The bond market selloff badly rattled investors. Here’s what analysts are saying about this key market and what’s to come

When 10-year Treasury yields head in the wrong direction that has major implications for the U.S. economy.

A plunging stock market may make it painful to check your 401(k), but as investors found out this week it was when bonds started plunging (and yields, which move inversely to bond prices, starting spiking) that things got really bad. So bad, in fact, that Trump hit his pain threshold and announced a 90-day pause on most tariffs. Why are bond yields, of all things, so important? For retail investors, it's likely something they haven't paid much attention to in the past. But the 10-year Treasury yield is a benchmark that directly influences borrowing costs for all U.S. consumers, and when it heads in the wrong direction, that has major implications for the U.S. economy.

What are bonds?

Bonds are loans where an investor lends money to an entity, usually a corporation, government or organization. Borrowers typically pay a fixed interest rate over a period of time. Bonds are considered fixed income financial instruments and are geared to investors who want stable returns.

Why are 10-year and 30-year Treasury notes popular bonds?

The safest of all bonds are U.S. Treasuries because they are backed by the U.S. government. The 10-year and 30-year Treasury notes are some of the more popular bonds, providing fixed-income payments every six months and guaranteeing a return of principal if investors hold the bond until maturity. The 10-year Treasury is the most liquid and widely traded bond in the world. U.S. Treasuries are a very large component of the U.S. bond market, but don't represent the entire U.S. bond market.

Why did investors get spooked and begin offloading bonds?

On April 2, President Trump introduced his “Liberation Day” tariffs which imposed taxes on nearly all products that are imported from other countries. The tariffs are expected to cause inflation to rise over the short term. They also caused a huge selloff in the broad market, with the value of U.S. listed stocks plunging by $7.7 trillion in value since April 2, according to the Wall Street Journal. Usually when a stock selloff occurs, investors buy bonds, especially U.S. Treasuries, because they’re considered safer. But that didn’t happen this time. Investors began unloading bonds late last week. That caused the yield for the 10-year Treasury to climb above 4% on Tuesday and then it jumped to 4.5% early Wednesday. Then Trump announced a 90-day pause on some tariffs, causing the S&P 500 to soar 9.5% and the Nasdaq Composite to skyrocket more than 12%. The bond market found some relief at that point, with the yield dropping to 4.34% on the 10-year by Wednesday afternoon. The dramatic moves had even seasoned investors whipsawed. “I am a bit surprised at both the speed and magnitude of the moves in the bond market,” noted Dominic Pappalardo, chief multi-asset strategist at Morningstar Wealth.

Why is the bond selloff important?

Basically, when investors sell 10-year Treasury notes, bond prices fall, and the yield rises. When Treasury bond yields climb, so do all other interest rates. The 10-year Treasury weighs heavily on what consumers are charged for mortgages, auto loans, and credit cards, said Tom Simons, chief U.S. economist at Jefferies.

High net worth investors and hedge funds will likely lose a lot of money, Simons said. But for consumers, interest rates will probably stay high because “lenders won't have confidence that Treasuries will stay at lower yields over time,” he said.

Who owns Treasuries?

