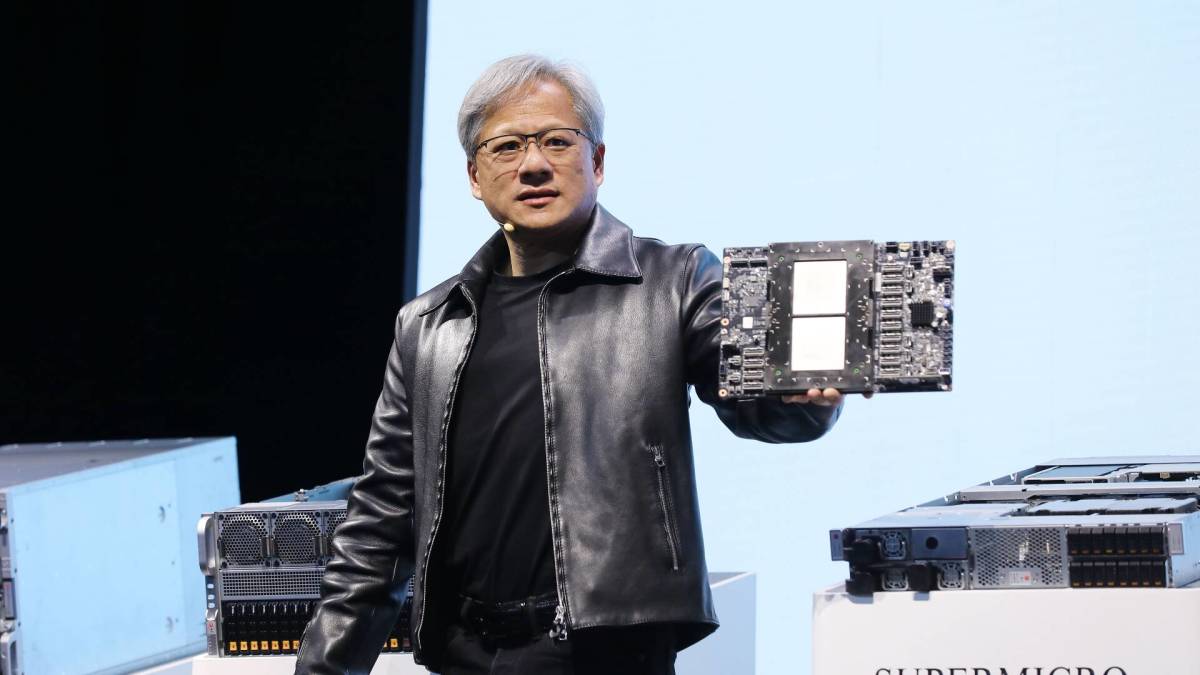

Top analyst revisits Nvidia stock price target amid DeepSeek questions

DeepSeek's emergence in late January loped nearly $600 billion from Nvidia's market value, the largest single-day move on record.

Nvidia shares extended their recent run of declines Tuesday as investors focus on the group's fourth quarter earnings later in the week and the impact of new and potentially tougher U.S. export restrictions on its near-term sales outlook.

Nvidia (NVDA) shares, the market's star performer in 2024, have stalled so far this year, falling around 6% amid a broader pullback in megacap tech stocks and concerns tied to the emergence of China-based DeepSeek on global AI chip demand.

DeepSeek, a startup developed by a former hedge fund manager in 2023, claims to have built, trained and launched an AI-powered Chatbot, called the R1, at a fraction of the price of its U.S.-based rivals,

News of the launch in late January, and the implications it has for AI investment spending over the coming years, triggered a $593 billion slump in Nvidia shares, marking the largest single-day decline on record.

It may also have sparked a potential overhaul of U.S. export rules as the Commerce Department investigates whether DeepSeek used chips that are banned from sale to China to train its large-language models.

Nvidia has designed specific, but less powerful, chips for the China market under rules put in place by former President Joe Biden, including the H800 version reportedly used by DeepSeek.

Tougher export rules on tap?

Bloomberg News, however, is reporting that President Donald Trump's administration wants a stricter set of export restrictions, including but not limited to China, in order to keep U.S. companies at the forefront of AI development.

Morgan Stanley analyst Joseph Moore, in a note published Tuesday, thinks those restrictions could have a "meaningful" impact on Nvidia sales over the second half of the year.

"In the wake of DeepSeek's success with the RI model, the government is likely to be more restrictive, but we don't know what that looks like," Moore said. "Most in the industry expect there to be incremental controls, which several U.S. software developers have asked for, but nobody knows what that may look like (and) unlike last year, it could be a meaningful headwind to second half results."

Related: Nvidia has 'room to grow:' What to watch ahead of earnings

Moore, who held his 'overweight' rating and $152 price target in place heading into Wednesday's earnings report, also noted the DeepSeek's success will lower-end chips, as well as the looming export restrictions, could stoke demand for Nvidia's legacy Hopper line instead.

Hopper demand in focus

"Since DeepSeek R1 negatively impacted the stock, our checks would say that demand has strengthened .... H20 has been notably strong, but H100 and H200 are strong as well," Moore said.

"Pull-forwards aren't the best source of demand, but given that Hopper builds are coming to a natural end, it is a nice bridge to a strong potential for Blackwell in the second half of the year," he added.

That could also mean, however, that Nvidia's near-term revenue guidance could be more conservative that first expected, given that Hopper chips command a lower price than their Blackwell successors.

Related: Analyst reworks Nvidia stock price target with Q4 earnings on deck

Analysts expect Nvidia to forecast April-quarter revenues in the region of $41.75 billion, a tally that suggests a 60% growth rate from the same period last year, with data center sales expected to rise 65% to $37.21 billion.

Markets braced for Nvidia swings

For the three months ending in January, the final quarter in Nvidia's fiscal year, Wall Street is looking for overall revenues of $38.05 billion, a 72% increase from last year, with data center sales rising 82% to $33.6 billion.

In terms of bottom line profits, analysts expect a tally of around $25.3 billion or 84 cents a share, with a gross margin in the region of 73.5%.

"We aren't seeing the quarter as a major positive catalyst, but we remain convinced that once we get past export controls there will be positive momentum into (the second half of the year)," Moore said.

More AI Stocks:

- AI startup smashes funding round, signals big changes for health care

- Analyst revisits Palantir stock forecast following annual report filing

- Analyst who predicted Palantir rally picks best AI software stocks

"We view this as something of a transitional quarter and thus not a major catalyst for the stock, but we remain overweight given expectations that the Blackwell cycle will continue to drive meaningful upside through (the second half of the year," he added.

Nvidia shares were marked 0.7% lower in premarket trading to indicate an opening bell price of $129.35 each.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast