The U.S. Owes This Country Over One Trillion Dollars

President Donald Trump, upon entering his second term in office, established the Department of Government Efficiency (DOGE) with a purported goal of cutting waste and reducing the federal deficit. But as DOGE goes after social security, Medicare, library funding, and Medicaid, among many other programs, has this been effective? Well, not really. In fact, it’s […] The post The U.S. Owes This Country Over One Trillion Dollars appeared first on 24/7 Wall St..

President Donald Trump, upon entering his second term in office, established the Department of Government Efficiency (DOGE) with a purported goal of cutting waste and reducing the federal deficit. But as DOGE goes after social security, Medicare, library funding, and Medicaid, among many other programs, has this been effective? Well, not really. In fact, it’s perhaps the opposite. Trump has called for a series of tax cuts that experts estimate will add between $5 to $11 trillion to our federal debt. The House also approved a budget “calling for $4.5 trillion in tax cuts and a $4 trillion increase in the U.S. debt limit.” While the impacts of these actions have yet to be seen, there remains a possibility that the U.S. will default on its debt by later in 2025. (Here are 24 surprising facts about the national debt.)

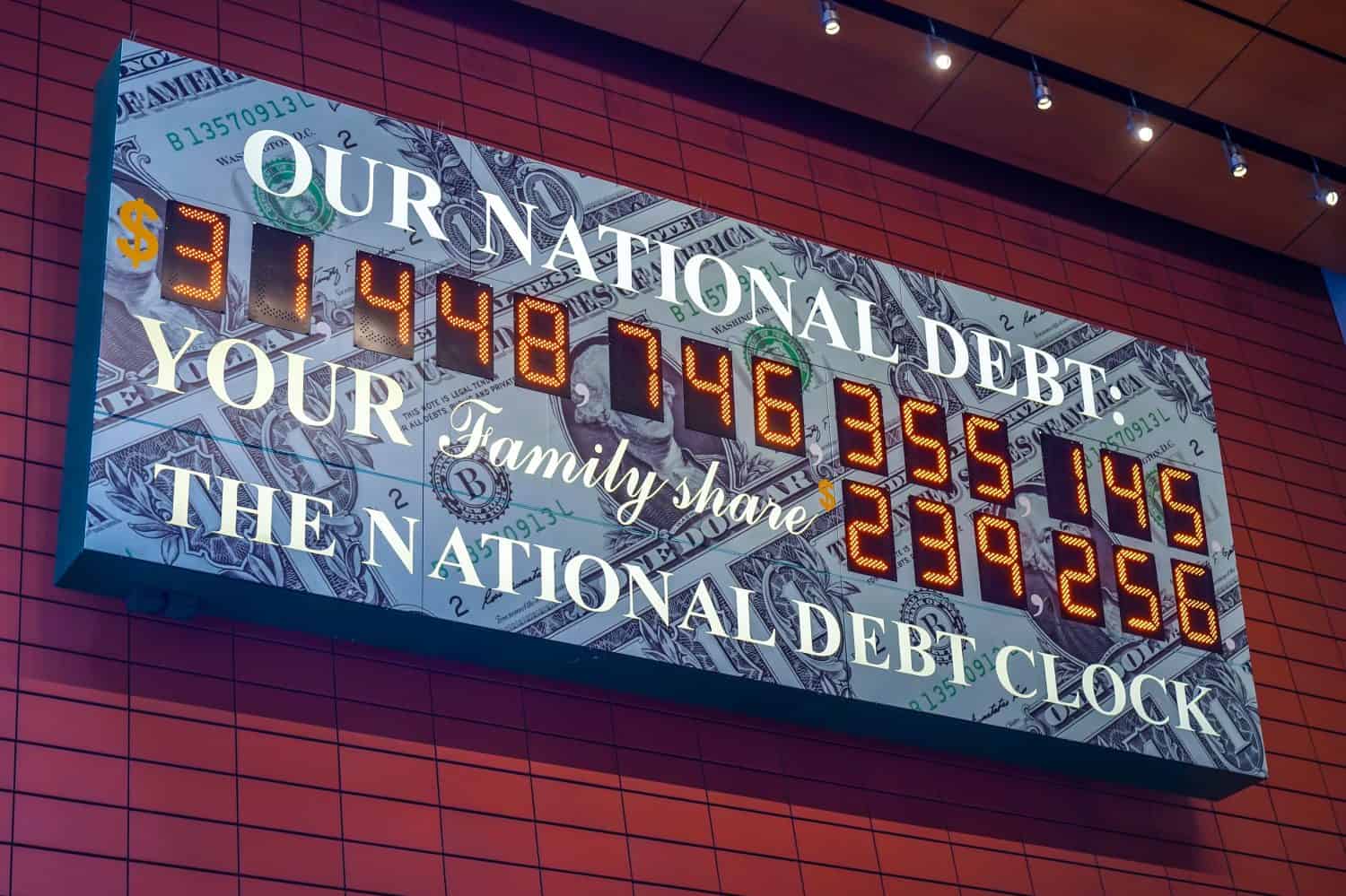

According to the U.S. Debt Clock, the U.S. national debt is at $36.6 trillion and counting every second. And with Donald Trump’s presidency and the imposition of tariffs causing worldwide controversy, we may soon hit a point where the U.S. government can no longer find anyone to borrow from or to invest in its debt. But what would that look like, and who have we borrowed from so far? To better understand the U.S. relationships with other countries, and to understand who we owe the most money to, 24/7 Wall St. searched through data from the U.S. Department of Treasury. We used the most recent data from January 2025 to identify the top 20 countries that hold the most U.S. debt. These countries are listed in ascending order from least debt to most debt.

This previously published article was updated in April 2025 to reflect ongoing financial discussions between the U.S. and other countries, as well as to provide updated numbers from the U.S. Department of Treasury.

Why We Have to Cover This Now

Interest on the national debt is costly, and this often takes funds away from educational programs, healthcare, or infrastructure. High debt can also lead to inflation. Several politicians, including Bill Cassidy, have stated that the American Dream will die if we cannot get the debt under control. Understanding the U.S. national debt and its economic implications is important when it comes to planning the future and potential investments.

What is the National Debt?

In simple terms, the national debt is the total amount of money that the United States has borrowed without paying it back. The government makes money from taxes. But the national debt is accrued when the U.S. is spending more than it is bringing in.

Who is the U.S. Borrowing From?

According to NerdWallet, creditors (AKA those who the U.S. has borrowed from) include:

- Foreign governments

- Security holders

- The American public

- U.S. government agencies

20% of the U.S. debt is intragovernmental, or owed to different branches or departments of the government.

How Did the National Debt Grow So Large?

Just like a family budget, the national budget goes into debt when spending is higher than revenues. Wartime needs during the Revolutionary War, Civil War, and World Wars I and II, as well as crises like the Great Depression, have led the U.S. to incur heavy debt in the past. In more recent years, America’s national debt has increased because of social programs inadequatly covered by tax revenues, alongside military spending. On average, the U.S. government takes in about $4.4 trillion in revenues every year but spends $6.1 trillion.

Debt Interest: Money Down the Drain

Every day, the U.S. government spends approximately $2.6 billion just on interest on the national debt. Projections indicate that within a decade, interest payments on the debt will surpass what the country spends on Medicare, Medicaid, or discretionary defense items, with the Peter G. Peterson Foundation estimating $4.9 billion in interest per day by 2035. Essentially, that means the U.S. is spending a lot of money that could instead contribute to benefits for U.S. citizens, including:

- Expanded mental health services for veterans

- Small business loans

- Improved funding for schools and educational programs

- Infrastructure improvements

- Environmental protection

What Are the Risks or Consequences of Rising National Debt?

There are several risks associated with a rising national debt — and many of these could make life significantly harder for future generations. Some possibilities include:

- Higher interest rates

- Less investment and slowed productive

- Poorer standards of living

- Recessions

How Do Demographics Affect the National Debt?

About 10,000 more Baby Boomers reach retirement age every day. This is straining the resources of programs like Social Security, Medicare, and Medicaid — programs that are now being threatened by DOGE. Moreover, the elderly population also puts extra strain on the healthcare system. Healthcare in the United States costs twice as much on average as other developed countries like the U.K., Canada, Sweden, France, and Australia. But despite these larger healthcare costs, our nation’s healthcare does not produce significantly better results.

How Does the Government Fund the Debt?

The U.S. government issues Treasury securities that are considered around the world to be stable investments for individuals, corporations, banks, and national treasuries. These are paid back with interest according to their maturity dates. The United States has maintained a high credit rating by paying its debts on time, making creditors willing to keep lending even as the country’s debt increases.

Here are the countries that hold the most U.S. Treasury securities:

20. Mexico

- Mexico holds $99.4 billion in U.S. debt.

Historically, relations have not always been good between the United States and Mexico, but in recent decades the countries have integrated their economies together with Canada in a free trade agreement that has benefited all three nations. However, U.S. President Donald Trump has been causing conflict with Mexico in arguments over the border wall, and cartel violence and intervention, and it’s unclear how this might affect the United States’ relationship with the nation in the future.

19. Germany

- Germany holds $105.5 billion in U.S. debt.

Although they were enemies in the two world wars, Germany and the U.S. have been close allies in more recent years, joined in a mutual defense agreement through NATO. However, amidst uncertain tariff policies from the U.S., the relationship may be souring. Several sources have reported that Germany could be looking to repatriate its gold from the United States.

18. South Korea

- South Korea holds $122.2 billion in U.S. debt.

The United States and other allies saved South Korea from an invasion by North Korea from 1950 to 1953. Today, tens of thousands of U.S. troops are permanently stationed in South Korea to deter another attack by the heavily armed and eccentric North.

17. Saudi Arabia

- Saudi Arabia holds $126.9 billion in U.S. debt.

Saudi Arabia has partnered with the United States based on shared interests in the oil industry and in deterring aggression from Iran. When the U.S. went to war to expel invading Iraqis from Kuwait, it was not only to save Kuwait but also to protect the nearby oil fields of Saudi Arabia.

16. Norway

- Norway holds $173.1 billion in U.S. debt.

Norway, a NATO ally, is situated in a strategic location to monitor Russian activities in the Arctic and North Atlantic Oceans. It is also a major petroleum producer from wells in the North Sea. Norway has been hit from tariffs from the Trump administration but hopes to negotiate. This could affect relations between the two countries.

15. Brazil

- Brazil holds $199.1 billion in U.S. debt.

Brazil, the largest country in South America, is considered along with India, South Africa, and a select few others, to be a great global power in the future economically and militarily. While Brazil’s former president Jair Bolsonaro was allied with Trump, his predecessor Luiz Inácio Lula da Silva (“Lula”) is less so. Brazil has recently suspended the free entry of Americans into the country, now requiring a visa, and has considered retaliatory tariffs if need be.

14. India

- The U.S. government owes India $225.7 billion.

India is the world’s most heavily populated country, with 1.46 billion people. Since we owe India $225.7 billion, it’s the equivalent of owing each Indian citizen about $154.

13. Singapore

- The U.S. owes Singapore $247.6 billion.

Singapore is a prosperous city-state at the tip of the Malay Peninsula. Its location is next to one of the world’s busiest shipping lanes, with traffic flowing between Japan, China, and other parts of East Asia to and from Europe, the Middle East, and India. Singapore has expressed upset at the recent tariffs levied against the nation, saying that the U.S. doing so was not friendly.

12. Hong Kong

- The U.S. currently owes Hong Kong $255.9 billion.

Hong Kong is a city-state that was previously a British colony but was returned to China when its lease expired. Today it is partially self-governing, though ultimately under the thumb of the People’s Republic of China (PRC). Concerned about the future and the uncertainty of the Trump administration, Hong Kong has stated it might sign more free trade agreements elsewhere.

11. Taiwan

- The U.S. owes Taiwan $290.4 billion.

Taiwan functions like an independent country, though there’s contention with China. When the communists took over the mainland, the Chinese government moved to the large offshore island of Taiwan but never formally declared independence. The United States helps arm and defend Taiwan, as mainland China continues to build up for a possible invasion of the island.

10. Switzerland

- Switzerland has invested $301.1 billion in U.S. Treasury securities.

Switzerland is a small country in the Alps of southwestern Europe, but it plays an outsized role in world affairs. Famed for its strict neutrality, Switzerland has become a prosperous and secure safe haven for wealthy individuals, companies, and countries. Currently, relations between Switzerland and the U.S. are strained thanks to (you guessed it!) the tariffs, though Switzerland has stated they do not plan to retaliate.

9. Ireland

- The United States owes Ireland $329.7 billion.

Approximately 9% of the U.S. population have Irish ancestors. While North Ireland goods face a 10% tariff from the U.S., the two nations have historically had good relationships with the other.

8. France

- The U.S. owes France $335.4 billion.

