These Are the States with the Highest Student Loan Debt per Capita

For many middle-class families, putting kids through college has become an increasingly daunting goal. Tuition, room and board, fees, and books have skyrocketed. Families are having to find increasingly creative ways to economize, and some are questioning the value of a college education at all, especially when trades and non-degree online jobs can provide a […] The post These Are the States with the Highest Student Loan Debt per Capita appeared first on 24/7 Wall St..

For many middle-class families, putting kids through college has become an increasingly daunting goal. Tuition, room and board, fees, and books have skyrocketed. Families are having to find increasingly creative ways to economize, and some are questioning the value of a college education at all, especially when trades and non-degree online jobs can provide a better living at times than a liberal arts degree. Some students graduate saddled with debt that will take a decade or more to pay off, if ever.

For a variety of reasons, student debt is higher in some states than others. We have a rundown for you that might be worth considering before choosing a college for yourself or helping your child choose one. And if you make it all the way to the end of the article, we’ve got some tips for you there for minimizing college debt you’ll want to check out.

Average college debt differs by state for reasons related to state budgets, college policies, and student culture. Regardless of the state, students have options to minimize college debt or eliminate it altogether.

4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

Key Points

Government Policies & State Funding

The states differ widely in average student borrower debt levels, from $29,647-$43,692 in 2024. Why the wide gap?

- Some states invest a greater portion of the state budget into public education. This defrays operating costs so colleges don’t have to charge students as much.

- Other states offer more generous scholarships and grants, sometimes funded by state lotteries.

- The economies of some states attract more college graduates from across the country with better-paying jobs. This doesn’t mean, then, that there’s a problem with the colleges in that state, but that students with debt from across the country are moving there for jobs.

College & Cost Factors

Other reasons for differentials in debt loads for college students in different states has to do with the colleges themselves.

- Some states have more private schools, which charge higher tuition than public institutions whose expenses are defrayed by state funding.

- Colleges that are well-established sometimes have endowments that give them deep pockets to offer scholarships and grants so that student don’t have to borrow as much.

- The cost of living in some areas greatly increases costs for students. New York City or Honolulu, for example, are extraordinarily expensive places to live.

Culture and Student Preferences

Finally, people in some states are more willing to take on college debt for cultural reasons or because of their post-graduation career expectations.

- Wages are high in some parts of the country, so students are willing to borrow more in the hope that their career will more than reimburse them for their debt burden.

- Culturally, borrowing for college is more normalized in some regions of the country, whereas in other areas, it may be more typical for families to encourage young people to go to trade school, community college, or to work their way through college to avoid taking on excessive debt.

