This Ultra-High Yield ETF (YMAX) Is the Best Performer and Paying a 72.34% Distribution

Over the past few years, YieldMax has garnered a reputation for offering intriguing, innovative exchange traded funds (ETFs) with an emphasis on high yield. Due to its notable performance and ultra-high yield, the YieldMax Universe Fund of Option Income ETFs (NYSEARCA:YMAX) stands out among YieldMax’s fund offerings. The diversification feature might make the YieldMax Universe […] The post This Ultra-High Yield ETF (YMAX) Is the Best Performer and Paying a 72.34% Distribution appeared first on 24/7 Wall St..

Key Points

-

Investors can diversify across many ultra-high-yield funds with the YieldMax Universe Fund of Option Income ETFs (YMAX).

-

Bear in mind, however, that the YMAX ETF is subject to certain risks, including share-price erosion.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Over the past few years, YieldMax has garnered a reputation for offering intriguing, innovative exchange traded funds (ETFs) with an emphasis on high yield. Due to its notable performance and ultra-high yield, the YieldMax Universe Fund of Option Income ETFs (NYSEARCA:YMAX) stands out among YieldMax’s fund offerings.

The diversification feature might make the YieldMax Universe Fund of Option Income ETFs seem low-risk. Plus, passive income seekers may find it difficult to resist the YMAX ETF’s eye-catching yield.

Yet, there are risks to this fund which prospective investors should be aware of. There’s no risk-less “free lunch” in the financial markets, so let’s put the YieldMax Universe Fund of Option Income ETFs under the microscope and see what’s inside this fascinating fund.

Indirect Exposure to Famous Names

As the fund’s name suggests, the YieldMax Universe Fund of Option Income ETFs includes a basket of income-focused YieldMax ETFs. Furthermore, these funds use options to generate consistent income.

These aren’t traditional dividend payments. However, they are cash distributions that will show up in YMAX ETF investors’ accounts. As we’ll discover in a moment, these cash distributions can add up quickly.

YieldMax describes the Universe Fund of Option Income ETFs as a “fund of funds,” because it’s a YieldMax ETF that invests in a variety of other YieldMax ETFs. This, in itself, is a disruptive concept.

If you feel that it’s too risky to invest in one or two of YieldMax’s ultra-high-yield ETFs, you can get instant diversification with YMAX. It includes a balanced mix of YieldMax funds, including the following:

