Surprising China news sends Nvidia stock surging

Nvidia's stock price surged nearly 19% on April 9.

The stock market got a much-needed spark today when President Trump announced he would pause reciprocal tariffs for 90 days, during which a 10% baseline tariff on imports would apply.

The news sent the S&P 500 and Nasdaq Composite surging 9.5% and 12.2%, respectively, on hopes it meant that recent trade turmoil would abate.

The gains were biggest across the technology sector, which had been especially hard hit this year. Tech stocks were among the best performers in 2023 and 2024, but they'd suffered this year on rising risks associated with a slowing economy and potential peaking in AI spending.

Related: Eye-popping tariff news sends stock market soaring

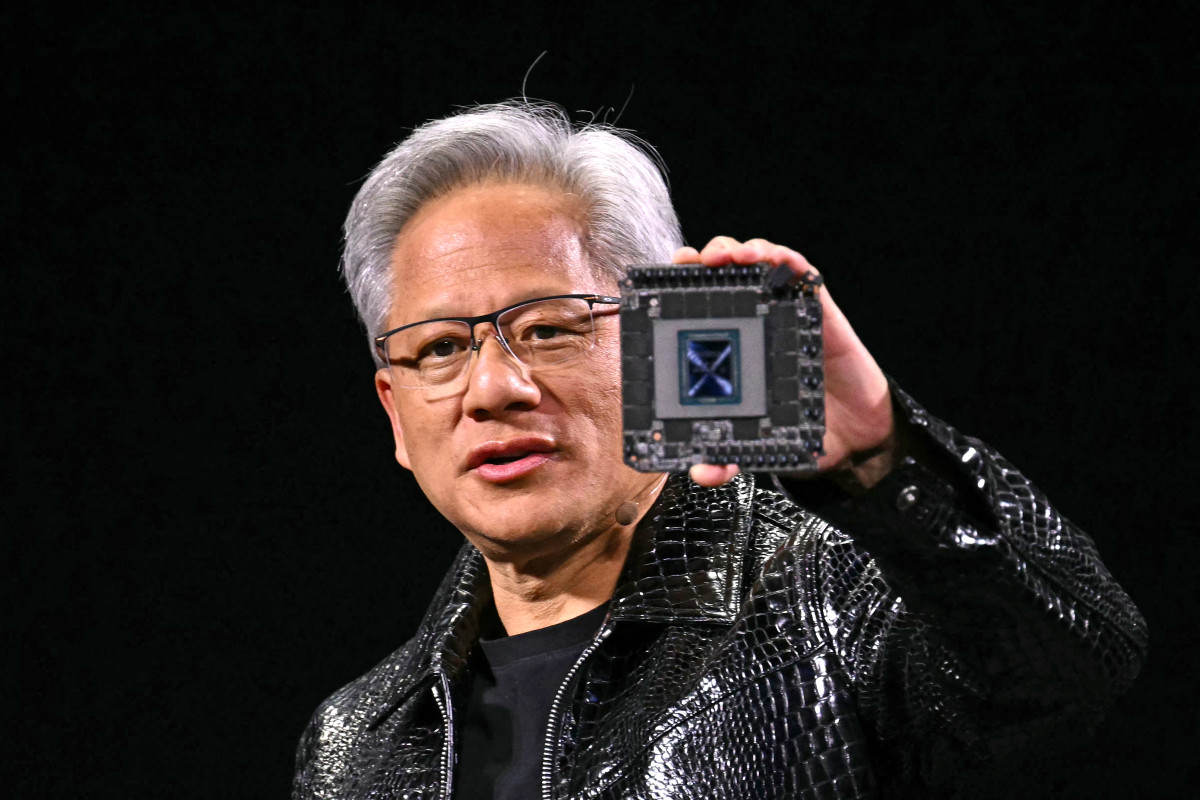

AI darling Nvidia is one of the most notable stocks that has been hard-hit this year. Nvidia, best known for its high-end graphic processing units that train and run AI apps, saw its share price surge 171% in 2024. Its stock price has gained a remarkable 684% since 2022.

This year has been much tougher sledding, though. Fears that hyperscalers like Microsoft and Amazon may pare back AI data center investments if the economy weakens heightened, and the launch of a low-cost AI model, DeepSeek, have sent Nvdia shares reeling nearly 15%.

The downdraft in Nvidia's stock has worried investors, but news regarding China contributed to its stock surging 19% on April 9.

Nvidia sees demand soar on AI growth

Banks like JP Morgan Chase are using artificial intelligence to hedge risks, drug companies are examining its use in drug development, and retailers are evaluating if AI can stop theft and improve supply chains. Even militaries are experimenting to see if the technology can provide an edge on the battlefield.

To say that AI activity is strong may understate things. Pretty much every company in every industry is evaluating the potential benefit of AI agents in streamlining work or improving practices and processes.

Related: Cathie Wood buys $15 million of tumbling Nvidia stock

That said, AI is far from a new concept. AI's pros and cons have been debated for decades. Computer scientist Alan Turing researched AI computers, and the Rand Corporation created the first AI program in the 1950s. Countless books and movies have considered AI's implications, from Isaac Asimov's iRobot to The Terminator.

However, AI has gone mainstream only recently. Open AI's ChatGPT shocked the planet when it became the fastest app to reach one million users after its launch in November 2022. Now millions turn to ChatGPT or rivals like Google's Gemini daily for insight.

The flurry of activity has been a boon to companies like Nvidia. Hyperscalers operating the world's largest data centers have plowed big money into the network infrastructure necessary to exploit the seemingly insatiable appetite for computing power to develop AI agents and chatbots.

In 2024 alone, Microsoft, Google, and Amazon spent $192 million on capital expenditures necessary to build their businesses, up from $117 billion in 2023.

Nvidia has been a huge beneficiary of all that spending. Like the shovel sellers during the 1800s gold rush, Nvidia has profited handsomely from selling high-performance software and graphic processing units, or GPUs better suited to handle AI's intense workloads than the traditional central processing units (CPUs) often deployed in enterprise and cloud networks.

Nvidia's sales of H100, H200, and the latest Blackwell AI chips have catapulted annual revenue above $130 billion (up 114% year-over-year) from $27 billion in 2023. And these chips are nicely profitable. Net income has expanded to nearly $73 billion from less than $5 billion in 2023.

Nvidia faces challenges in 2025, but one just got less worrisome

Demand for Nvidia's AI chips is global, but one key market, China, has been a big headwind lately.

Related: Bank of America gives eye-popping Nvidia stock forecast amid tariffs

China is a major consumer of semiconductors, but the U.S. has implemented strict regulations to limit the sale of next-gen technology to China over fears that it could someday be used against it.

As a result, Nvidia has seen a marked drop in China revenue despite working diligently to create lower-powered AI chips that meet U.S. restrictions.

In the past, China accounted for about 20% of Nvidia's data center sales. Nowadays, Nvidia CEO Jensen Huang says, "It's about half of what it was before the export control."

The situation could have worsened this year, though, because there's been debate over whether Nvidia's chips designed for the Chinese market should also be restricted.

More Nvidia:

- Bank of America offers Nvidia stock forecast amid tariffs

- Amazon directly targets Nvidia with bold new strategy

- Analyst unveils startling Nvidia stock forecast amid tariffs

Specifically, the U.S. government is considering limiting sales of Nvidia's H20 chip.

The H20 is the most powerful chip sold by Nvidia in China, and big AI players like Alibaba, Tencent, and ByteDance reportedly ordered $16 billion of them in the first quarter.

Fortunately, it appears less likely that the H20 will be restricted. The White House has reportedly back-burnered cracking down on H20 chips, according to NPR.

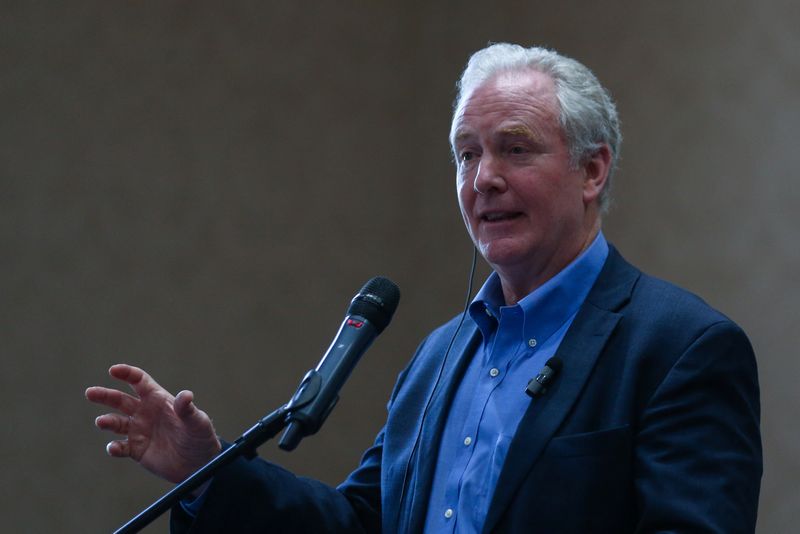

The administration's decision may be related to Huang's successful lobbying. Huang recently attended a $1 million Mar-a-Lago dinner with President Trump. According to NPR sources, the reversal may be because Nvidia said it would invest in new data centers in America.

Regardless, the potential for Nvidia to continue selling the H20 in China, avoiding a further slowdown in sales there, is a win for shareholders.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast