These Questions Separate the Rich from the Poor According to Dave Ramsey

Debt has long been part of the American lifestyle. Many of us succumb to loans and credit cards when faced with financial predicaments, and these balances can be carried for months or years, continuing to grow under high interest rates. Dave Ramsey is one of the top financial gurus, and he has made a name […] The post These Questions Separate the Rich from the Poor According to Dave Ramsey appeared first on 24/7 Wall St..

Debt has long been part of the American lifestyle. Many of us succumb to loans and credit cards when faced with financial predicaments, and these balances can be carried for months or years, continuing to grow under high interest rates. Dave Ramsey is one of the top financial gurus, and he has made a name for himself specifically regarding his hardcore advice regarding debt. Ramsey says a key method of avoiding debt is to stop asking “how much down?” and start asking “How much?” He reminds us of the value of living within our means.

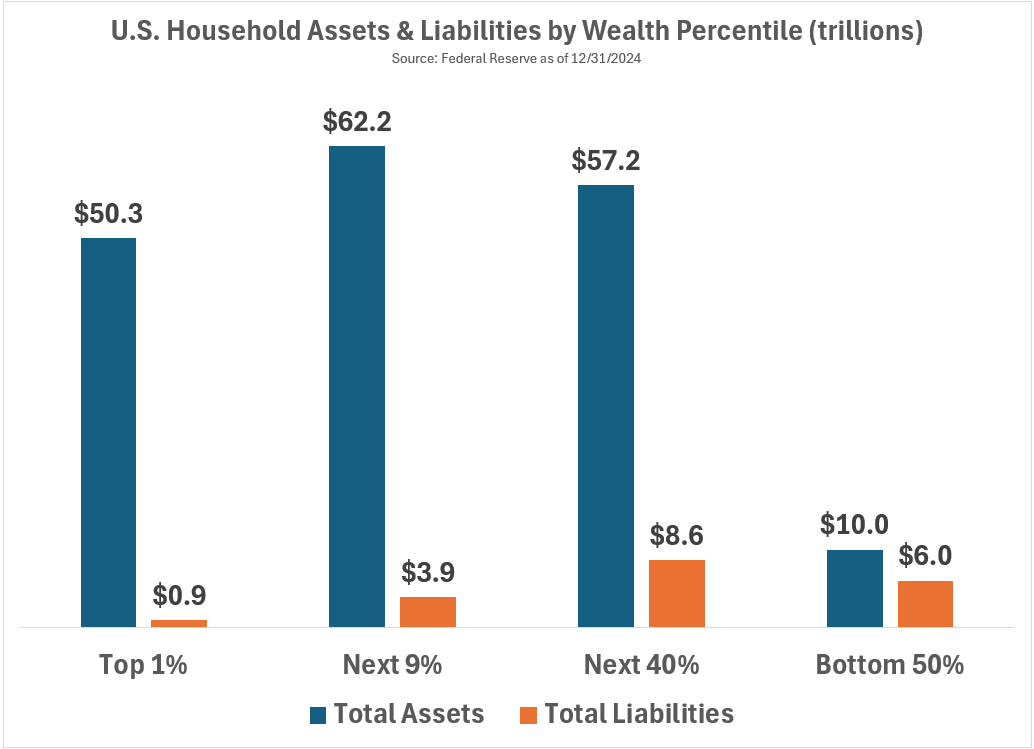

Ramsey’s focus on helping Americans get out of debt is based on real world concerns; Data from Debt.com reveals one in three Americans have maxed out their credit cards. Another shocking statistic from Business Insider states that the average American has upwards of $104,000 in debt. And as citizens continue to struggle with economic issues, credit card use only continues to rise. This burdensome cycle can begin to feel relentless.

This slideshow reveals Ramsey’s best financial advice regarding debt, including the latest statistics, how to find your way out of debt, and tips to avoid future debt. If you want to regain control of your finances and make a firm commitment to your future, check out Dave Ramsey’s proven methods.

Dave Ramsey’s Debt Philosophy

- Dave Ramsey highlights the importance of mindset in financial decisions.