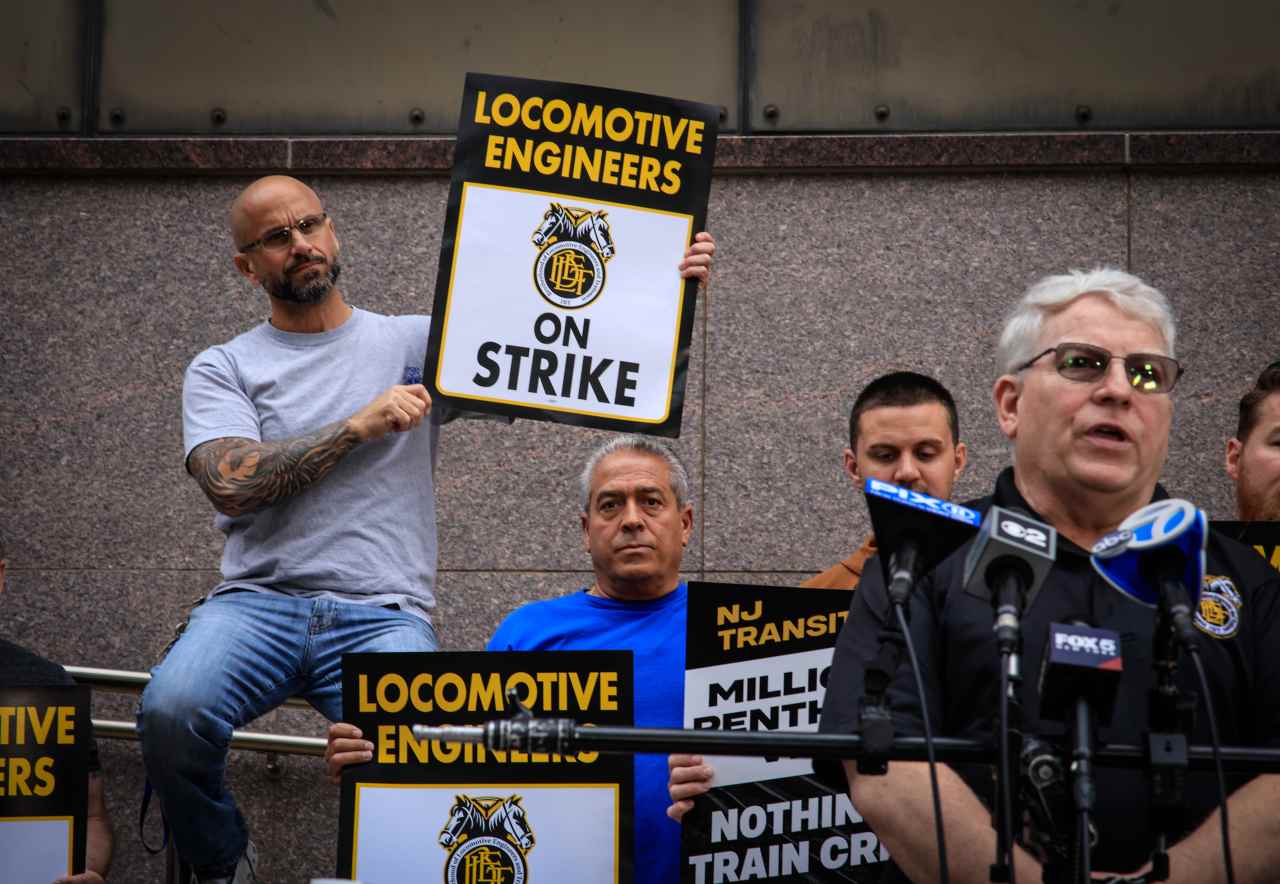

- The YieldMax CVNA Option Income Strategy ETF (NYSEARCA:CVNY), which uses options to indirectly track the performance of Carvana (NYSE:CVNA) stock and generate income

- The Yieldmax TSLA Option Income ETF (NYSEARCA:TSLY), which indirectly tracks and generates income from Tesla (NASDAQ:TSLA) stock