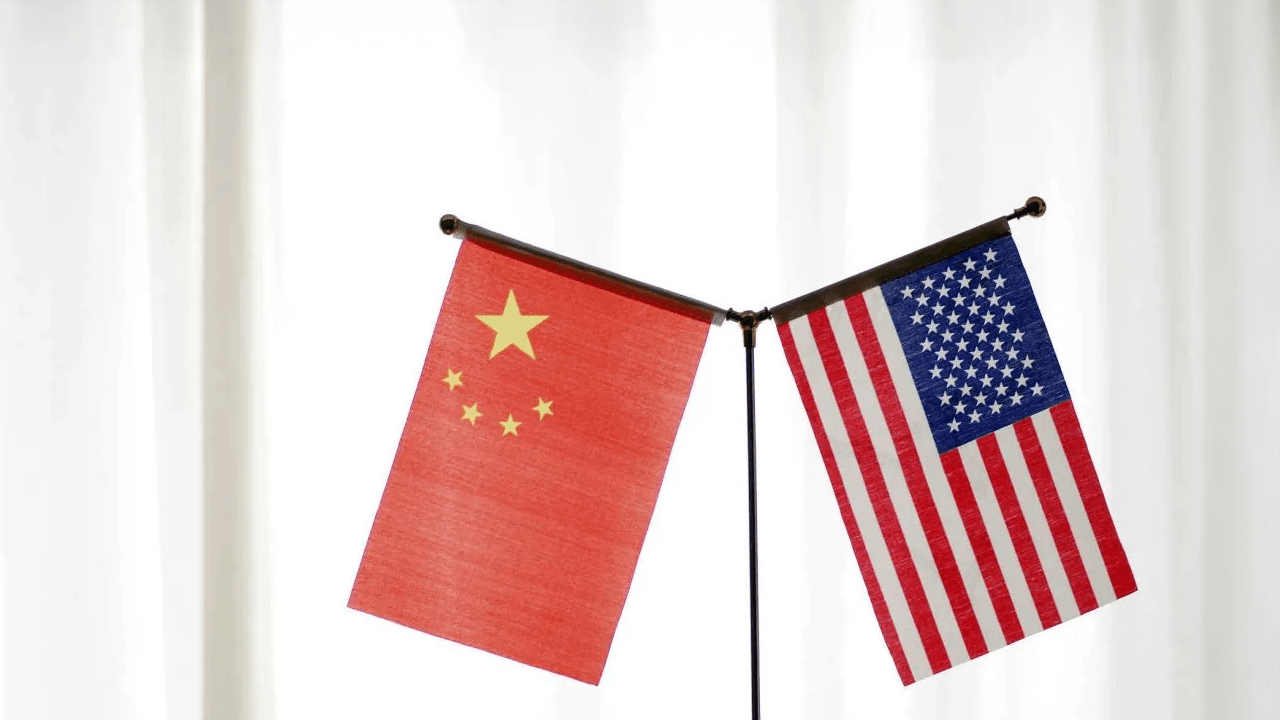

Ownership of Treasuries is spread out all over the world and include sovereign wealth funds, foreign central banks, pension funds, domestic banks, insurance companies, and hedge funds. Japan, China and the U.K. are said to be the largest holders of Treasuries.

Could the bond selloff get worse?

Absolutely. On Thursday, the U.S. Bureau of Labor Statistics is expected to release its monthly Consumer Price Index, or CPI, which tracks price changes in goods and services commonly bought by households. If the CPI shows that inflation in March was higher than expected, that will put further upward pressure on bond yields, likely causing bond prices to come down even further, Pappalardo said. “It would push interest rates higher without a doubt if that were to occur,” he said.

The current 10-year Treasury yield is 4.34 but it has gone much higher. In 1981, when inflation was high, the yield hit 15.84%.

Has a selloff of both bonds and stocks happened before?

Yes. The most recent example is in 2022, when the yield for the 10-year Treasury hit about 3.9% that December, up from around 1.5% at the start of the year. The S&P 500 and the Nasdaq Composite also performed poorly that year.

What can the Federal Reserve do?

In 2022, high inflation spurred the Federal Reserve to step in and raise interest rates seven times that year. This slowed economic activity and “helped cool down inflation,” said Morningstar’s Pappalardo. It’s unclear if the Fed will take action this time. If the Fed rushed out and hiked interest rates to cool inflation, it would “trigger a massive economic downturn,” he said. But if they lowered interest rates to support economic activity, they risk causing inflation to increase even faster. “The Fed is really caught in a conundrum where they're almost a bit paralyzed,” Pappalardo said. The futures markets are predicting a 40% chance that the Fed cuts rates at its next meeting in May, he said. But given how quickly market conditions are changing, that timeframe seems a world away.

This story was originally featured on Fortune.com