The Worst 5 Reasons to Claim Social Security at 62

One of the most important financial decisions you might make for retirement is figuring out when to claim Social Security. You can sign up for benefits as early as age 62. But if you don’t wait until full retirement age (FRA) to file for benefits, you’ll have to accept reduced monthly payments. FRA is […] The post The Worst 5 Reasons to Claim Social Security at 62 appeared first on 24/7 Wall St..

Key Points

-

The earliest age to claim Social Security is 62.

-

Doing so could slash your monthly benefits by as much as 30.%

-

There are certain situations where it pays to claim benefits early, but it’s important to have a good reason.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

One of the most important financial decisions you might make for retirement is figuring out when to claim Social Security. You can sign up for benefits as early as age 62. But if you don’t wait until full retirement age (FRA) to file for benefits, you’ll have to accept reduced monthly payments.

FRA is 67 for people born in 1960 or later, which means that filing for Social Security at 62 could shrink your monthly checks by 30%. If you’re going to take that hit, there should be a good reason for it. But here are some of the worst reasons to claim Social Security at 62.

1. You’re afraid to touch your savings

A lot of people work hard to build retirement savings and don’t want to see their money disappear too quickly. That’s understandable. But if you have decent savings for retirement, you shouldn’t necessarily claim Social Security at 62 to avoid touching that money.

If you wait to sign up for Social Security, you’re guaranteed larger monthly payments, whereas your savings unfortunately are not guaranteed to last. It pays to preserve an income source you know is set up to send you money each month for the rest of your life.

2. You’re convinced Social Security will run out of money

You may have heard rumors that Social Security is running out of money and won’t be able to pay benefits soon enough. If you believe that, you may be inclined to claim Social Security as early as you can.

You should know, however, that Social Security is not at risk of disappearing. The program may have to broadly cut benefits in the future, but that doesn’t mean Social Security is going bankrupt.

Filing early won’t spare you from benefit cuts. It will only leave you with less Social Security each month.

3. You’re worried about a layoff but still have a job

These days, a lot of people are worried about becoming unemployed. And losing a job at an older age can be especially scary, since workers in their 60s may have a hard time getting hired due to age discrimination (it’s illegal, but that doesn’t mean employers don’t do it).

That said, claiming Social Security at 62 due to layoff concerns is a bit premature. It’s one thing to file for benefits at 62 if you’ve actually lost your job. But why shrink your monthly benefits before a layoff even happens?

4. You’re planning to invest the money

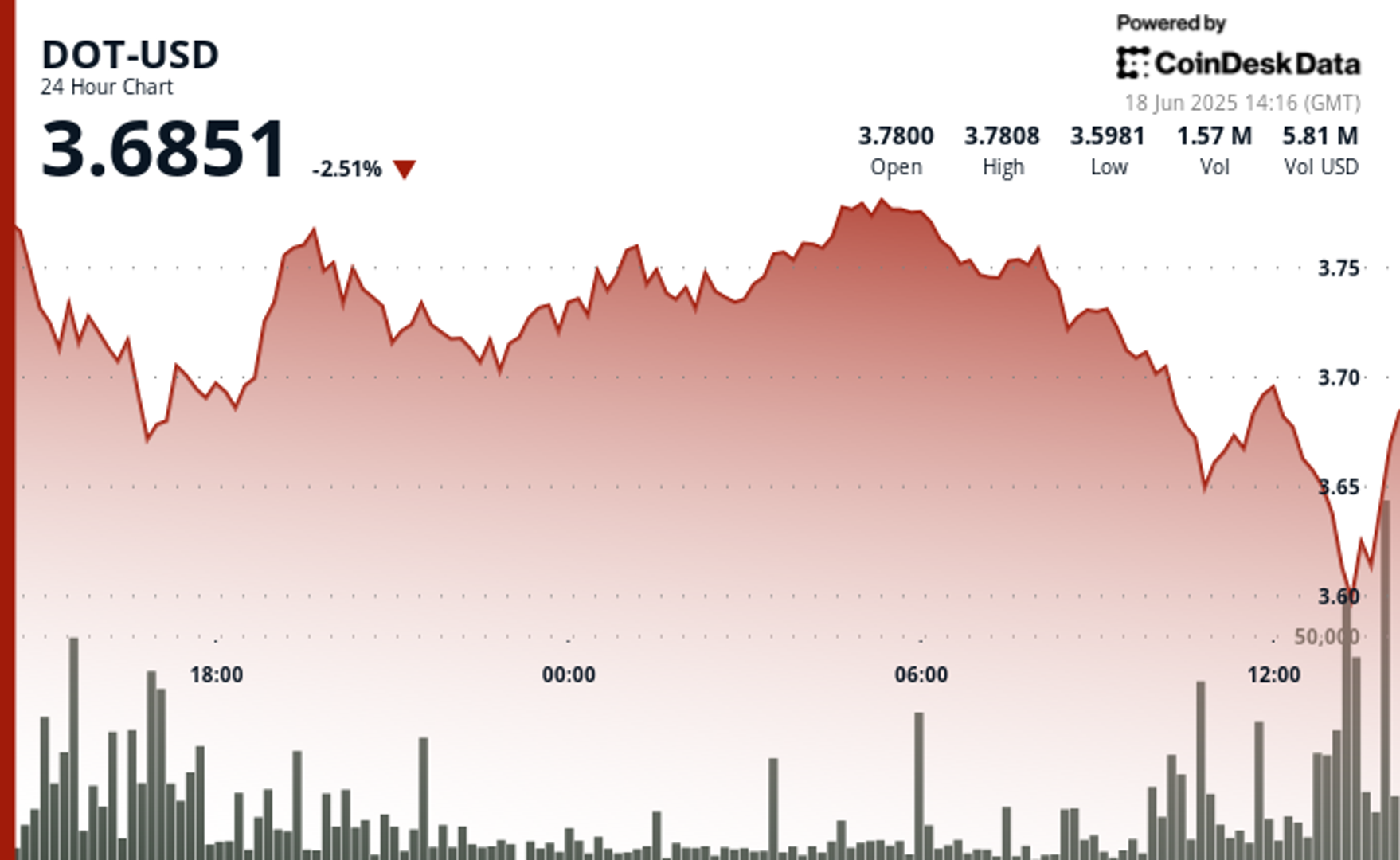

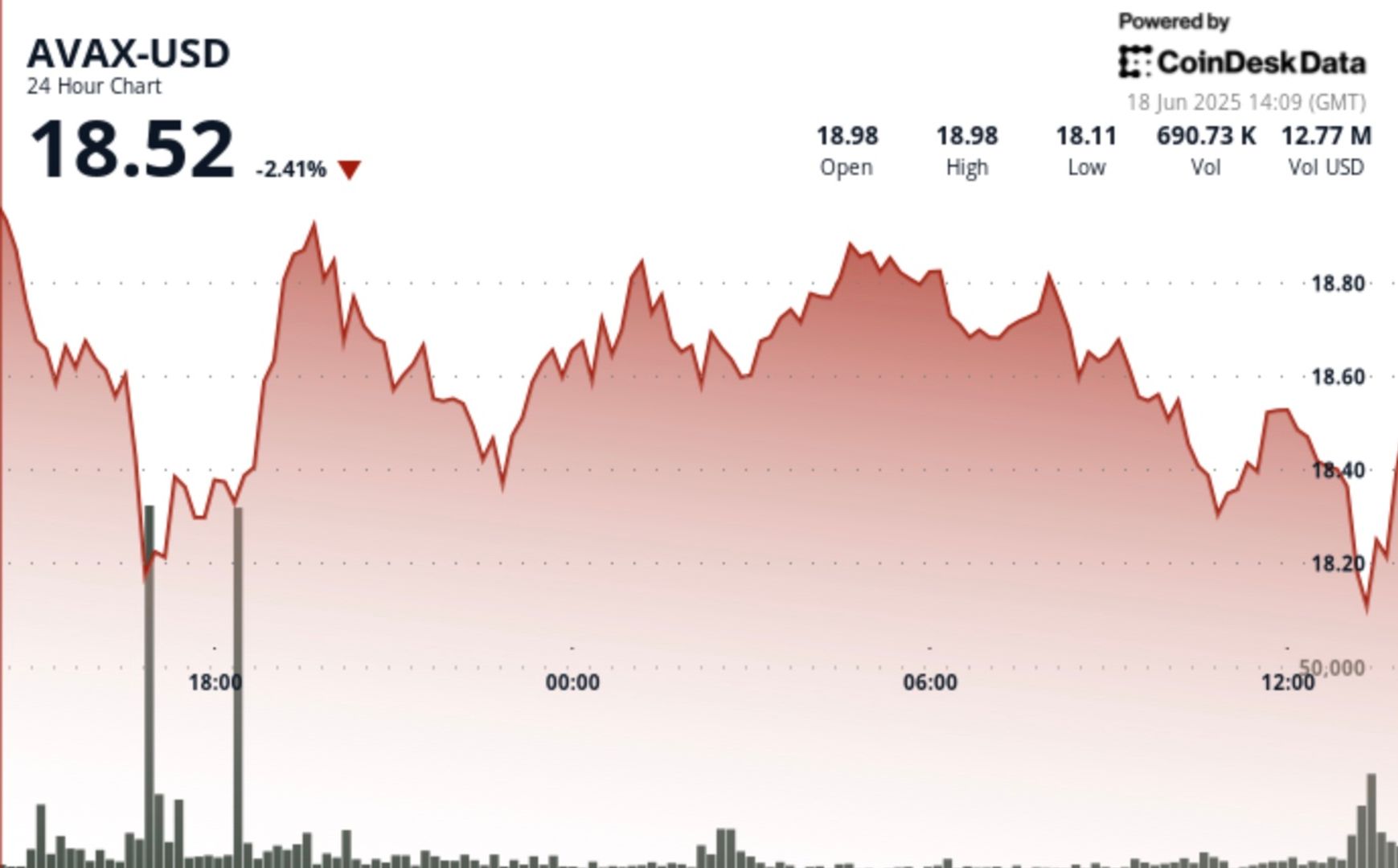

You may be inclined to claim Social Security at 62 so you can invest the money. But if you do that, you’re taking a risk.

You don’t know how the market is going to perform in the coming years, or how your portfolio will perform specifically. On the other hand, if you claim Social Security at FRA instead of 62, you’re guaranteed larger monthly checks. You don’t have to take on any market risk at a time in life when steady income is probably important to you.

5. You’re not aware of the consequences of filing early

Some people think it’s no big deal to claim Social Security at 62 because once FRA arrives, their benefits will be boosted back up. But that’s not how an early filing works.

If you claim Social Security at 62, your benefits get reduced permanently unless you manage to undo your filing, which is difficult since it requires you to pay back all the money you received in benefits within a year. Before you decide to sign up for Social Security at the earliest age possible, make sure you understand the rules, and recognize that you may be stuck with that lower benefit for the rest of your life.

The post The Worst 5 Reasons to Claim Social Security at 62 appeared first on 24/7 Wall St..