The Tariff Turmoil Could Trigger 4 Interest Rate Cuts in 2025 -- Here's What It Means for Stocks

The U.S. Federal Reserve reduced the federal funds rate (overnight interest rate) in September, November, and December last year, for a total reduction of 100 basis points. It reversed some of the aggressive rate hikes from 2022 and 2023 when the central bank was trying to tame a four-decade high in the Consumer Price Index (CPI) measure of inflation.The CPI continues to decline toward the Fed's 2% annualized target, and since the U.S. economy faces significant uncertainty right now in the face of simmering global trade tensions, Wall Street is forecasting several more rate cuts this year.According to the CME Group's FedWatch tool, which calculates the probability of the central bank's potential decisions based on the interest rate futures market, there could be four cuts before 2025 is over. This would have significant implications for the S&P 500 (SNPINDEX: ^GSPC) index but not in the way you might expect.Continue reading

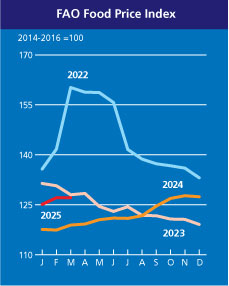

The U.S. Federal Reserve reduced the federal funds rate (overnight interest rate) in September, November, and December last year, for a total reduction of 100 basis points. It reversed some of the aggressive rate hikes from 2022 and 2023 when the central bank was trying to tame a four-decade high in the Consumer Price Index (CPI) measure of inflation.

The CPI continues to decline toward the Fed's 2% annualized target, and since the U.S. economy faces significant uncertainty right now in the face of simmering global trade tensions, Wall Street is forecasting several more rate cuts this year.

According to the CME Group's FedWatch tool, which calculates the probability of the central bank's potential decisions based on the interest rate futures market, there could be four cuts before 2025 is over. This would have significant implications for the S&P 500 (SNPINDEX: ^GSPC) index but not in the way you might expect.