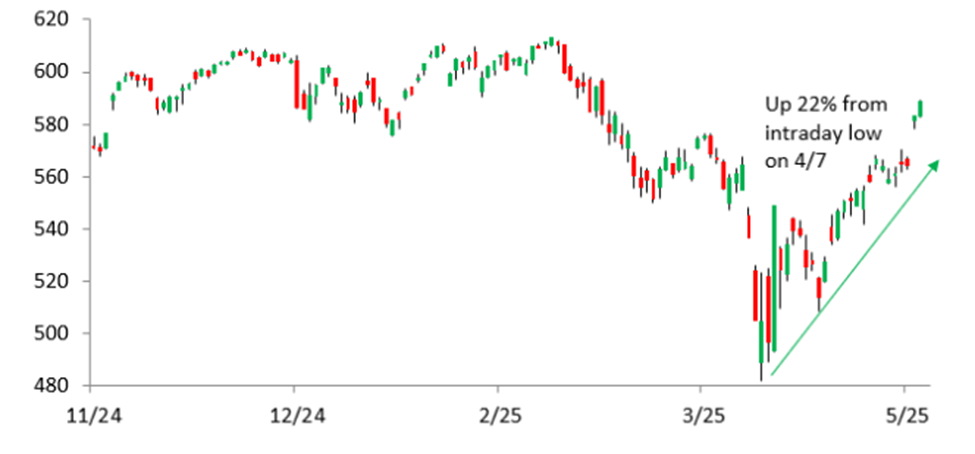

The equity was expected to be sold at market price as of the close on May 23. On that day, shares of Trump Media (DJT) closed at $25.72, marking a 4.6% increase on the day. Trump Media’s market capitalization was $5.7 billion as of May 23.

The company’s reported plan follows a similar approach to that pioneered by companies such as Strategy, Metaplanet, Semler Scientific and others, allocating part of their funds to Bitcoin (BTC).

Betting on crypto provides a hedge against inflation and keeps them from becoming “zombie companies,” some of the companies have said.

Related: Strategy bags 4,020 Bitcoin as price briefly breaks $110K

Trump Media’s move may increase scrutiny

The move could have also resulted in more scrutiny toward the Trump family’s growing crypto businesses. Democratic lawmakers have pushed back against bipartisan bills over the Trump family’s crypto dealings, with some staging protests against the memecoin dinner Trump hosted on May 22.

Trump’s crypto ties include non-fungible token collections, the Official Trump (TRUMP) and Melania (MELANIA) memecoins, decentralized finance platform World Liberty Financial and a dollar-pegged stablecoin. Critics say that Trump’s crypto ventures pose a conflict of interest, especially as he could hold influence over an industry he stands to profit from.

According to the report, Trump transferred his 53% share in Trump Media and Technology to a revocable trust managed by his son Donald Trump Jr.

Magazine: Trump’s crypto ventures raise conflict of interest, insider trading questions