Using JEPQ for Regular Dividends—Is It Worth the Trade-Off?

Investors seeking sizable capital appreciation will usually search out aggressive growth stocks and exchange traded funds that are tied to tech indexes or the S&P 500. Those that want growth but lack the stomach for the market’s turbulence may opt for the stability of blue chip Dividend King (50 or more consecutive years of dividend […] The post Using JEPQ for Regular Dividends—Is It Worth the Trade-Off? appeared first on 24/7 Wall St..

Investors seeking sizable capital appreciation will usually search out aggressive growth stocks and exchange traded funds that are tied to tech indexes or the S&P 500. Those that want growth but lack the stomach for the market’s turbulence may opt for the stability of blue chip Dividend King (50 or more consecutive years of dividend increases) or Dividend Aristocrat (25 or more consecutive years of dividend increases) stocks. For the most part, companies with the wherewithal to increase dividends on a regular basis are generating sufficiently large profits to do so. This points to a successful business model with savvy management and solid growth prospects for the future. Stocks representing American business history that have become household names, such as Johnson & Johnson, Altria Group (Marlboro cigarettes), Stanley Black & Decker, Pepsi Co. and Target are just a few such companies.

Other investors are often focused on income. These investors will sacrifice growth for regular dividends or debt payments. Many retirees fall into this category. If not investing directly in government municipal, or corporate debt, then businesses that generate regular liquid income have become popular with income investors. Platforms available for investment include:

- Real Estate Investment Trusts (REIT) – primarily predicated on commercial and/or residential rent rolls, but also includes mortgage finance and other real-estate related debt products.

- Business Development Companies (BDC) – this sector addresses the private corporate debt arena, which involves many voids of corporate finance that were left behind after the post-subprime mortgage meltdown banking consolidations.

- Midstream Companies – a subsector of the energy industry, midstream companies are involved with logistics and transport of oil, natural gas, and various by-products via pipeline or other means to refineries, warehouses, and distribution sites.

Key Points

-

Actively managed income focused ETFs can use derivative strategies to boost returns, although doing so can decelerate capital appreciation.

-

Institutional level trading of Equity Linked Notes for access to covered call option profits is a strategy that savvy fund managers can use to protect portfolio integrity from direct call writing.

-

As option premiums are higher during volatile markets, dividend returns will likely be proportionately greater during these periods, and smaller in calmer market environments.

-

Roughly 4.2 Million Americans are set to retire this year. If you’re one of them, make sure you have a plan for your future, and don’t leave it to chance. Speak with an advisor and learn if you’re ahead or behind on your goals. Click here to get started. (Sponsored)

ETF Dividends By Other Means

Equity Linked Notes (ELN) are synthetic financial products created by financial institutions. Usually linked to a particular index or stock, ELNs often have a call option attached to a principal protection component, and usually resemble a zero-coupon bond. In most cases, the ELN is a short term instrument that has a maturity of no longer than a few months. The returns on the ELN are linked to the underlying index or stock. Additionally, most, if not all ELNs are purchased directly from the issuer and held to maturity. There is no secondary market for ELNs.

An ETF that has utilized ELNs successfully to date is the JP Morgan Nasdaq Equity Premium Income ETF (NASDAQ: JEPQ). Sporting a yield of 11.23% at the time of this writing, JEPQ contains 94-102 holdings at any given time, and has AUM of $24.23 billion. Its expense ratio is 0.35%. It launched in May, 2022, and has options availability. The top 5 holdings include, unsurprisingly, all Magnificent 7 stocks.

| Symbol/Exchange | Company | Percentage |

| MSFT | Microsoft Corp. | 7.54% |

| NVDA | Nvidia Corp | 7.35% |

| AAPL | Apple, Inc. | 6.47% |

| AMZN | Amazon | 4.96% |

| GOOG | Alphabet Class C | 4.02% |

JEPQ uses slightly out-of-the-money calls on the NASDAQ 100 Index, leaving moderate room to capture the index’s upside. JEPQ manager Hamilton Reiner staggers one-month calls into multiple weekly buckets, then diversifies the expiration dates and strike prices. However, he doesn’t directly write covered calls for the fund. Instead, Reiner purchases ELNs that give the fund exposure to the profits on those call options, without the risk of any of the top tech stock holdings being subject to calls if the market takes off and the calls go in-the-money. This simplifies the fund’s tax treatment but precludes it from taking advantage of lower long-term capital gains tax rates.

Market Volatility = Dividend Growth?

Most investors who turn to dividend oriented investments often do so to better embrace income and market stability and eschew aggressive growth and sleepless nights. As a result, these investments often are looked up as being defensive in nature against volatility.

While it might seem oxymoronic, the dividends of JEPQ actually tend to increase with market volatility. This is because increased delta, i.e. volatility, adds, by design, to the premiums of near term options, which usually shed premium as each calendar day approaches closer to the expiration date.

An analyst for Morningstar noted that JEPQ doesn’t participate past the short call strike price during rallies and pays out its call premiums and dividends as distributable income. While the historical strike price for JEPQ averages 2.5%, 40% of the Nasdaq 100 Index’s monthly returns, by contrast, have been between 2.5% and 7.5%.

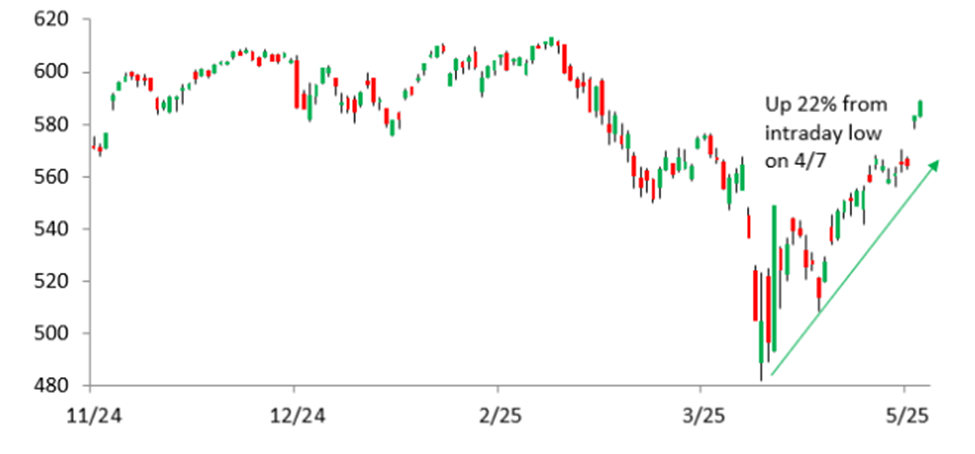

The higher than normal market volatility has coincided of late from the mistaken institutional reactions to President Trump’s tariff announcements and calls for revised international trade agreements. The increase in market turbulence has subsequently seen iver 1,000 point intraday swings on the Dow Jones Industrial Average. This unusual excess volatility has fattened index option premiums considerably since March, 2025.

For example, JEPQ’s dividend payout per share for ex-dividend shareholders of March 1st was $0.482. For April 1st, it was $0.54, and for May 1st, it was $0.597. This is shy of 30% dividend growth in 60 days.

If the market turbulence calms down the dividend growth rate will inevitably slow down, but the fund’s overall growth component should still be robust, due to its tech stock portfolio weighting. However, the March dividend payout would be more indicative of the normal range in a routine market environment, versus that of May.

Worth The Trade-Off?

While the JEPQ 11.32% yield looks attractive, there are considerably more market variables connected to sustaining that size of a dividend than that of a REIT or Midstream investment. Market prices for real estate rent rolls are probably the most stable, with oil prices, interest rates, and then stock market prices decreasing in reliable support at current levels.

If being considered as part of an overall portfolio, JEPQ’s unique dividend, combined with relative asset protection and overall tech market upside exposure, could be a valuable addition. If being looked upon as an end all, be all investment, there are a multitude of risks that one needs to weigh before taking the plunge. While the trade-off may be very attractive at present, calculating for the worst case scenario in a boring, calm market should be conducted for the opposite reason for gauging high risk tolerance – inert market resistance, and can lack of previously high dividends can impact one’s overall objectives and plans.

The post Using JEPQ for Regular Dividends—Is It Worth the Trade-Off? appeared first on 24/7 Wall St..