The 4 Biggest Risks to AT&T’s (NYSE: T) 4.1% Yield

AT&T (NYSE:T) is tempting income investors with a tantalizing 4.1% dividend yield that pays $0.28 quarterly, especially attractive in a jittery market. With a $193 billion market cap and a focus one again on its legacy telecom operations, AT&T’s $1.11 annual payout has held steady since a 50% cut in 2022 following its WarnerMedia spinoff. […] The post The 4 Biggest Risks to AT&T’s (NYSE: T) 4.1% Yield appeared first on 24/7 Wall St..

AT&T (NYSE:T) is tempting income investors with a tantalizing 4.1% dividend yield that pays $0.28 quarterly, especially attractive in a jittery market. With a $193 billion market cap and a focus one again on its legacy telecom operations, AT&T’s $1.11 annual payout has held steady since a 50% cut in 2022 following its WarnerMedia spinoff.

Yet, beneath this high-yield allure lurks significant risks that could threaten its stability. Here are the three biggest challenges to AT&T’s dividend sustainability.

AT&T (T) offers an attractive dividend yield 4.1% annually.

After slashing the payout 50% in 2022, the dividend has remained untouched since and doesn’t appear ready to rise anytime soon.

While the payout appears secure at the moment, income investors need to be mindful of the risk T’s dividend potentially faces.

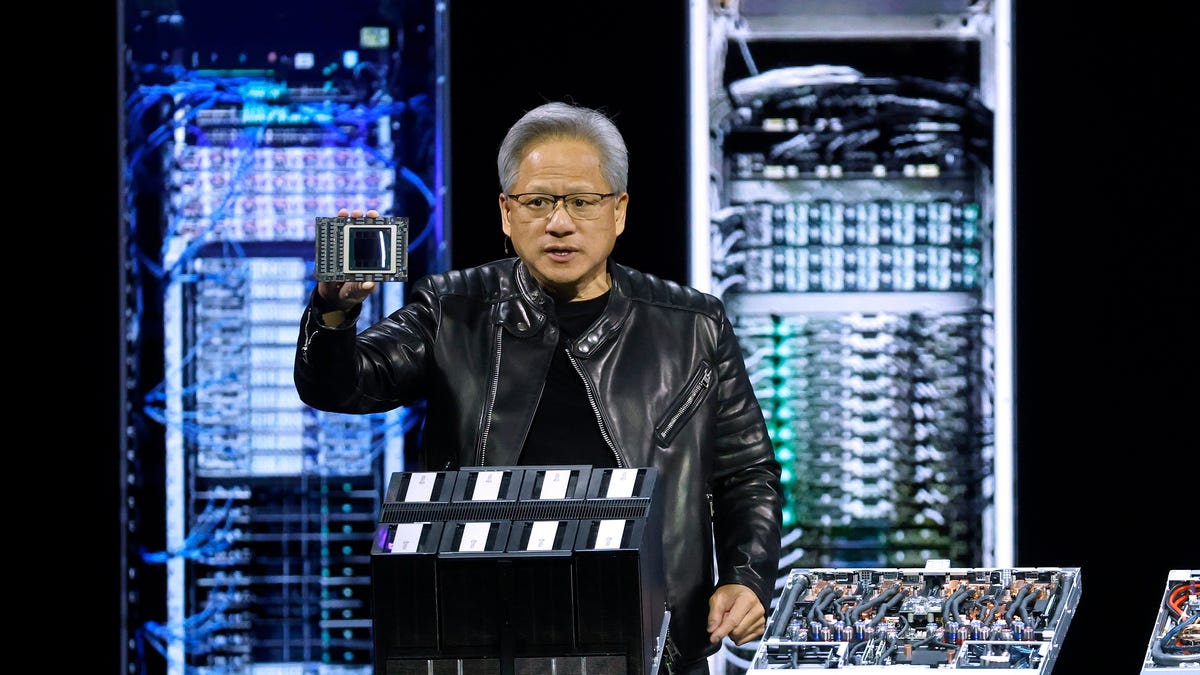

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

24/7 Wall St. Insights:

1. Crushing debt and rising interest costs

AT&T’s $123.5 billion in total debt is a massively heavy burden. Although the figure is down from $137.3 billion in 2023, net debt stands at $120.1 billion, which is still 2.4x of adjusted EBITDA, higher than the 2x comfort zone that Wall Street prefers.

Free cash flow (FCF) of $4.9 billion in the fourth quarter alone looks solid, but $3.6 billion in yearly interest payments (a 3% increase from 2023) eats into AT&T’s available wiggle room and underscoring why its payout hasn’t increased.

The Fed’s December 2024 rate cut to 4.25% helped with interest payments, yet $18 billion of its debt matures by 2028. If rates climb, refinancing costs could jump, squeezing AT&T’s 2.2x FCF coverage. Fortunately, analysts are expecting rate cuts, not increases for the coming year, otherwise it could be a debt clock ticking down on the dividend.

Because this debt overhang is stunting AT&T’s payout growth, if FCF dips — say, from an economic slowdown — the dividend’s safety net narrows and it risks repeating 2022’s cut, even if not to the same degree.

2. Weak revenue growth and competitive pressure

AT&T’s revenue growth is anemic. Fourth-quarter sales rose less than 1% to $32.3 billion, trailing inflation at 2.8%. While it did have impressive wireless additions — some 482,000 in postpaid users — mobility average revenue per user (ARPU) increased just 0.9% to $56.72 as T-Mobile’s (NASDAQ:TMUS) 5G discounts and Verizon’s (NYSE:VZ) bundles ate into greater growth.

The telecom’s fiber business continues to shine with 307,000 net additions, but $20.3 billion in 2024 capital expenditures (up from $17.9 billion) strains its cash. If revenue stalls further or ARPU slips, FCF could shrink below the $18 billion to $19 billion guidance, pressuring the dividend. Analysts at Jefferies last month flagged this “growth trap” as a yield risk.

As the third-largest carrier, AT&T has added pressure to keep up with its larger, better financed rivals. Verizon recently said competition was starting to heat up more in the first quarter, which could upset the equilibrium that had been in play in the industry. Should customer growth slow, AT&T may chase them at the expense of profitability.

3. Regulatory risk and legal headwinds

AT&T faces billions of dollars in cleanup costs for lead-cable lawsuits and its $10.8 billion fourth-quarter adjusted EBITDA could take a blow if courts rule against AT&T, diverting FCF from the dividend. And while the current administration in Washington won’t be imposing net neutrality on the telecoms anytime, that could easily flip in a few years.

4. Market distractions

Still, the telecom giant’ need to pay down debt will limit shareholder returns for now and it is trying to acquire Lumen Technologies (NASDAQ:LUMN) for $5.5 billion. It’s a lower margin business than AT&T’s existing one, and while opening potential growth opportunities, it could be a distraction to management. Moreover, even if it can earn attractive returns by deploying fiber in these rural markets, there is the cost of doing so that must still be factored in, expenses it wasn’t previously counting on.

A balancing act

AT&T’s 4.1% yield isn’t on the chopping block today — or tomorrow for that matter. Operating costs are rising faster than revenue, and debt, competition, and legal woes could converge.

Its 35% payout ratio (down from 60% pre-dividend cut) and $6 billion debt reduction target by 2026 show AT&T’s intent to deleverage. Fiber growth and its 5G rollout counter the worst of its competitive woes. However, there are real hazards income investors need to be mindful of before investing in T stock, even if they ultimately pull the trigger.

The post The 4 Biggest Risks to AT&T’s (NYSE: T) 4.1% Yield appeared first on 24/7 Wall St..