How the Next Wave of RWAs is Becoming Crypto’s Real Edge

The introduction of tokenized reinsurance signals how far RWAs have progressed, says OnRe's Dan Roberts, allowing capital allocators broader access, greater transparency and potentially more resilient returns.

In the search for stable, scalable yield on-chain, real world assets (RWAs) have become a cornerstone of digital asset strategies. Tokenized treasuries and private credit brought off-chain yield on-chain, delivering much-needed stability and quickly emerging as one of the strongest-performing segments in crypto.

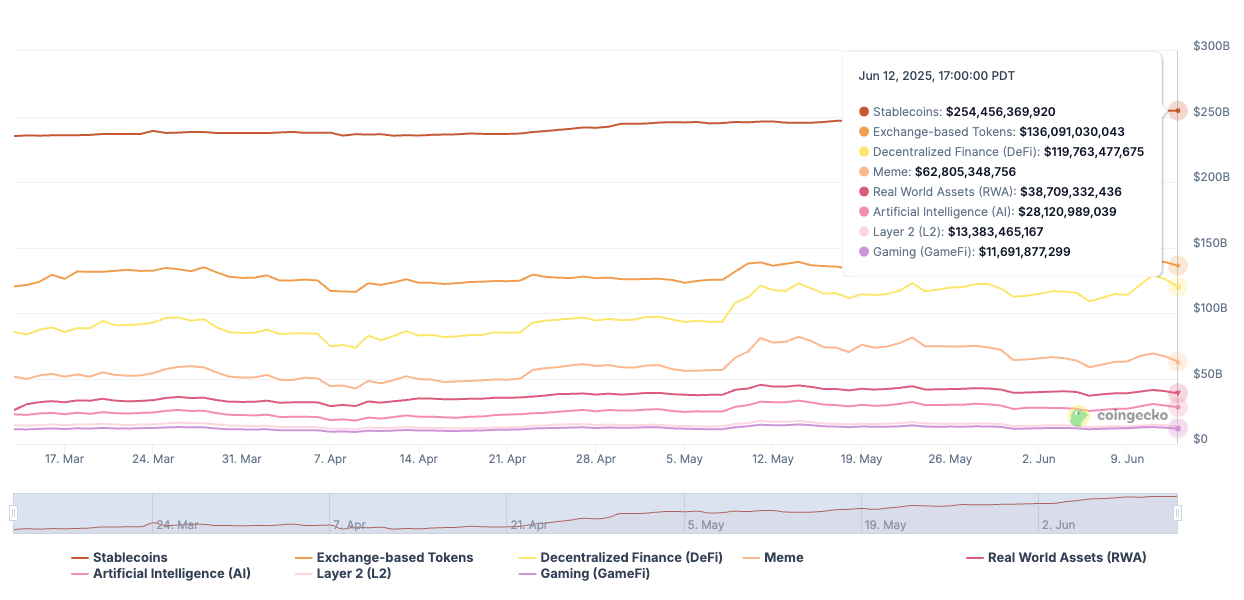

Top crypto categories by market cap

https://www.coingecko.com/en/categories#key-stats

However, much of this early RWA activity has simply mirrored traditional finance. The next stage of evolution demands more. Capital moves quickly, and investors expect more from their assets. They’re looking for returns that aren’t tied to cycles, access that doesn’t depend on intermediaries and assets that are composable across the DeFi ecosystem.

One emerging example is tokenized reinsurance, bringing some of the world’s largest and illiquid industries into the fund flows of DeFi.

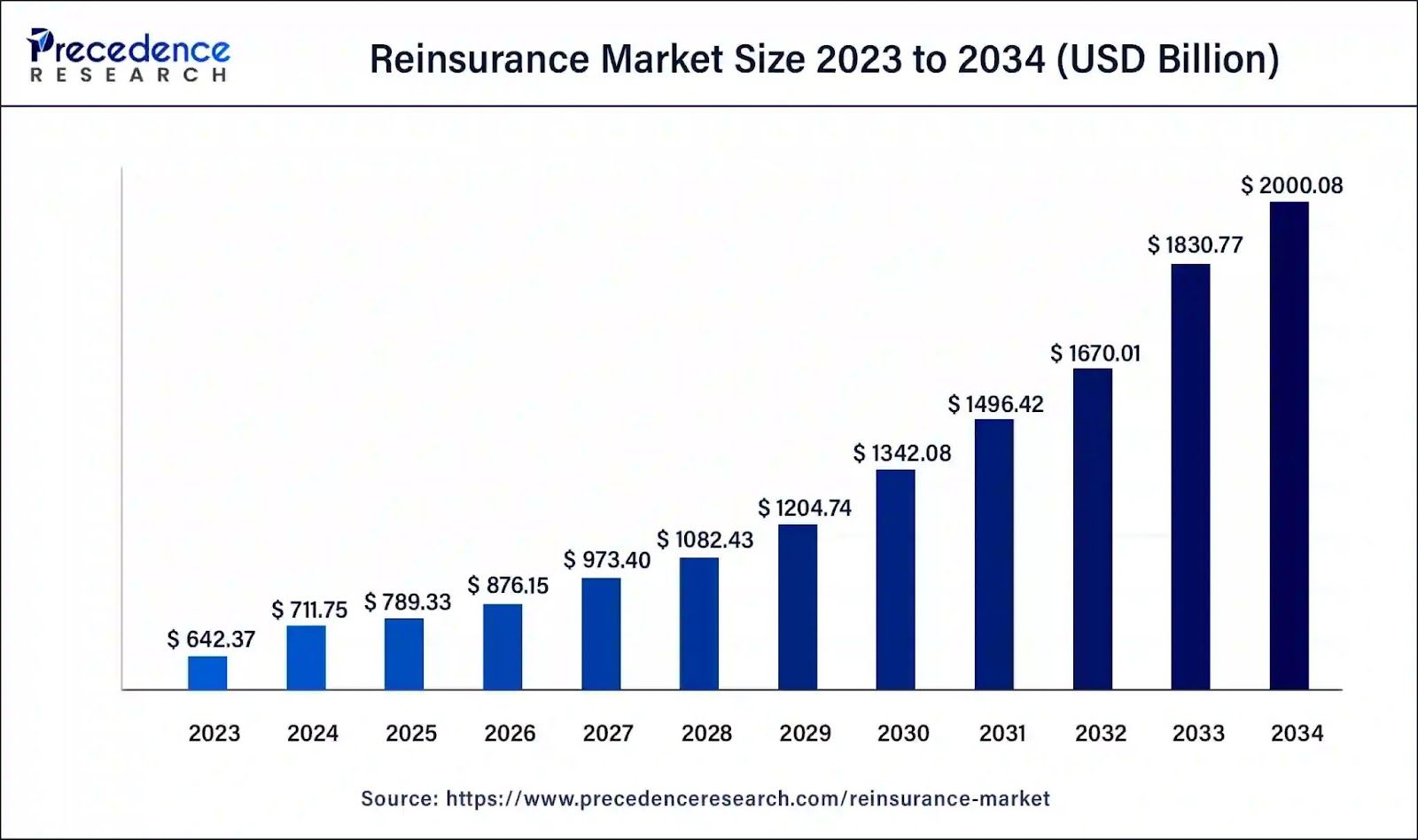

Reinsurance is a form of structured finance that helps insurers manage large or unexpected losses. For most investors, it’s been inaccessible — held back by outdated infrastructure, opaque processes and high barriers to entry. Despite that, it’s a $784B+ global market that generates returns from both underwriting profits and investment income, with capital expected to grow to $2T over the next decade.

Let’s put it into perspective:

- Today, $770B in capital supports $460B in property and casualty premiums.

- In 10 years, that capital base is expected to more than double, reaching $2T and writing an estimated $1.2T in premiums.

- That’s $740B in additional premiums expected to flow through the market over the next decade.

The opportunity is becoming accessible through new infrastructure built on-chain — rebuilding access to reinsurance from the ground up and opening the door to a broader class of investors. Pair a yield-bearing stablecoin like Ethena’s sUSDe with a tokenized pool of reinsurance risk, and you’ve got a structured product that earns underwriting yield in all markets, captures collateral yield in bull cycles and plugs into the rest of DeFi.

This shift is happening alongside a broader transformation in how capital moves in the market. Whereas legacy reinsurance markets rely on private deals and siloed systems, Web3 makes it easier to move capital faster, and with more transparency, so capital markets can flow more easily in and out of such positions depending on reinsurance performance. Composability opens the door to new integrations across DeFi, and together these features allow for a more accessible model.

The introduction of tokenized reinsurance signals how far RWAs have progressed. The focus is shifting from simply replicating traditional finance on-chain to establishing new, crypto-native forms of structured yield. More broadly, RWAs are beginning to unlock financial structures that would be difficult, if not impossible, to implement in traditional markets. For capital allocators, on-chain reinsurance offers broader access, greater transparency and potentially more resilient returns.

As structured finance continues to intersect with Web3 infrastructure, reinsurance offers a preview of where the next wave of RWA innovation is headed: real-world markets reimagined for speed, scale and open participation. The larger opportunity lies in connecting decentralized and traditional systems in a way that is scalable, transparent and durable.