- He believes rich people ask, ‘How much?’ while poor people ask, ‘How much down?’

- This reflects a focus on affordability versus long-term debt.

The Weight of American Debt

- Business Insider reports the average American holds $104,215 in debt.

- This includes mortgages, student loans, auto loans, and credit card debt.

- Debt can quickly become overwhelming, especially with rising interest rates.

The Credit Card Trap

- 1 in 3 Americans have maxed out their credit cards according to Debt.com.

- Many people rely on credit to afford basic needs due to inflation.

- 22% carry $10,000–$20,000 in debt, and 5% owe more than $30,000.

Massive Growth of the Debt Industry

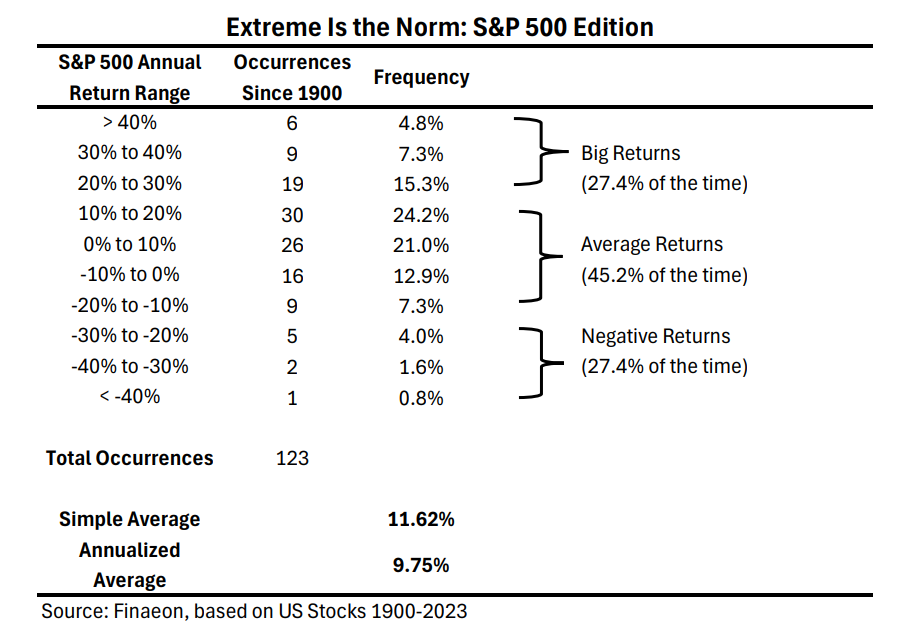

- Visa and MasterCard stocks are near record highs.

- Credit card balances exceeded $1 trillion in Q4 2023.

- The debt industry is booming despite rising financial insecurity for many.

Psychology of Spending

- Ramsey stresses that poor spending decisions often stem from emotional buying.

- Social media and constant advertising pressure consumers to spend.

- Asking ‘Can I afford this?’ is a better question than ‘Can I make the down payment?’

How Inflation Drives Debt

- Inflation has caused basic expenses to rise significantly.

- 45% of people report using credit cards to pay for necessities.

- This reliance contributes to long-term debt and high interest payments.

Ramsey’s Core Advice

- Ramsey’s core philosophy is: ‘Don’t buy it if you can’t afford it.’

- This means avoiding purchases that lead to debt without secure income.

- He promotes living below your means as a path to wealth.

Budgeting to Break Free

- Weekly budgeting helps differentiate between wants and needs.

- Small, consistent savings add up over time.

- Budgeting allows for better financial planning and less reliance on credit.

Cutting Credit Card Dependency

- Avoid habitual use of credit cards by using cash or debit.

- Credit card interest makes small purchases cost significantly more.

- Track spending regularly to stay within budget.

Consider Debt Consolidation

- Refinancing high-interest credit cards can reduce debt faster.

- Consolidation into lower-interest loans may provide relief.

- Act before rates rise again to secure better terms.

The post These Questions Separate the Rich from the Poor According to Dave Ramsey appeared first on 24/7 Wall St..