Average Borrower Debt: Under $30,000

- North Dakota: $29,647

Average Borrower Debt: $30,000 – $30,999

- Iowa: $30,925

- South Dakota: $30,928

Average Borrower Debt: $31,000 – $31,999

- Wyoming: $31,022

Average Borrower Debt: $32,000 – $32,999

- Oklahoma: $32,103

- West Virginia: $32,358

- Nebraska: $32,377

- Wisconsin: $32,628

Average Borrower Debt: $33,000 – $33,999

- Indiana: $33,119

- Kansas: $33,270

- Kentucky: $33,281

- Rhode Island: $33,470

- Utah: $33,746

- Arkansas: $33,858

- Montana: $33,945

Average Borrower Debt: $34,000 – $34,999

- Minnesota: $34,071

- New Mexico: $34,280

- Maine: $34,292

- Nevada: $34,589

- Louisiana: $34,866

- New Hampshire: $34,884

Average Borrower Debt: $35,000 – $35,999

- Ohio: $35,033

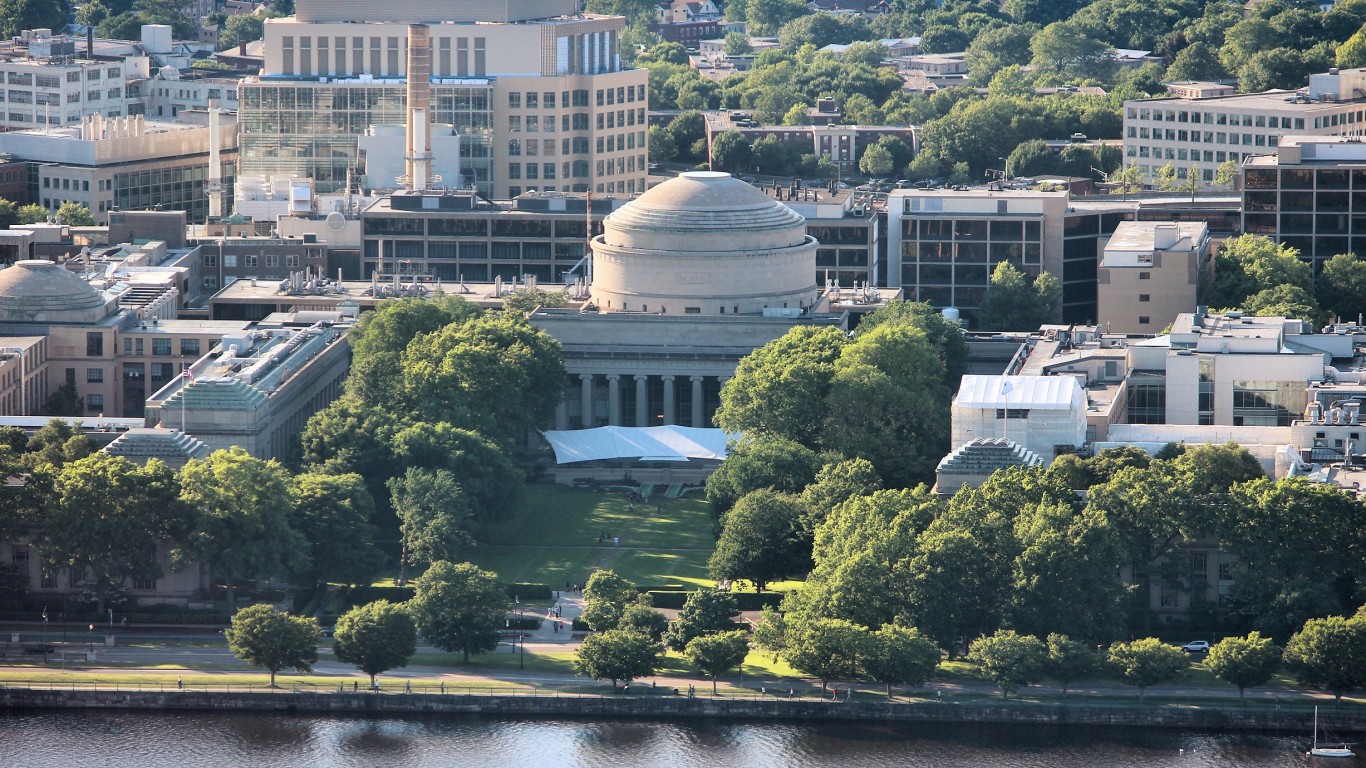

- Massachusetts: $35,529

- Missouri: $35,675

- Arizona: $35,675

- Alaska: $35,821

Average Borrower Debt: $36,000 – $36,999

- Pennsylvania: $36,267

- Connecticut: $36,672

- Washington: $36,762

- Tennessee: $36,886

- Michigan: $36,974

Average Borrower Debt: $37,000 – $37,999

- New Jersey: $37,201

- Mississippi: $37,254

- Colorado: $37,392

- Alabama: $37,709

- Oregon: $37,829

Average Borrower Debt: $38,000 – $38,999

- Hawaii: $38,158

- California: $38,168

- Vermont: $38,404

- Delaware: $38,683

- New York: $38,690

- North Carolina: $38,695

- South Carolina: $38,770

Average Borrower Debt: $39,000 – $39,999

- Illinois: $39,055

- Florida: $39,262

Average Borrower Debt: $40,000+

- Virginia: $40,137

- Georgia: $42,026

- Maryland: $43,692

Strategies for Minimizing College Debt

College debt can in some cases be a strategic decision that jump-starts a person’s entry into a successful career. But in other cases it can be an anchor around a graduate’s life that can seriously interfere with their ability to explore different career options, buy a house, start a business, or raise a family. Here are some thoughts about how to minimize the amount of money you and your children borrow for college.

