These Are the Biggest Retirement Mistakes Social Security Can’t Fix

In many ways, determining the right time to retire, whether early or upon reaching Full Retirement Age at 67, involves several considerations. While not always top of mind, understanding how Social Security plays a role should play heavily into deciding when to retire from the workforce. The reality is that retirement planning has to go […] The post These Are the Biggest Retirement Mistakes Social Security Can’t Fix appeared first on 24/7 Wall St..

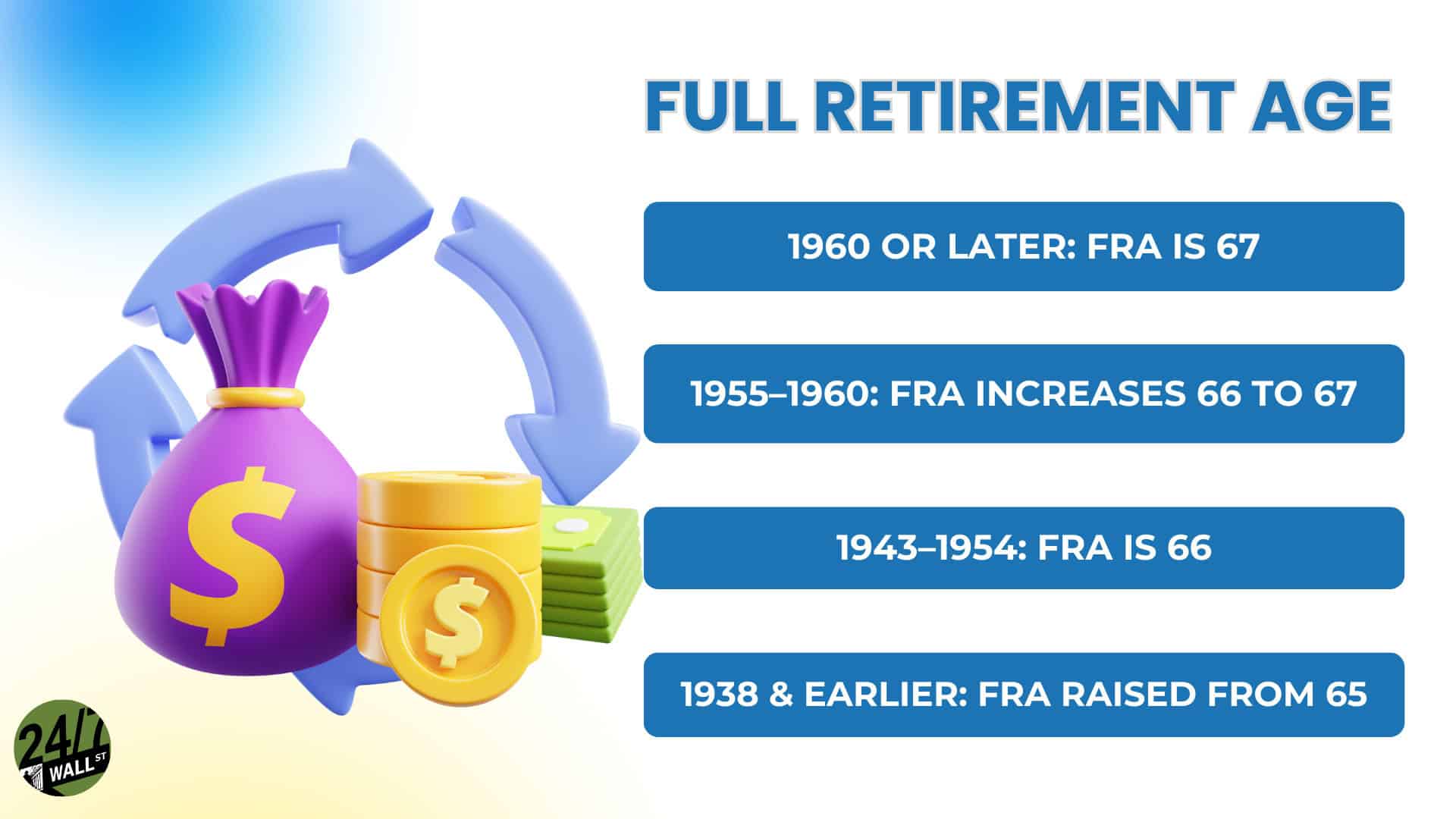

In many ways, determining the right time to retire, whether early or upon reaching Full Retirement Age at 67, involves several considerations. While not always top of mind, understanding how Social Security plays a role should play heavily into deciding when to retire from the workforce.

It’s a common mistake to think that Social Security can provide enough to retire.

The reality is that Social Security is only supposed to provide no more than 40% of pre-retirement income.

This means you must find alternative ways to save before you retire so you can live comfortably.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. If you’ve saved and built a substantial nest egg for you and your family; get started by clicking here.(Sponsor)

Key Points

The reality is that retirement planning has to go well beyond Social Security to feel truly comfortable calling it quits. Investments, diversification, and focusing on healthcare costs are just a few of the mistakes people make while planning for retirement, and rest assured, Social Security income can’t help fix all of these.

10. No Estate Plan

The hope is that you will have enough money one day to consider what can be passed on to future generations. Social Security benefits stop when someone dies unless you file for survivor benefits. Still, you must consider additional ways to navigate the future so family members aren’t left holding the bag.

Create A Plan

Establishing a will or trust well before retirement is essential, so your family does not have to figure anything out. Designating beneficiaries if you have an IRA or life insurance is equally important. The truth is that Social Security does not impact estate planning, so you have to handle it all separately.

9. Poor Tax Planning

There is no hiding the reality that too many overlook how taxes affect you post-retirement. This is true for Social Security, of which up to 85% of this money can be taxed, but also for navigating taxes around withdrawals from either 401(k) or IRA plans, or even both.

Create Tax Strategies

Whether opening a Roth account or considering tax-free withdrawals, working with a financial advisor or certified public accountant is a smart idea to learn how to navigate high taxes during retirement. With a smart strategy, you can reduce your tax bracket, which puts more money in your pocket.

8. Bad Investment Decisions

If you try to be too risky or too conservative pre-retirement, you might find yourself in a position where your money isn’t enough for a comfortable retirement. High-risk investments can lead to more losses, while staying in all cash doesn’t give you enough return to beat inflation.

Balanced Portfolio

When you have a balanced portfolio, preferably working with a financial advisor, you can consider combining your financial goals and risk tolerance to balance everything. Most importantly, regularly review your portfolio (with a financial advisor) and adjust as needed depending on your retirement goals.

7. Not Considering Inflation

Unfortunately, inflation is likely here to stay, and there is no question that even with the cost-of-living increases Social Security (likely) receives every year, it doesn’t always keep up with inflation. This means that the average $1,900 in payments most people receive in 2025 will not be good enough to cover expenses down the road.

Inflation Proof Plan

One idea that too many people are unaware of is to take out something like Treasury Inflation-Protected Securities, which offers you stability against inflation. In addition, if you have savings, adjust how much you take out to account for rising inflation and work with a financial advisor.

6. Relying on Social Security

A big mistake that happens all too often is focusing too much on Social Security during retirement as a safety net. It is, but it’s not a retirement plan. The average monthly payment in 2025 is only around $1,900, far below what most retirees need during retirement.

Diversifying Your Income

Whether through pension, annuities, or even investment dividends that come in quarterly, you can build out full income streams that don’t rely on Social Security benefits. This is also one of the reasons why many retirees are building outside hustles or still work part-time to ensure additional income.

5. Ignoring Healthcare Costs

Arguably, the biggest surprise during retirement is the rising cost of healthcare, with the understanding that Medicare does not and will not cover everything. You have to plan for any gaps that come out of pocket for long-term care, dental, vision, or anything else that might pop up.

Preparation Is Key

One thing to consider before retirement is establishing a Health Savings Account, preferably early on in life, that can help you build up a tax-free fund for future medical expenses. Out-of-pocket healthcare costs only go in one direction these days, and it is not in retirees’ favor. Social Security won’t offer enough to offset the rising healthcare costs, so you must plan for this.

4. Understanding Retirement Expenses

There is a better-than-good chance that most people coming into retirement don’t have the proper sense of what everything will cost. The hope is that expenses will drop significantly, but this isn’t what really happens. Instead, rising healthcare costs and inflation, eroding purchasing power without continued income to offset, come into play.

Go Beyond Social Security

It shouldn’t surprise anyone that you must think beyond Social Security when planning for retirement expenses. First and foremost, a detailed and comprehensive budget should be created that considers living expenses, inflation, and healthcare. The more proactive your planning is, the better off you will be in the long term.

3. Too Much Debt

If you have a significant or above-average amount of debt pre-retirement, the ideal scenario is to eliminate any balance before calling it quits. Far too many people enter retirement with high credit card balances or mortgages that are too large, straining already limited income.

Managing Pre-Retirement Debt

When and where possible, you should always look to pay off any high-interest debt, like a credit card, before retiring. A mortgage is less of a concern depending on your interest rate, but refinancing is always possible. The closing cost charges might be small enough to make this a valuable idea that could put more money in your pocket.

2. Taking Social Security Early

With the ability to take Social Security as early as 62 years of age, many people do so without realizing the downside. This downside is pretty substantial, as taking Social Security early can cut your benefits by as much as 30% if you apply before you hit Full Retirement Age at 67.

Time Your Benefits

The best scenario is to wait until you are 70 before applying for Social Security, in which case you could make 8% increases in monthly benefits for every year you wait past 67. The hope is that you have additional savings to help bridge any gap between 62 and 70, as strategically timing this can make a significant income difference in the long term.

1. Failing to Save Enough

One of the most important things anyone can do before retiring is to ensure they are saving enough. Unfortunately, far too many Americans retire with an inadequate amount of savings. In fact, four out of every 10 Americans already indicate they are not ready for retirement because they don’t have the right amount of savings.

Build A Savings Plan

The most important thing you can and should do is build a savings plan early in your career or work history. With Social Security only set to provide around 40% of pre-retirement income for average earners, this leaves quite a bit of money to cover. Ideally, you should aim for around 15-20% of your income annually, and make adjustments relative to any increases in salary.

The post These Are the Biggest Retirement Mistakes Social Security Can’t Fix appeared first on 24/7 Wall St..