Are Tariffs a New US VAT Tax?

A quick note on tariffs: Over the past few weeks, I’ve been putting together my quarterly call for clients. The challenge is how to frame the current economic scenario in a way that is useful and informative and not the usual run-of-the-mill noise. It’s easy to get distracted by the chaos of random… Read More The post Are Tariffs a New US VAT Tax? appeared first on The Big Picture.

A quick note on tariffs: Over the past few weeks, I’ve been putting together my quarterly call for clients. The challenge is how to frame the current economic scenario in a way that is useful and informative and not the usual run-of-the-mill noise.

It’s easy to get distracted by the chaos of random policies that have been coming rapid-fire at Americans. We see this in the Tariffs On, Tariffs Off, Sell, Buy pattern of news-flow. But rather than get pushed and pulled by the daily deluge, let’s find some better context.

Markets are trying to digest a troika of unknowns:

1) What are the new proposals actually going to be?

2) What will their impact be on economic activity and inflation?

3) How will the above affect corporate revenues and profits?

This is what markets do: They suss out the complexities of events and calculate the probability of how they will impact future cash flows.

~~~

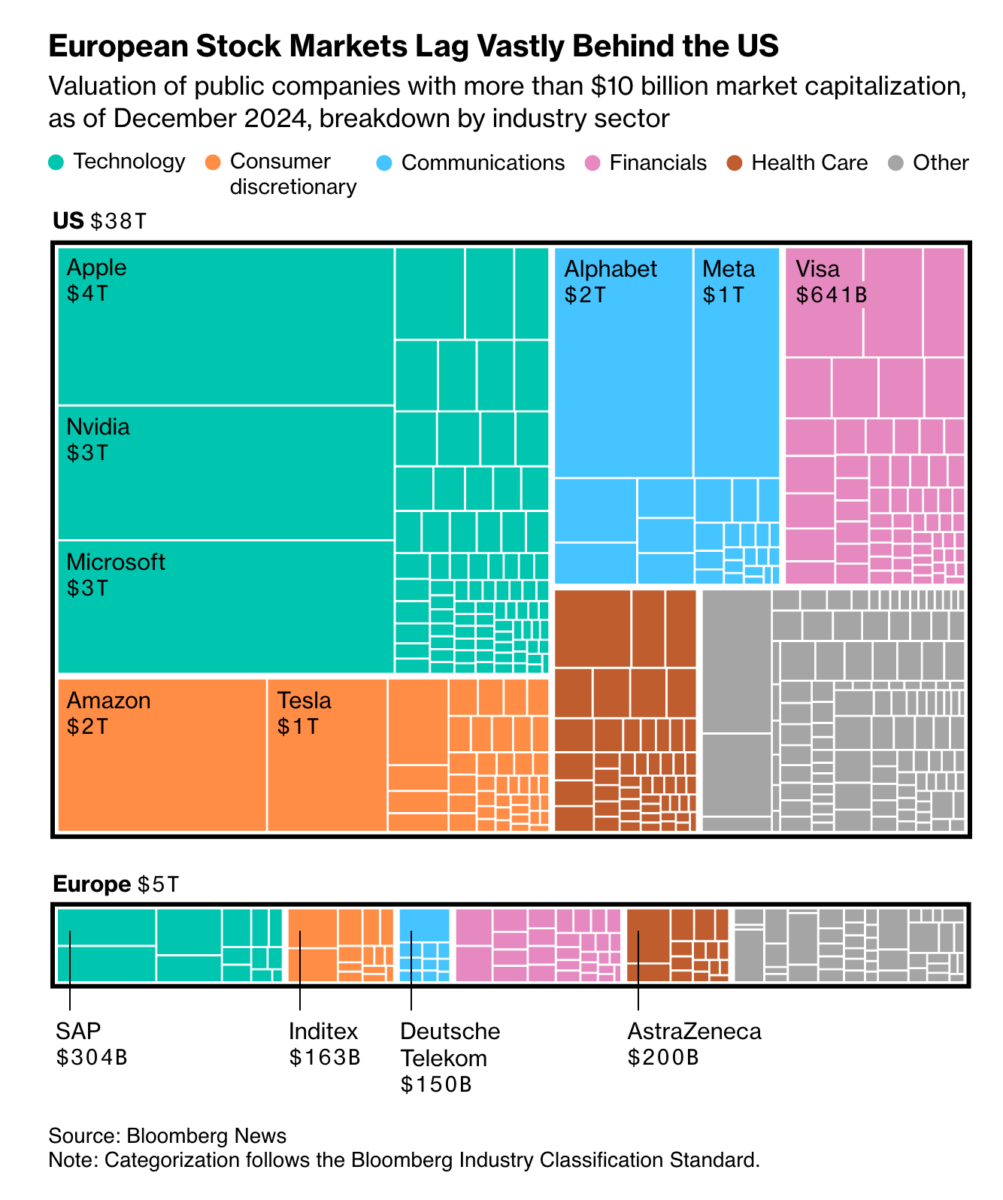

The tariff structure that exists today was based on agreements from the Uruguay Round that established the World Trade Organization. Recognizing the rising importance of intellectual property and services, the U.S. wanted to make sure three of America’s largest and fastest-growing segments had protections: Finance, Technology, and Entertainment:

The Washington Post discussed why the WTO was a big win for the US:

“These were huge wins for Hollywood, Silicon Valley and Wall Street, and brought order to a type of trade that the U.S. dominated. While the U.S. has run a deficit in its merchandise trade since 1975, it has consistently sold more services to the rest of the world than it has imported. The U.S. last year exported more than $1 trillion worth of services, enjoying a nearly $300 billion trade surplus.”

The broad incentives of cheap labor and minimal regulatory oversight led Corporate America to shift much of its production overseas. In hindsight, perhaps too much. As we learned during the pandemic, this created significant national security risks.

The last administration took some steps to correct this, and I give this administration the benefit of the doubt in attempting to do the same – especially when it comes to China.

But the chaos of the way this is being implemented, and the tossing aside of a broad overall strategy developed over decades, has been giving the market fits.

The market does a great job sniffing out new developments before any most of us realize it. Any interpretation is more art than science, so take this with a grain of salt. But the way this sell-off feels, and especially how sentiment measures from consumers and CFOs are running on future spending plans and CapEx plans, implies the market is fearing something wicked this way comes.

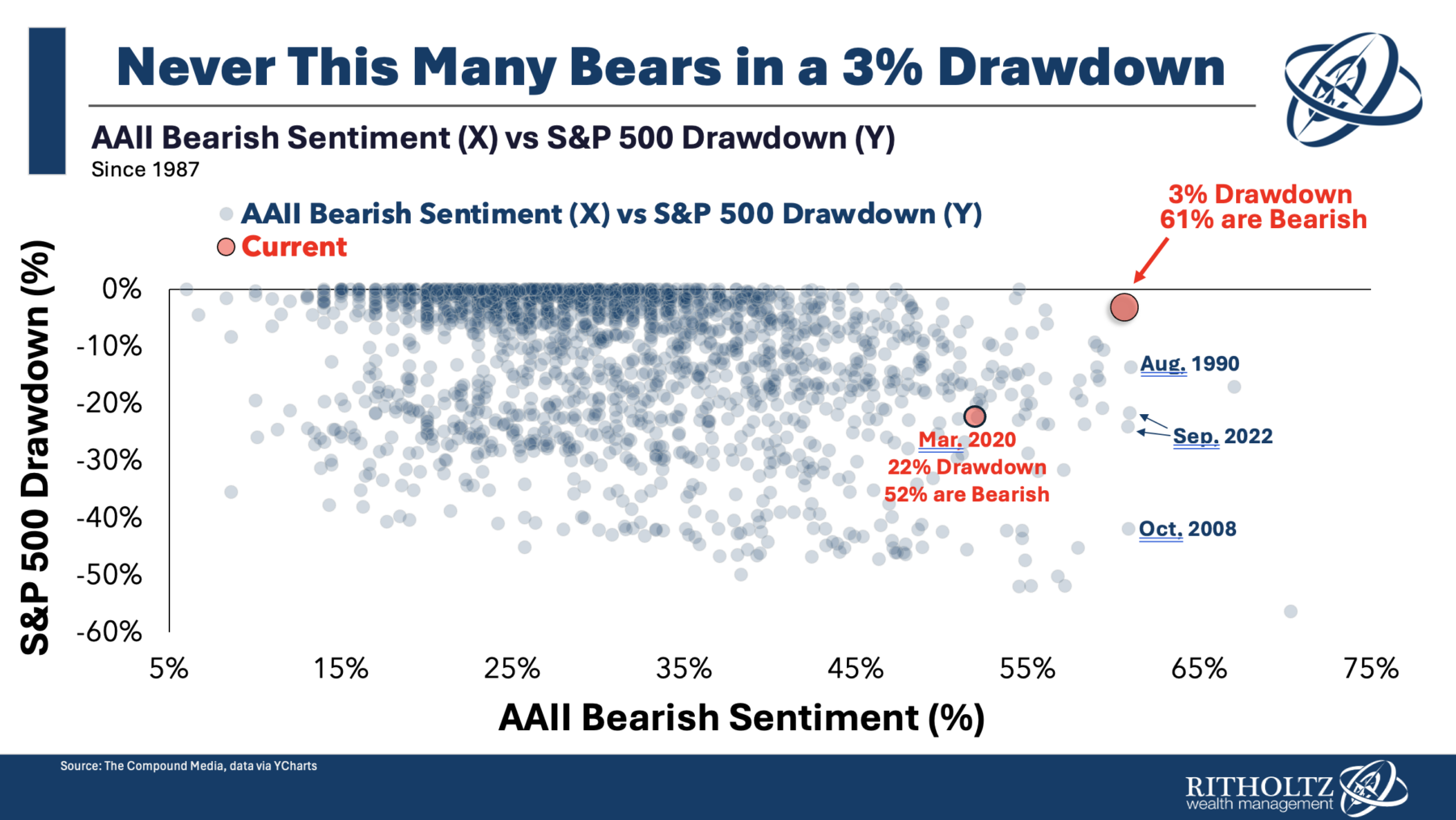

This became apparent in the first 3% drop off of all-time highs:

Sentiment this extreme suggested this was more than a runoff-the-mill selloff. I didn’t understand this as representing a significant threat to the established economic order. As the chart at top implies, it appears that the economic changes are not a one-time adjustment but a permanent tax on consumption.

In a word, the U.S. tariff implementation seems to be moving towards the equivalent of a national VAT tax.

Hey, I understand the U.S. tariff implementation is not the equivalent of a national VAT tax. It’s not the same thing in theory, but in practice, especially with the chatter of reducing income taxes, it feels that way: European consumption tax minus the universal health care, education, and retirement benefits.

I hope this take is wrong. I understand that any VAT or sales tax is agnostic as to place of production, while tariffs are not. It’s not a perfect metaphor, but the parallels between a consumption tax versus an income tax are there.

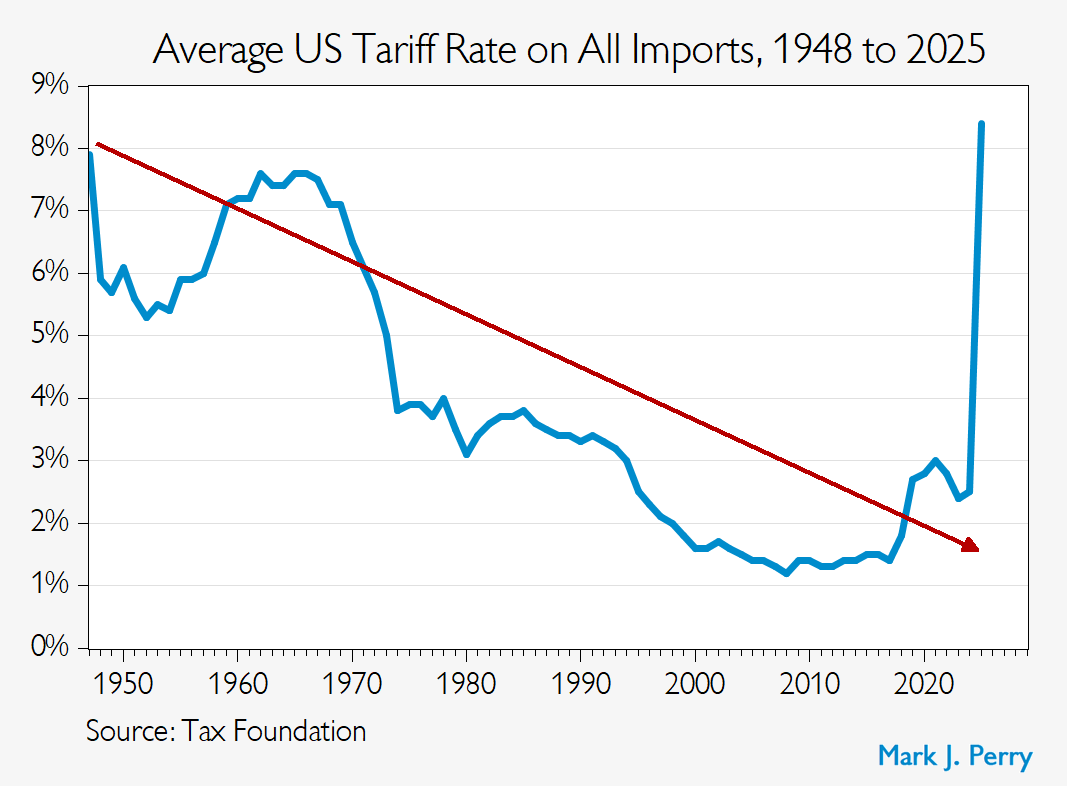

The market reaction seems to be anticipating something more than reciprocal tariffs. Or as the chart below shows, via Mark Perry, the new proposal is an extreme historical anomaly:

We will get a better sense of actual tariffs Wednesday; for better or worse, markets will continues incorporating these new VAT-like consumption Taxes into prices as we move forward.

Previously:

7 Increasing Probabilities of Error (February 24, 2025)

Tune Out the Noise (February 20, 2025)

The post Are Tariffs a New US VAT Tax? appeared first on The Big Picture.