1. Apply for Scholarships and Grants

- Always fill out the FAFSA well before the deadline so you can be considered for free federal and state grants.

- Colleges have some scholarships but private organizations often have smaller ones that go unclaimed because people don’t know about them or don’t take the time to apply for them. Find them online or contact a local university’s financial aid office for ideas.

- In your junior and senior year of high school, research online and make a practice of applying for at least 2 scholarships every week. This will mean you have applied for 200 scholarships by the time you graduate. There’s a good chance that is going to get you a few thousand dollars you didn’t have before, and maybe a whole college education.

2. Soak Up Cheap College Credits

- Fully take advantage of any dual enrollment programs that allow students to get college credit while in high school.

- Consider going to community college for the first two years and in the summers to knock out general education requirements like English, math, history, and science.

- Look for online college classes that cost less than in-person college. Think about this. If you wish you could go to Hawaii to college but can’t afford it, get a job in Hawaii and take online classes at a community college in Nebraska while you’re there. This whole setup can be cheaper than a year of tuition, room, and board at a university.

- If and when you do go to a four-year college, choose one where you will pay in-state tuition. Yes, you want to get away from home. Understood. Put in your two years and don’t get into debt, then move as far away as you want. Your break for freedom doesn’t have to be at a high-priced private or out-of-state college.

3. Minimize Expenses

- Live at home or with roommates, comparing on- and off-campus rental costs.

- Buy a partial meal plan with one good meal a day in the cafeteria and prepare other meals affordably yourself.

- Buy used books and clothes, limit expensive coffees and going out with friends or expensive travel on breaks.

- Use public transportation or drive an older car.

- Drop gym memberships and other expenses that duplicate free facilities available to you on-campus.

- Use student discounts any time you can, including deals for cheaper computers, phone plans, or other benefits.

4. Work Your Way Through School

- Get a part-time job to cover some of your expenses. Consider being a seasonal worker during holiday breaks as well.

- Make sure your work hours and conditions don’t compromise your health or lower your grades to such an extent that you have to repeat classes or lose a scholarship.

- Look for jobs, internships, or co-op programs that will complement the skills and experience you need to develop for your chosen career field.

5. Graduate in the Right Amount of Time

- Notice we didn’t say “on time,” because this will differ for each person. There’s no law that says you have to get a college degree in 4 years. Some people take longer because they are working their way through and paying as they go to avoid debt. Others might have a family situation that means they cannot devote full time to their education.

- What should not happen, though, is that your college education costs more because you’re failing and repeating classes, changing majors frequently, or self-sabotaging to delay graduating and starting your career. Stay focused and purpose-driven to finish what you start without dragging it out and paying twice for it.

6. Borrow Strategically

- You don’t want to be stuck in a minimum wage job for 7 years trying to complete a bachelors’ degree and prove that you can do it debt-free. Borrow what you have to when that is what is necessary to achieve your goal and move into a better-paying career that will let you pay off reasonable debt reasonably fast.

- Take out loans only for absolute essentials, like tuition, not for lifestyle things you could do without.

- Try to stick just to federal loans that have better terms and lower interest rates than private educational loans.

- Do not get a credit card. Card companies target college students and get them hooked early. Many people waste many tens of thousands of dollars over a lifetime trying to pay off credit cards. There are other ways to build a good credit rating including making rent payments or payments on Federal student loans.

Do You Need a College Degree?

Finally, and this should no doubt be at the beginning of our list, but consider, do you even need a college degree? Many people have become successful entrepreneurs, digital freelancers, coders, or have built good careers in trade school. Education is more accessible than ever in history. You can learn about anything you like on internet if you just have an inquisitive mind and love learning. If you need to get away from home, the $50-100,000 you’ll spend going to college could get you a mind-blowing year traveling the world and networking contacts that will give you new ideas and opportunities. So think outside the box, consider what you actually need an

The post These Are the States with the Highest Student Loan Debt per Capita appeared first on 24/7 Wall St..