France helped the United States win independence from Britain, doubled the size of the country by selling the Louisiana Territory, and gave the nation the Statue of Liberty as a love-gift. In turn, the U.S. defended and liberated France in both world wars and has been allied with it throughout the Cold War. But the two countries have seen much strife since the onset of the Trump presidency — and some French politicians have even called for the U.S. to return the Statue of Liberty, saying the country no longer stands on the values that the statue represents.

7. Canada

- The United States owes Canada $350.8 billion.

Canada has always been one of the U.S.’ closest allies, literally and metaphorically. The two share thousands of miles of peaceful, undefended border in addition to thoroughly integrated economies and a combined defense infrastructure as part of NATO. Unfortunately, U.S. President Donald Trump has levied significant tariffs against Canada and repeatedly stated that he wanted to make Canada the 51st state. Many Canadians have fiercely begun buying only goods made in Canada, and the relationship between the two countries may be strained for years, if not decades, to come.

6. Belgium

- Belgium holds $377.7 billion of the American debt.

Belgium is a NATO ally and the headquarters of the European Union. Recently, Belgium has told the U.S., however, that defense spending for all NATO allies could not be 5% of the GDP as it was not possible for many countries.

5. Cayman Islands

- The Cayman Islands invest a good chunk of their profits in the U.S. national debt: $404.5 billion currently.

The Cayman Islands are not an entirely independent country but are instead a self-governing Overseas Territory of the United Kingdom located in the Caribbean. The islands are a popular location for offshore bank accounts for wealthy people and corporations seeking tax shelter.

4. Luxembourg

- Luxembourg holds $409.9 billion in U.S. debt.

A small country between France, Belgium, and Germany, Luxembourg is one of America’s NATO allies.

3. United Kingdom

- The United Kingdom holds $740.2 billion of the U.S. national debt.

The U.K. is arguably the closest ally of the U.S. The two countries are linked in the NATO alliance, but their so-called “Special Relationship” makes them even closer allies than they are with other NATO countries. However, during the Trump presidency, there have been some issues between the two nations. Not only has the U.K. issued a travel warning for the U.S., but U.S. citizens visiting the U.K. are now required to apply for online authorization.

2. China

- China holds $760.8 of the United States’ national debt.

The People’s Republic of China is the second largest foreign holder of U.S. debt. Relations between the two countries are strained over issues of trade, territorial disputes in the South China Sea, and China’s support for Russia in the war in Ukraine.

1. Japan

- The United States owes $1.079 trillion to Japan.

Japan holds the most U.S. Treasury securities of any country. The two economies are deeply intertwined and have a mutual defense pact.

Take-Away Thoughts

While the unprecedented size and continuing growth of the U.S. debt is concerning, here are a few thoughts that might help keep it in perspective:

1. Big debt, but also big economy

The U.S. has a gross domestic product (GDP) of $29.9 trillion. The size of our debt compared to the size of our economy is more favorable than many other countries. However, the Congressional Budget Office has projected that the U.S. national debt will expand to 156% of the GDP in or by 2055; the U.S. government should look at ways to mitigate this.

2. Friendly creditors

The vast majority of the overseas holders of the U.S. debt have been friendly and closely allied countries, many of whom depend on America for their defense. They are not trying to hurt the U.S., but just see a good business opportunity to loan money to a country they trust will pay it back. However, the Trump administration should ensure it is taking actions to maintain this relationship, as we are in a tenuous position at this point.

3. Military strength

No country can come and take our assets to collect the debt. The U.S. has the strongest military in the world. In the end, we could just simply refuse to repay the debt and no one could do anything about it except stop loaning us money in the future. And if the U.S. defaulted on its debt, it would disrupt the entire world financial system, which wouldn’t be good for anyone.

4. Above our pay scale

The debt problem is not going to be solved in our lifetime. Period. We can vote and lobby for candidates with spending priorities we agree with, but beyond that, there is little any of us as individuals can do about this macro-scale problem.

No matter how serious a problem is, if you have limited or no power to affect it, then there isn’t much point in worrying about it. It makes sense to be a good citizen, pay your taxes, vote according to your conscience, and find things to do that make your life and the lives of people around you better. And if 346 million Americans did that, we might see this whole thing start to move incrementally in a better direction.

The post The U.S. Owes This Country Over One Trillion Dollars appeared first on 24/7 Wall St..