These Are the Most Common Sense Arguments For and Against Increasing America’s National Debt

There’s a lot of news coverage about the national debt, especially as we rush headlong to a possible debt ceiling conflict and eventual recession. If Congress and the president don’t get their act together, we might face an economic crisis. However, despite the impending conflict, there are reasonable and experienced voices on all sides that […] The post These Are the Most Common Sense Arguments For and Against Increasing America’s National Debt appeared first on 24/7 Wall St..

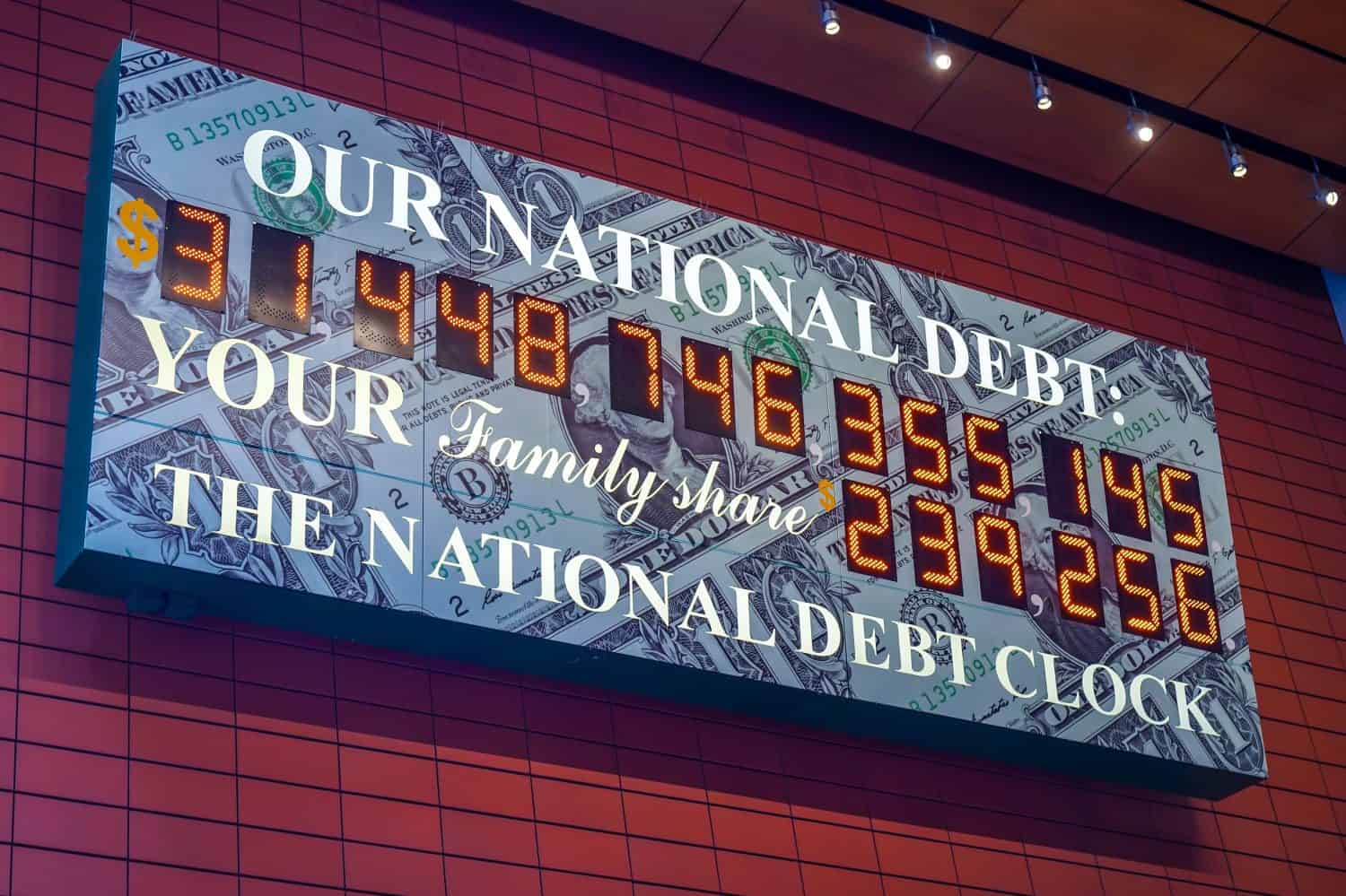

There’s a lot of news coverage about the national debt, especially as we rush headlong to a possible debt ceiling conflict and eventual recession. If Congress and the president don’t get their act together, we might face an economic crisis.

Key Points

-

Economists agree that high levels of debt is bad and negatively impacts the economy, but not all agree on what should be done about it.

-

An economic disaster is all but guaranteed at this point, as our government refuses to address the budget and funds tax cuts for the rich by taking on more debt.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

However, despite the impending conflict, there are reasonable and experienced voices on all sides that support increasing our debt instead of paying it off. What are the arguments for both? And what will the impacts be?

For: Economy Investment Can Pay Off

In the past, the government borrowed money primarily for two reasons: a world war or a large investment in the economy or public sector in the form of welfare programs. In the case of wartime borrowing, the government completely repaid these debts by increasing the taxes on companies and the wealthy. However, in the case of economic investment, this money typically led to people earning more money or more companies being created, which returned higher taxes and helped the government pay back the loan.

Economy Investment Can Pay Off

Today, however, the vast majority of money doesn’t go to public investment or welfare, it goes toward the military and a growing portion goes just to pay the interest on existing debt. None of this money increases the productivity or strength of the economy or raises people out of poverty. If the government wanted to borrow money to invest in the economy or increase welfare programs, economists would support that decision wholeheartedly, but since existing and future plans call only for increased military spending and other frivolous programs, it is hard to justify it.

For: We Don’t Exactly Know How High We Can Go

We are in uncharted waters. Never has there been a country as wealthy, powerful, or controlling as the United States. The money the U.S. borrows funds a military that covers the globe and is one of the most valuable investment options for large corporations and countries. As a result, experts cannot say how much debt the U.S. can afford to have or if there is any limit to how much it can borrow at all.

We Don’t Exactly Know How High We Can Go

A collapse of the U.S. economy due to a default or being overburdened by debt would impact the entire world. Aside from the most powerful and least-integrated countries, this would not be a preferable event. There is significant interest in preventing a collapse of the international economy, but that doesn’t mean there isn’t any at all.

For: The U.S. Government Can’t Pay its Existing Expenses

This might sound like a reason not to increase the debt, but it works both ways in a dark cycle of debt, interest payments, and dwindling tax revenue. Because the government does not receive enough tax revenue to service the debt it already has, it is forced to borrow money to finance these payments. This increases the debt, which increases the payments, which limits how much tax it takes in, and so on.

The U.S. Government Can’t Pay its Existing Expenses

In our current situation, the government is forced to take on more debt or default on its payments. It can, of course, choose to raise taxes on companies and the rich, which has been the only way it has paid its debts in the past, but that seems unlikely to happen.

For: The Government has Negative Real Interest Rates

According to experts, the United States has actually had negative real interest rates since 2010. In simplified terms, this means that the inflation rate has been lower than the interest rate on existing debt. This is only possible when international bankers and markets believe that there is no reasonable alternative to existing options.

The Government has Negative Real Interest Rates

Negative real interest rates mean that the government borrowing money actually saves taxpayers’ earnings and can improve creditworthiness. Countries in the past have significantly reduced their debts far beyond what is typically possible by taking advantage of negative real interest rates. While there is no guarantee that rates will stay this low, it would be the best time for the government to take out debt and use it to strengthen the economy for the future.

Against: The U.S. Already Can’t Keep up With Payments

Every year the interest payments on the government debt grow larger, and even if the government stopped taking on more debt, the payments would continue to increase until it actually decides to pay off the debts it already has. Taking on more debt to finance the already monstrous debt is the behavior of a severe addict and cannot lead to any positive outcome.

The U.S. Already Can’t Keep Up with Payments

There is only one way to reduce the amount of money spent on interest payments: reduce the principal. Over the last century, Republican administrations have always increased the debt and government deficit by growing the military budget and cutting taxes for the wealthy. On the other hand, the government has been successful in reducing the debt by increasing taxes on the wealthy and reducing spending on the military.

For: A Default Would Ruin the World Economy

Despite all the risks posed by growing debt and the damage it would do to American citizens, there are significant amounts of experts who strongly recommend doing anything and everything necessary to avoid a default. A U.S. default would destroy the economies around the world, and many experts believe there is no reason to drag the rest of the nations down with us because we couldn’t handle our own debt.

A Default Would Ruin the World Economy

Nobody knows how bad an economic collapse resulting from a credit default would be, but by all estimates it would be worse than any crisis before and far worse than anybody is expecting. The economic hardships posed domestically by high debt do not outweigh the consequences of a worldwide crisis.

Against: More Debt Means a Slower Economy

According to economic experts, as the national debt increases, the growth of the economy slows proportionally. When debt reaches 60% of GDP, the slowdown increases until 90% of GDP at which point it stalls almost entirely. Currently, the debt-to-GDP ratio of the U.S. is far above 100%.

More Debt Means a Slower Economy

Any growth experienced by the U.S. economy since passing the 100% ratio has been in spite of the high level of debt, and probably fueled by international reliance on the U.S. economy. There is no guarantee that this will continue, and we are playing in extra time when it comes to avoiding an economic collapse.

Against: The Control of Our Debt is Out of Our Hands

The debt of the U.S. is owned by a number of different entities, including foreign countries and corporations. The political and economic goals and aspirations of these entities might not be aligned with the goals of the U.S. The largest holders of U.S. debt have been Japan, China, and the United Kingdom.

The Control of Our Debt is Out of Our Hands

The more debt the U.S. creates, the more control foreign entities have over the U.S. government. By selling vast amounts of debt, other countries can devalue the dollar or persuade other countries to avoid buying U.S. debt. If the U.S. wants to avoid having other countries tell it what to do, it should avoid digging its hole any deeper.

Against: Less Money Goes to New Programs

This is a nice way of saying that as debt and interest payments increase, the amount of money the government can spend on new or existing programs decreases. And, if the behavior of the current administration is anything to go by, the first programs to be cut will be welfare programs and departments that support a healthy and fair economy.

Less Money Goes to New Programs

If things don’t change, there will come a time when interest payments alone are bigger than the rest of the U.S. budget put together. Eventually, the government will be spending more money every year on programs from decades ago than on future or current programs. At a certain point, it will become impossible to pay for anything except interest payments.

Against: It Creates a Burden That Future Generations Can’t Pay Back

Financing government operations through debt creates a financial burden that is naturally paid by later generations. Typically, this isn’t an issue because responsible governments pay off that debt and create new programs for current generations that are, in turn, paid by later ones. The problem today is that we don’t have a responsible government.

It Creates a Burden That Future Generations Can’t Pay Back

Our government has repeatedly funded tax breaks for the rich and corporations through huge increases in debt. This not only expands the existing wealth inequality but creates a bigger debt burden that future generations will be hard-pressed to pay back because they have been paying higher taxes than the wealthy for decades. Nobody knows at what point the rising poverty level will lead to economic collapse, but it probably isn’t that far away.

The post These Are the Most Common Sense Arguments For and Against Increasing America’s National Debt appeared first on 24/7 Wall St..