These Are the Can’t-Miss Signs the National Debt Is Out of Control

It goes without saying that the national debt is rising every day as the “clock” continues to show the math heading in the wrong direction. Whether due to an aging population, budget deficits, or even increasing healthcare costs, the national debt is not likely to be reduced anytime soon. As a result, it begs the […] The post These Are the Can’t-Miss Signs the National Debt Is Out of Control appeared first on 24/7 Wall St..

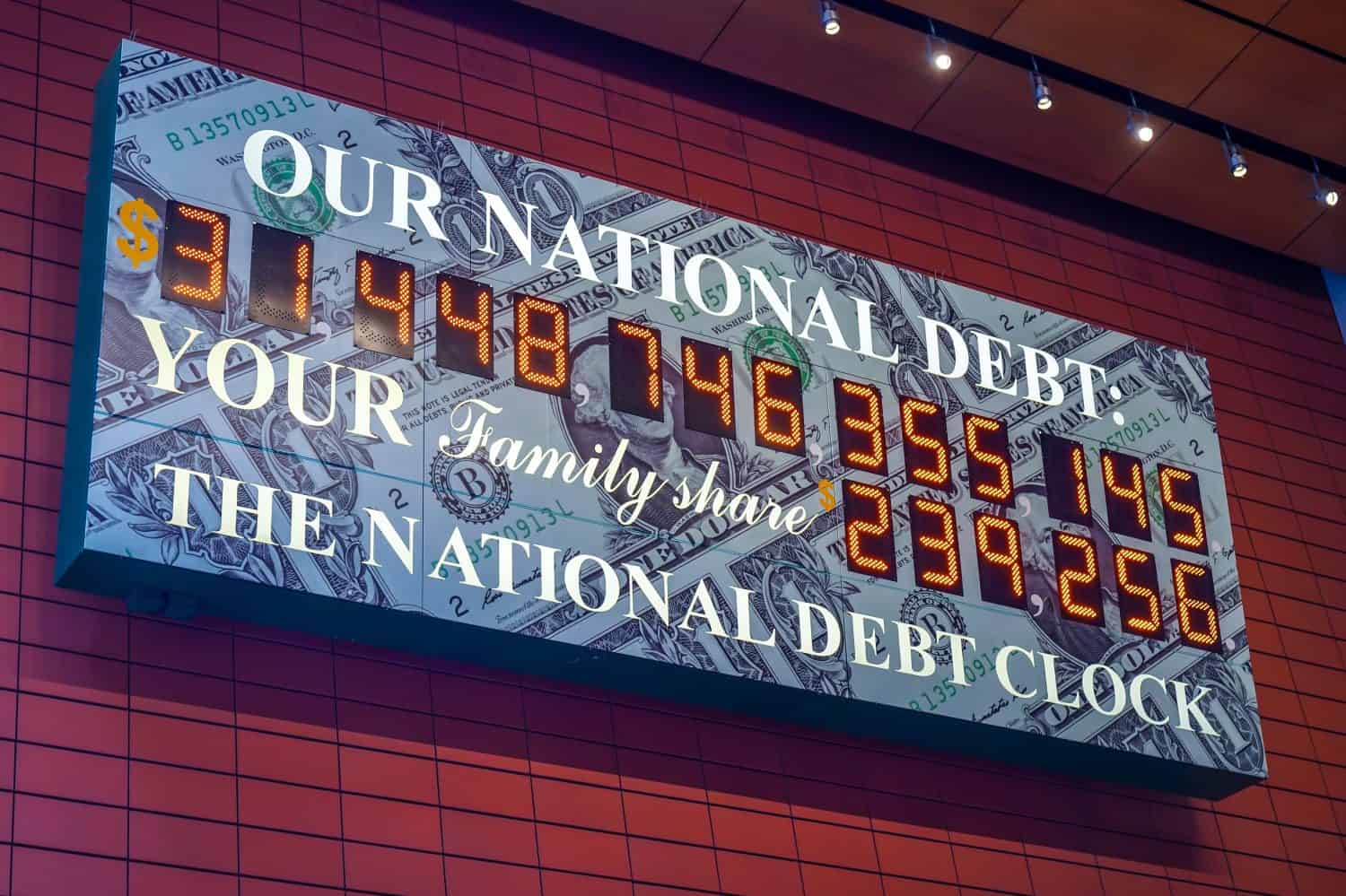

It goes without saying that the national debt is rising every day as the “clock” continues to show the math heading in the wrong direction. Whether due to an aging population, budget deficits, or even increasing healthcare costs, the national debt is not likely to be reduced anytime soon.

Key Points

-

Concerns over the national debt continue to grow significantly.

-

Inflationary concerns are a big red flag that must be tackled now.

-

There is definite need for Republicans and Democrats to come together.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

As a result, it begs the question of what the can’t miss signs are that the national debt is genuinely out of control. While we don’t think we’ve hit this point yet and there is no immediate reason to panic, it might be time to start thinking differently if you see any of these signs come to life.

7. Social Program Concerns

If the national debt were to start threatening any funding for programs like Social Security and Medicare, it would be a can’t-miss sign that things are increasingly out of control. The US knows the Social Security trust fund is already set to be depleted by 2033, meaning only 70-80% of Social Security beneficiaries will receive a portion of their funds. According to CBO estimates, the same goes for Medicare, as only 80% of program costs are covered by taxpayers, and the remaining 20% is covered by borrowing.

Public Risk

Any instance in which the national debt spirals out of control will result in significant public risk. Putting aside concerns for Social Security, any cuts to these programs would result in voter outrage, which France saw play out in 2023 over retirement age hikes, with fierce protesting nationwide. Public trust in the government would fall, and younger voters may never see the benefit programs they are voting for and paying into.

6. Economic Stagnation

The biggest concern would be if the debt level grows so that capital must be diverted from federal projects toward interest payments. High interest rates coincide with this, limiting how much money can be borrowed by small and private businesses and limiting economic growth.

Investments Start Declining

Sticking with the small business idea, if this happens and it’s far more challenging to borrow money, hiring becomes more limited as more companies are no longer opening or growing, leading to unemployment. All of this culminates in less funding overall, something the world saw take place during Japan’s “lost decades,” which economic stagnation played out in a real way.

5. Political Gridlock

Any conversation about the national debt is polarizing in Congress, and the two parties consistently debate the best path forward. The debate often concerns spending cuts or tax hikes, which has led to concerns about the debt ceiling. This played out in 2023 during a 45-day standoff, which resulted in $1.5 billion in market losses and led 70% of Americans to worry about debt, according to a 2024 Pew poll.

Delaying Reforms

According to the Congressional Budget Office, Social Security and Medicare face $50 trillion in unfunded liabilities over the next 75 years. This means that proposals to raise the retirement age, which have been blocked since 2010, could lead to this occurrence. The result would be that mandatory budget spending rises to 70% by 2035, limiting what the government could fund in discretionary projects.

4. Inflationary Pressure

If government borrowing continues to grow, the need to create more money to pay off the debt will increase the overall money supply, which means rising inflation, eroding consumers’ purchasing power, and making the cost of living continuously unsustainable, especially for lower-income households.

Global Pressure

If this situation continues and inflation rises unchecked, the US dollar will weaken, increasing the cost of importing goods and services. Domestic pricing will grow, and any other nation with high debt levels will also contribute to raising the cost of importing goods into the US.

3. Reduced Fiscal Flexibility

Loosely defined, fiscal flexibility is the government’s ability to borrow or spend money during a “crisis” without destabilizing the rest of the government. This also occurred in 2008 during the Great Recession and in 2020 during the COVID pandemic when debt spiked. A tax hike could help, but it isn’t easy to get through Congress.

Future Generations

The big concern with reduced fiscal flexibility is that any inaction will put future generations at risk. Economists have indicated that if there is no room for borrowing to pay off the debt, a recession could occur by 2030. In addition, the biggest concern is that if the CBO predictions are correct and the debt-to-GDP ratio is 180% by 2040, younger taxpayers will be paying the bill.

2. Declining Investor Confidence

When you think about investor confidence, it’s essentially a “measurement” of how much trust exists in the federal government’s ability to manage the national debt and issue repayments. The larger the US debt grows, the more likely investors will look at other stable currencies, which could reduce demand for US treasury bonds.

Geopolitical Risks

Another potentially worrying sign about the national debt would be geopolitical turmoil. As a portion of the national debt is owned by China and Japan, anytime geopolitical tensions come to the forefront of the news, these nations could use this as leverage to get something out of the United States, weakening demand for the dollar.

1. Unsustainable Interest Payments

As it stands today, interest now consumes more than 10% of federal spending, and is projected to pass defense spending by 2028. These payments are being made directly to creditors for borrowing, resulting from the national debt accumulating as it has. For this reason, if interest payments become unsustainable, it would be a strong sign that the national debt is well and truly out of control.

Worrying Priorities

If you think about this in the most basic context, every dollar spent on interest payments is a dollar not spent on programs like Social Security or Medicaid. These interest payments are also squeezing other departments, and if the Congressional Budget Office predictions are correct and interest consumes 20% of the budget by 2035, it’s time to worry.

The post These Are the Can’t-Miss Signs the National Debt Is Out of Control appeared first on 24/7 Wall St..