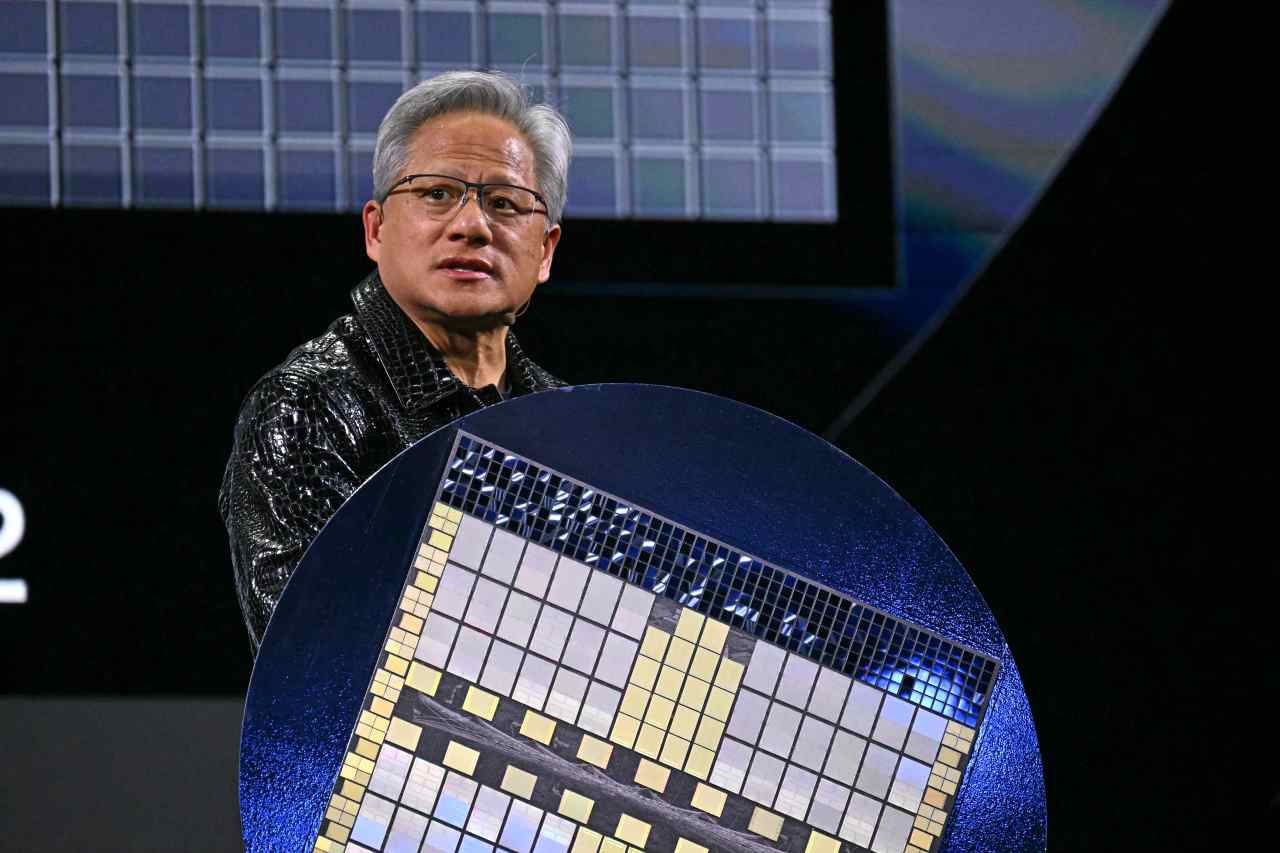

- The YieldMax NVDA Option Income Strategy ETF (NYSEARCA:NVDY), which uses a similar strategy with options on NVIDIA (NASDAQ:NVDA) stock

Other YMAX holdings generally track the price performance and attempt to generate income from the stocks of Palantir Technologies (NYSE:PLTR), Walt Disney (NYSE:DIS), Meta Platforms (NASDAQ:META), Microsoft (NASDAQ:MSFT). All in all, there are around 30 ETFs included in the holdings of the YieldMax Universe Fund of Option Income ETFs, and none of them exceed 4% of YMAX’s weighting.

Giant Yield Makes a Powerful Performer

Before discussing the share-price performance of the YieldMax Universe Fund of Option Income ETFs, I want to get to the headline topic: the fund’s gigantic yield. After all, that’s the reason many investors flock to YieldMax ETFs.

Currently, the distribution rate (i.e., the expected cash yield that investors will get during the next 12 months) for the YieldMax Universe Fund of Option Income ETFs is a whopping 72.34%. YieldMax uses call option strategies to indirectly juice all of that income from the stocks of Carvana, Tesla, NVIDIA, and so on.

As a result, the YMAX share price could decline substantially during the next 12 months but the funds can still deliver a sizable net gain for investors. To put it another way, the fund’s 72.34% cash yield is a big cushion that allows for a lot of share-price decline.

Granted, the YieldMax Universe Fund of Option Income ETFs subtracts operating fees from the share price. These fees total 1.28% per year, and that’s high for an ETF. Still, YMAX’s 72.34% yield will probably make up for a potential share-price decline as well as the operating fees.

No Price-Performance Promises

On the other hand, prospective investors of the YieldMax Universe Fund of Option Income ETFs should be mindful of the fund’s risks. The fund’s prospectus lists multiple risks associated with the YMAX ETF, and I believe that two of these risks deserve special attention.

First, the “price participation risk” of the YieldMax Universe Fund of Option Income ETFs is due to the fund’s covered call strategy. This strategy limits the possible upside movement of YMAX when the underlying stock goes up.

Thus, the share prices of Carvana, Tesla, NVIDIA, and so on might rise sharply but YMAX would only rise to a limited extent. This is a limitation, and perhaps a risk, of the YieldMax Universe Fund of Option Income ETFs.

On top of that, there the “erosion risk” of the YieldMax Universe Fund of Option Income ETFs. It’s exciting, no doubt, that the fund pays investors a cash distribution every week. However, the YMAX share price is reduced by that same amount when the cash distribution is paid.

This share-price erosion helps to explain why the YMAX ETF chart doesn’t necessarily look great. The erosion risk also means that no price performance or total return promises can be made for the YieldMax Universe Fund of Option Income ETFs.

So, YMAX has pros and cons, and the fund’s attention-getting yield doesn’t tell the full story. Nevertheless, if you feel that the giant yield will outweigh the fund’s risks and limitations, you might consider a small, cautious position in the YieldMax Universe Fund of Option Income ETFs.

The post This Ultra-High Yield ETF (YMAX) Is the Best Performer and Paying a 72.34% Distribution appeared first on 24/7 Wall St..