These Are the 10 Bigges Lies About the National Debt, Debunked

In a time of extreme polarization and high amounts of fake news, propaganda, and misinformation, especially from our elected representatives, it’s natural for myths about the government and how it functions to spread like wildfire. In few places is this more true than when it comes to the national debt, what it is, what it […] The post These Are the 10 Bigges Lies About the National Debt, Debunked appeared first on 24/7 Wall St..

In a time of extreme polarization and high amounts of fake news, propaganda, and misinformation, especially from our elected representatives, it’s natural for myths about the government and how it functions to spread like wildfire. In few places is this more true than when it comes to the national debt, what it is, what it does, and how bad it can be.

Key Points

-

Most myths about the national debt are spread by the minority party whenever the president passes any kind of legislation that will impact the federal budget.

-

The best way to reduce the debt is to cut military spending and increase the taxes on the rich and wealthy and to tax corporate profits.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

We looked into some of the most popular and common myths about the national debt of the United States, specifically, and debunked them with simple research available from independent sources and government departments.

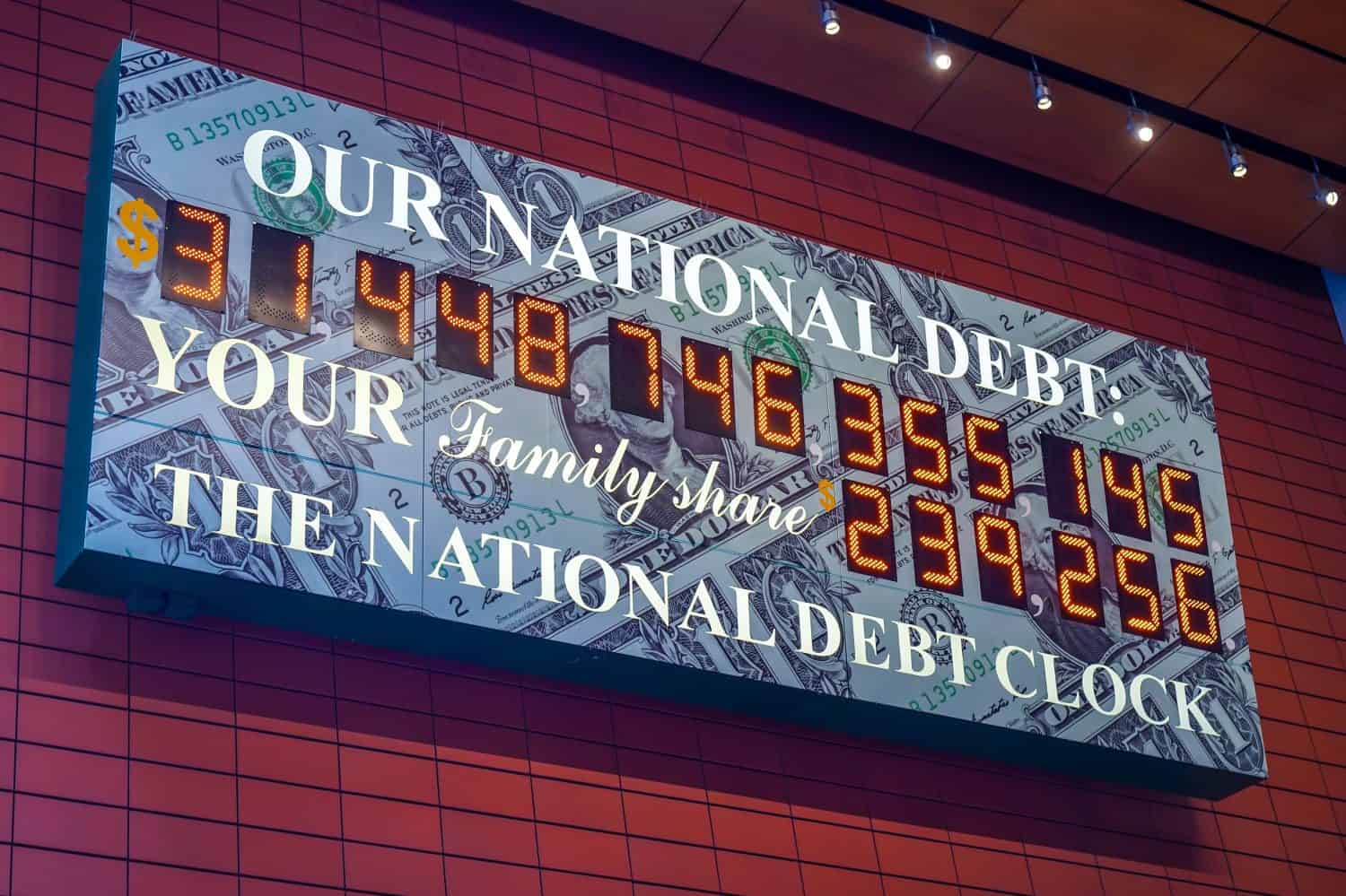

#1 The National Debt is Divided Among Americans

On the famous national debt clock in New York City, there is a second number that shows “YOUR family’s share”. Not only is this number essentially useless, but it can be reasonably argued that it is less than helpful to the point of confusing the dialogue surrounding the national debt.

The National Debt is Divided Among Americans

The first reason why is that American citizens aren’t responsible for the debt and will not be required to service the debt or pay it back to any collector or entity. That’s simply not how national debts work.

Second, even if the government somehow managed to get the citizens to pay for the debt, through taxes, it is extremely unlikely that the rich and wealthy would pay anything near what the debt clock shows, and the majority of the burden would fall on the poor and working class.

#2 Citizens Have a Responsibility to Pay the Debt

Whenever the discussion around the national debt arises in the public discourse or on news stations, there is often a call for “us” to do something about it or it will hurt “us”.

Citizens Have a Responsibility to Pay the Debt

It is the behavior of the federal government and how it chooses to collect taxes and then spend those taxes that impact the national debt. While a default on our national debt would lead to widespread economic turmoil, inflation, and other issues, a high debt doesn’t really impact regular people and they don’t have any influence over it, either. Don’t fall for politicians who try to blame you or regular people for how high the debt is.

#3 We Have to Pay $33 Trillion

While the amount of debt is unprecedented and almost impossible to pay off over multiple lifetimes, we don’t actually have to pay it off.

As long as the government is able to pay the interest on its debts, or service its debt, it can continue to borrow money and operate like normal.

We Have to Pay $33 Trillion

Many of those who own U.S. debt probably don’t want us to pay it off anyway, since there is more money and power to be made through receiving regular interest payments, and the debt functions as a valuable asset that can be sold.

#4 As Long as We Service the Debt, we’ll be OK

While the previous point is true with normal levels of debt, the amount of debt the US currently has is quickly approaching a point at which interest will be growing faster than we can reduce the debt. Over time, interest payments will take up larger and larger portions of the government budget every year until it is all the government can afford to pay. (Most likely the government would collapse before that point).

As Long as We Service the Debt, we’ll be OK

This growing interest payment would crowd out other government expenditures like welfare programs, military spending, and more. In all likelihood, based on U.S. history, the government would probably choose to cut benefit programs and then borrow money from Social Security before even considering cutting spending on the military.

Regular people will begin to feel the impact of irresponsible levels of debt even without a government default.

#5 Debt is Bad

One of the tactics used by the minority party during election season is to relentlessly decry the growing debt and the irresponsible size of the government’s budget. However, this usually misrepresents the traditional use of government debt and how it works.

Debt is Bad

The government pays for everything through debt, and modern governments are essentially impossible to run without generating significant amounts of it. But if debt is used wisely it creates economic growth and healthy populations that strengthen a country and its economy. Economists unanimously agree that if debt is used to fund public works, welfare programs, and investment in the people and infrastructure of the country, then it will more than pay off in the end.

#6 The Debt Doesn’t Matter Because the U.S. Can’t Default

This is a uniquely American myth spawned from American exceptionalism and our position as world hegemon. The U.S. is the center of trade, investments, and monetary policy for the entire planet. We control the flow of goods, ideas, and money for hundreds of countries, and when the U.S. sneezes, other countries catch a cold.

The Debt Doesn’t Matter Because the U.S. Can’t Default

Given that so many countries have such a huge interest in making sure the U.S. remains stable, functioning, and in control, some people argue that it is impossible for the U.S. to actually default on its debts because the countries will work together to avoid that at all costs.

Not only is this opinion not based on any facts, it is among the most dangerous of the myths on this list. The U.S. can default, and it will default if modern political trends continue.

#7 Economic Growth Can Get Us Out of Trouble

This was true in the past when we had a more manageable debt and the government only had large increases in debt during war. Economic growth would lead to more tax revenue which would help the government pay its debts during peacetime.

Economic Growth Can Get Us Out of Trouble

But in our era of perpetual war, there is no peacetime economy and the debt and interest payments are increasing faster than the economy, meaning it will never be big enough to reduce the debt.

#8 We Can Fix the Debt by Cutting Public Spending

This is a particularly relevant myth since President Trump and Elon Musk are using it as an excuse to gut the federal government, and it continues to be one of the primary excuses used by the far Right to justify cutting welfare programs.

We Can Fix the Debt by Cutting Public Spending

The only times the U.S. has been able to reduce its debts to a manageable level after significant increases have been during peacetime and taxing the rich. The cutting of taxes for the wealthy and the perpetual increases in military spending are the two biggest contributors to the national debt.

In fact, experts all agree that cutting all the benefits and welfare programs run by the U.S. government would do more harm than good, actually leading to higher debt. This is because welfare programs lift people out of poverty where they can pay more taxes.

#9 Low Taxes Can Help Reduce Debt

This is usually couched with the myth of #7 or trickle-down economics (also known as the horse and the crow economics). It posits that if people have more money, they will spend it in the economy, which means everyone has more money that can be taxed and eventually generates more revenue.

Low Taxes Can Help Reduce Debt

History shows us that this is a lie used to justify lowering taxes on the rich while keeping taxes on the poor. This not only does not reduce the debt but also slows down the economy. The rich also do not spend their increased money in local businesses or local economies, instead, it is usually invested in the stock market or stored in bank accounts where it does nothing to grow the economy and the tax base.

#10 Democrats and Progressives Increase the Debt More Than Republicans

The last time the government had a budget surplus was during the Clinton administration, and before then during the Carter Administration.

After its peak during World War II, reduced military spending and higher taxes on the wealthy caused the debt to drop sharply even as the government implemented some of the biggest welfare programs in the history of the country.

Democrats and Progressives Increase the Debt More Than Republicans

However, capitalists and right-wing politicians took issue with this and made concerted efforts to undo this work, eliminating government welfare programs and departments, deregulating our industry, and reducing taxes on the wealthy. Each time a Republican was elected, they increased the national debt significantly while Democrats tended to reduce it.

The post These Are the 10 Bigges Lies About the National Debt, Debunked appeared first on 24/7 Wall St..