Stock Market Today: Stocks tumble as China hits back in escalating trade war

The S&P 500 has fallen more than 12.1% since President Trump's tariff announcement last week.

U.S. equity futures move firmly lower in early Wednesday trading, paired with a spike in Treasury bond yields, as investors braced for the global market impact of President Donald Trump's sweeping tariffs and the rising odds of a domestic recession.

Updated at 7:05 AM EDT

China counter-punch

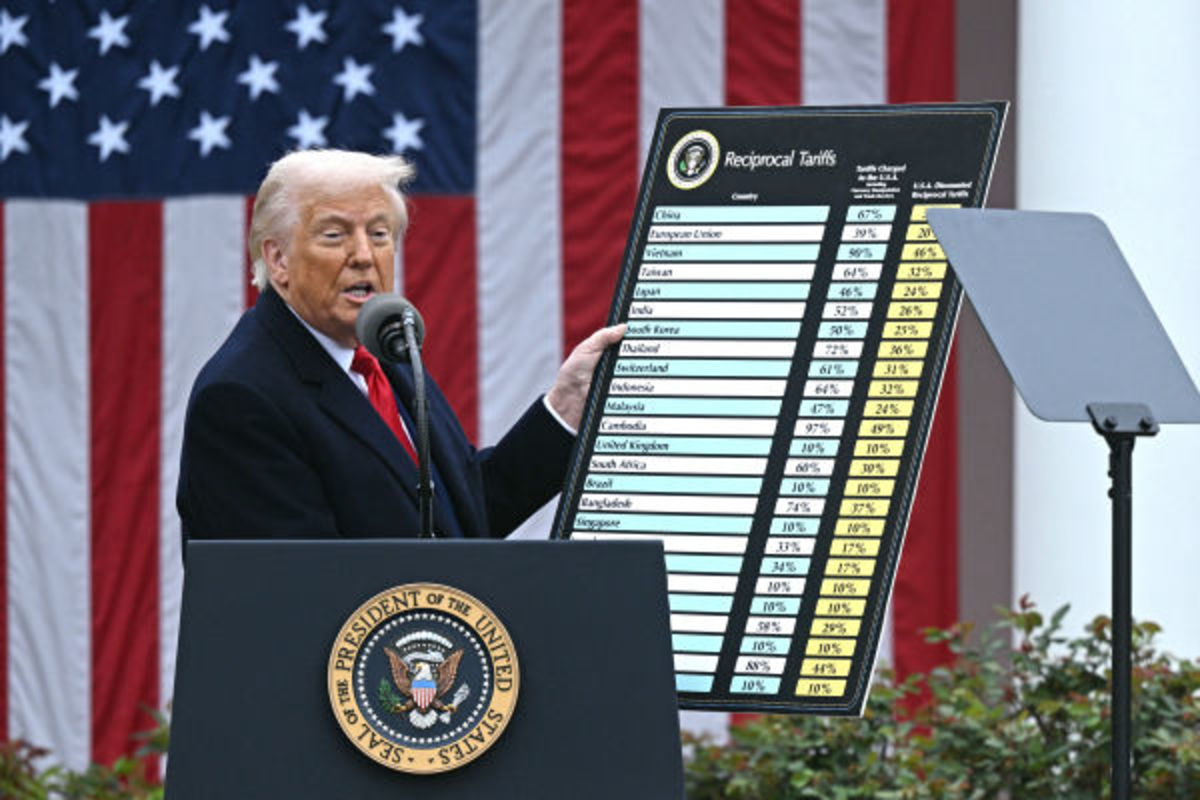

Stocks turned sharply lower in premarket trading after China's Finance Ministry said it would impose an additional 84% tariff on U.S.-made goods in response to the 104% levy put in place by President Donald Trump earlier this week.

Futures tied to the S&P 500 now suggest an 85 point opening bell decline, with the Dow called 630 points lower and the Nasdaq priced for a 172 point slump

BREAKING: CHINA ANNOUNCES ADDITIONAL TARIFFS OF 84% ON US GOODS BEGINNING APRIL 10TH.

WOW.— The Kobeissi Letter (@KobeissiLetter) April 9, 2025

Stock Market Today

Stocks ended sharply lower on Tuesday following a volatile session that included a 360 point peak-to-trough swing for the S&P 500, one of the largest on record, as the benchmark closed below the 5,000 point mark for the first time in more than a year.

The Nasdaq, which is now 25% south of its mid-December peak, fell 2.15% yesterday as China-sensitive stocks such as Apple (AAPL) and Tesla (TSLA) tumbled ahead of President Trump's decision to impose a crippling 104% levy on goods from the world's second-largest economy.

The mid-cap Russell 2000 index, meanwhile, entered bear market territory at the close, defined as a 20% retreat from its recent peak, suggesting elevated odds of a U.S. recession over the next twelve months.

Markets are braced for a similarly wild session today, with the CBOE Group's VIX volatility index pegged at $48.63, near the highest in five years and a level that suggests daily swings of around 3.05%, or 150 points, for the S&P 500.

Bond market volatility gauges are also on the rise, with Merrill Lynch's Options Volatility Estimate, known as the MOVE index, trading at the highest levels in a year amid a violent bond market selloff that has added around 40 basis points to benchmark 10-year note yields over the past week.

The paper was last marked at 4.376% heading into the start of the New York trading session and a key $39 billion auction of re-opened notes later in the session.

Related: 10-year bond auction will provide key test to Trump's tariff strategy

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500, which has suffered the largest five-day loss since the index was established in the 1950s, suggest an opening bell decline of around 22 points.

Futures linked to the Dow Jones Industrial Average, meanwhile, are priced for a 255 point slump while the Nasdaq is called for a 10 point bump.

Stocks overseas are also in retreat, with Europe's Stoxx 600 falling 14 points, or 2.82%, to drag the regional benchmark to within touching distance of bear market territory. Britain's FTSE 100, meanwhile, fell 2.4% in London.

Overnight in Asia, the Nikkei 225 slumped 3.93% on the first day of President Trump's so-called 'reciprocal' tariffs on Japanese goods kicked-in, pinning the index at its lowest levels since August.

The region-wide MSCI ex-Japan benchmark, meanwhile, fell 1.21% into the close of trading.

More Economic Analysis: