Taiwan Semiconductor (TSM) Price Prediction and Forecast (March 2025)

Taiwan Semiconductor holds a crucial place in the semiconductor supply chain, and we project a substantial gain for the stock by the end of the decade. The post Taiwan Semiconductor (TSM) Price Prediction and Forecast (March 2025) appeared first on 24/7 Wall St..

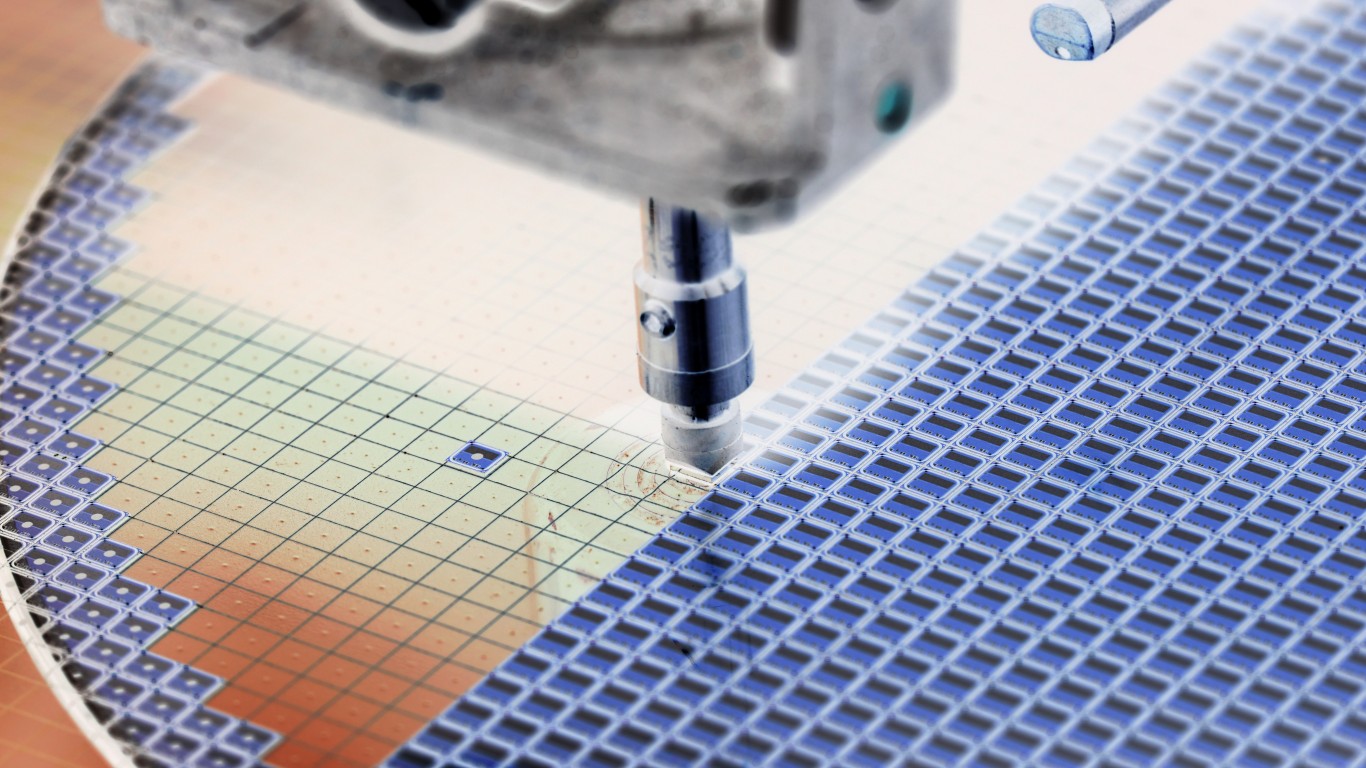

Due to efforts to bolster U.S. domestic chip production and reduce reliance on overseas supply chains, Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM), AKA TSMC, plans to drastically increase its investment in U.S. semiconductor manufacturing, including new fabrication plants and advanced packaging facilities in Arizona.

24/7 Wall St. Key Points:

-

Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM) holds a crucial place in the semiconductor supply chain, commanding over 60% of global spending at chip foundries.

-

Its ability to deliver cutting-edge manufacturing capabilities is essential for customers developing artificial intelligence (AI), high-performance computing, and other advanced technologies.

-

Therefore, we see a more than 46% gain for the stock by the end of the decade.

-

If you’re looking for some stocks with huge potential, make sure to grab a free copy of our “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

The stock hit an all-time high of $226.40 earlier this year but has been in retreat since then. In fact, the share price is 8.3% lower than at the start of the year. It is up 28.9% year over year, though, outperforming the broader markets in that time. Wall Street remains optimistic, and analysts see plenty of room for the stock to run, at least in the short term.

Investors are of course concerned with future stock performance over the next 1, 5, to 10 years. Although most Wall Street analysts will calculate 12-month forward projections, it is clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term prognostications irrelevant. 24/7 Wall St. aims to present some farther-looking insights based on TSMC’s own numbers, along with business and market development information that may be of help with your own research.

All Roads Lead to Taiwan Semiconductor

In the high-tech universe, there is a single common road that top-flight companies like Nvidia, AMD, Apple, Qualcomm, Broadcom, and many others must travel to get their chips made, no matter where they hail from. That road inevitably leads to TSMC, the largest semiconductor foundry on the planet.

When a company like Nvidia Corp. (NASDAQ: NVDA) designs a new chip, it takes it to TSMC to actually print the design on a silicon wafer. TSMC is the top choice for Nvidia, AMD, and many other chip designers, thanks to its precision, quality control, and innovative technical capabilities. At the time of this writing, TSMC commands over 60% of global spending at chip foundries.

The explosion of growth in the artificial intelligence and data center arenas have led to a commensurate demand acceleration for graphics processing unit (GPU) chips and a panoply of similar ones for those fields. By focusing on precision foundry work, TSMC has become the premier “go-to” player, for chip designers, even among those competing in various sectors.

TSMC does face certain challenges, including:

- Despite its crucial place in the semiconductor supply chain, Taiwan Semiconductor is based in Taiwan. The Leadership of the People’s Republic of China claims that Taiwan is a part of China proper. Any overt military action on Taiwanese soil likely would result in a domino-effect of chip shortages.

- TSMC had raised prices for its 3-nanometer and 5-nm process products by up to 8%. However, Samsung is focusing on its 2-nm process to meet future technologies’ high-performance, low-power, and high-bandwidth requirements, and rival Intel has a 1.4-nm ultra-fine process slated to be unveiled in 2027.

- The semiconductor industry has historically been cyclical. While AI investment soars, TSMC has few rivals of significance. During slow periods, semiconductor companies have often been glutted with excess inventory. It remains to be seen how TSMC will handle a slowdown after ramping up production to such a high level.

TSMC’s Performance

The company experienced significant growth and transformation from 2014 to 2024, in that time solidifying its position as a global leader in semiconductor manufacturing.

- 2014 was the year that the TSMC-Apple cooperation began in earnest, with Apple’s A8 and A8X SoCss. Such has the cooperation expanded that Apple has gone to TSMC for nearly 100% of its chip requirements by 2024.

- Opposing patent infringement lawsuits with GlobalFoundries in 2019 eventually settled with a cross-licensing agreement, which ends in 2029.

- 2020 saw TSMC prudently decide to diversify its manufacturing by opening up new plants in Phoenix, Arizona, and Dresden, Germany.

- In July 2020, TSMC signed a 20-year deal with Ørsted to buy the entire production of two offshore wind farms under development off Taiwan’s west coast. At the time of its signing, it was the world’s largest corporate green energy order ever made.

- 2021 saw TSMC form joint ventures with Sony and Denso in Japan.

| Fiscal Year (DEC ) | Price | Total Revenues | Net Income |

| NYSE | (TWD) | (TWD) | |

| 2014 | $22.38 | $762.81 M | $254.30 M |

| 2015 | $22.75 | $843.49 M | $302.85 M |

| 2016 | $28.75 | $947.98 M | $331.73 M |

| 2017 | $39.65 | $977.95 M | $344.99 M |

| 2018 | $36.91 | $1.03 B | $363.05 M |

| 2019 | $58.10 | $1.07 B | $353.95 M |

| 2020 | $109.04 | $1.34 B | $510.74 M |

| 2021 | $120.31 | $1.59 B | $596.54 M |

| 2022 | $74.49 | $2.24 B | $1.016,53 B |

| 2023 | $104.00 | $2.16 B | $838.50 M |

| 2024 | $197.49 | $2.89 B | $1.17 T |

Key Drivers for TSMC’s Future

The surge in artificial intelligence (AI) is a primary driver for TSMC, but its future growth is also heavily tied to strategic partnerships, geopolitical considerations, and the following:

Technological Leadership:

TSMC’s ongoing advancement in process technology, particularly in nodes like 3nm and beyond, allows them to command premium pricing and maintain a strong market share. The company’s ability to deliver cutting-edge manufacturing capabilities is essential for customers developing advanced technologies such as artificial intelligence (AI), high-performance computing, and advanced mobile devices.

Demand from Key Sectors:

The increasing demand for semiconductors in crucial fields like AI, high-performance computing (HPC), and 5G and advanced mobile devices. While the surge in AI applications drives a need for the powerful chips TSMC manufactures, data centers and other HPC applications also require high-end semiconductors. Furthermore, the evolution of 5G and the increasing sophistication of mobile devices contribute significantly to TSMC’s revenue.

Supply Chain Dynamics:

The importance of robust semiconductor supply chains is undeniable, and TSMC’s role in that chain is very crucial. This serves as an incentive for the international community to keep Taiwan out of Beijing’s control.

Because of its uniquely advanced manufacturing capabilities, TSMC can easily scale for demand acceleration, and it holds close to a near monopoly on large graphics processing unit (GPU) chip contracts from major semiconductor designers for AI and data center use.

Stock Price Prediction for 2025

The consensus recommendation for TSMC stock from 17 Wall Street analysts is to buy shares. Three of those analysts have Strong Buy ratings. Their average price target in 12 months is $247.07, which is 37.5% above the current price.

24/7 Wall St.’s 12-month projection for TSMC’s price is $183.92 a share, which signals a gain of 2.4% in the coming year. While the company is set to start its 2-nm process this year, Samsung has a vested interest in developing its own niche advantage and support from the Korean government in that space. As a result, we do not anticipate as big of a 2025 surge from 2-nm as other analysts might.

Outlook for the Next 5 Years

Since TSMC consumes as much as 5% of Taiwan’s entire energy output, its Ørsted wind farm energy production should manifest tangible cost savings benefits. Therefore, we project 2026’s stock price to hit $186.00, a 5.8% year-over-year retreat.

While its 2-nm process will likely compete favorably at the start against Samsung, the TSMC competitive advantage in other avenues of chip manufacturing will ultimately prove to be overwhelming. The anticipated surge of data center spending on chips should fuel larger contracts. Collaborations with research institutions and tech giants in developing next-generation AI chips could open new revenue streams and strengthen its position as an innovation leader in the industry. Our projection for 2027 is $206.80.

2028 should begin to see the rewards from the 2024 R&D surge of $32 billion in advanced process technologies. New products from TSM investments in quantum computing research are expected to bear fruit by 2028, potentially revolutionizing certain computing applications. The company’s focus on developing ultra-low power consumption chips for IoT and edge computing devices could position it as a key player in the growing market for energy-efficient technologies. The 2028 24/7 Wall St. price target is $213.90.

2029 will mark the expiration of TSMC’s GlobalFoundries cross-licensing agreement, which should double up the revenues from that stream. Further developments in chips for quantum computing, healthcare, and other applications can open up more direct government contract opportunities. U.S. and German TSMC factories should be operating at full capacity by 2029. We anticipate a price jump to $245.99.

By 2030, TSMC’s work in quantum computing should pave the way for neuromorphic computing chips at the forefront of AI applications. These would mimic human brain functions more closely than ever before. The company’s involvement in space exploration projects and renewable energy initiatives may also diversify its revenue streams and enhance its global technological influence. We expect a $254.59 stock price, representing a more than 46% gain over today’s stock price.

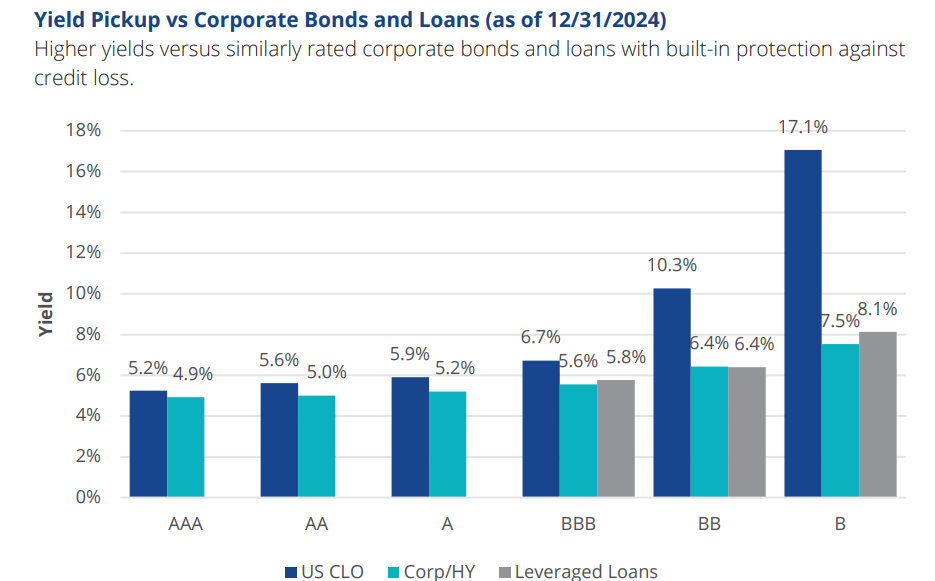

| Year | P/E Ratio | EPS | Price | Upside |

| 2025 | 22 | $8.36 | $183.92 | 2.4% |

| 2026 | 20 | $9.30 | $186.00 | 3.5% |

| 2027 | 22 | $9.40 | $206.80 | 15.1% |

| 2028 | 20 | $10.70 | $213.90 | 19.0% |

| 2029 | 20 | $12.30 | $245.99 | 36.9% |

| 2030 | 18 | $14.14 | $254.59 | 41.7% |

The post Taiwan Semiconductor (TSM) Price Prediction and Forecast (March 2025) appeared first on 24/7 Wall St..