Stock Market Today: Stocks higher with peace talks, Walmart in focus

The S&P 500 is taking a solid 1.23% February gain into the holiday-shortened week, with Walmart earnings and peace talks in focus.

U.S. equity futures edged higher in early Tuesday trading, helped by a pullback in Treasury bond yields and modest gains in Europe, as investors looked ahead to a holiday-shortened week focused on the impact of new tariff polices and the health of the domestic economy.

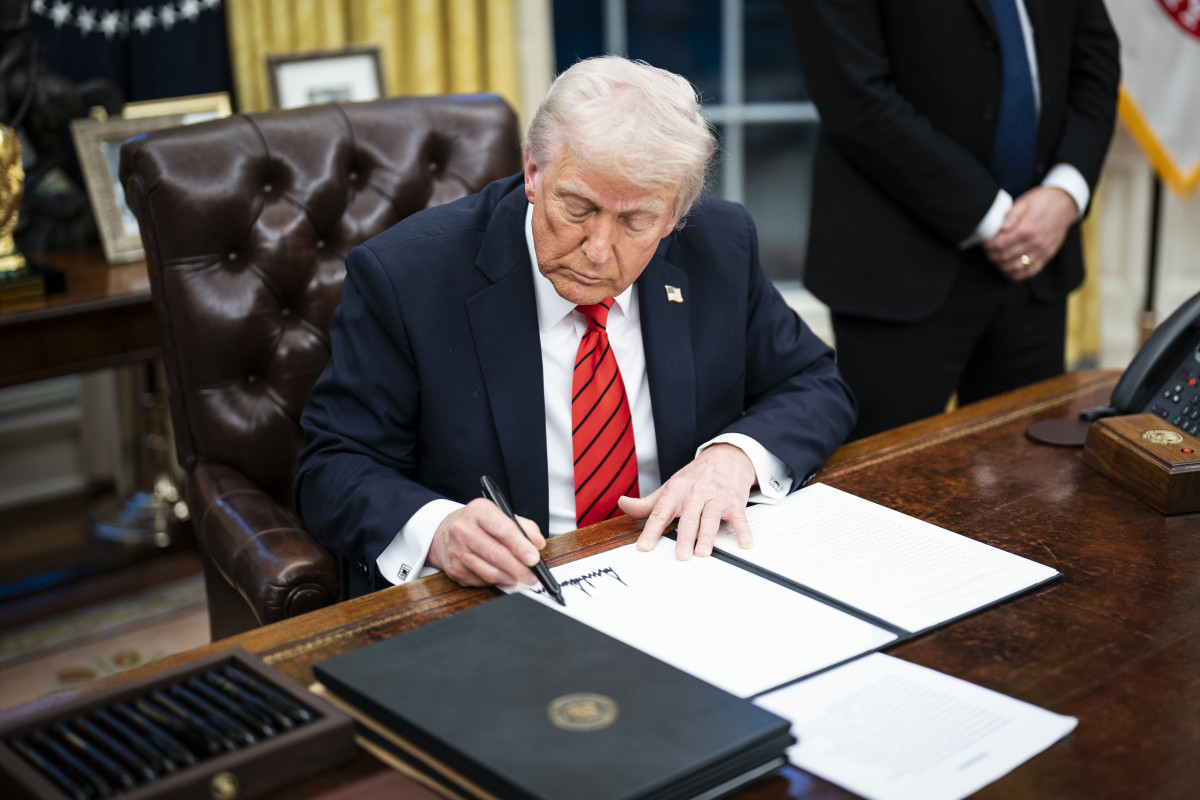

Stocks ended modestly lower last Friday but still managed to book a solid weekly gain of around for the S&P 500 as investors navigated a blizzard of announcements from the White House on tariffs, government spending, technology ambitions and foreign policy directives.

A weaker-than-expected reading for January retail sales, however, paired with a faster-than-forecast inflation report has some investors worried about the impact that new tariffs from the Trump administration will have on domestic growth, and ultimately corporate profits, as the new administration enters its first month in office.

Corporate profits, however, have held up well so far, and with around 383 companies in the S&P 500 reporting for the December quarter so far, collective earnings are forecast to rise 15.3% from a year earlier to $546.3 billion.

Around 43 companies will update investors this week, with investors likely focused on Walmart's (WMT) fourth quarter update after the close of trading on Thursday.

The retail giant, a bellwether for consumer spending health, is also at the forefront of the tariff discussion, given its reliance on imported goods from a host of U.S. trading partners.

Wall Street's early focus Tuesday, however, is likely to center on talks between U.S. and Russian envoys, held in Saudi Arabia and aimed and devising a plan to end Moscow's three-year war on Ukraine.

Related: Stocks are shaking off huge risks for one crucial reason

The talks, however, do not include representatives from Kyiv and President Volodymyr Zelenskyy has said he will not agree to any terms negotiated in his absence.

Heading into the start of the trading day on Wall Street, stocks are set for a modestly firmer open, with futures contracts tied to the S&P 500, which is up 1.23% for the month, priced for a 19 point opening bell gain.

Futures linked to the Dow Jones Industrial Average, meanwhile, are called 39 points higher with the tech-focused Nasdaq called 92 points higher.

In the bond market, a rise in European government bond yields, tied to comments from European Commission President Ursula Von der Leyen that defense spending could be exempt from EU budget rules, triggered an overnight rally in U.S. Treasuries.

Related: Retail sales tumble in January, testing Fed rate cut forecast

Benchmark 10-year note yields were last marked around 10 basis points lower from Friday levels at 4.505% while 2-year notes were pegged at 4.274%.

In overseas markets, Europe's Stoxx 600 hit a fresh all-time high in early Frankfurt trading, and was last marked 0.08% into the green, as tech and defense stocks powered the regional benchmark.

Britain's FTSE 100, meanwhile, was marked 0.16% higher in mid-day London dealing.

More Wall Street Analysis:

- Goldman Sachs analysts warn on Trump tariff impact for stocks

- Analyst predicts stocks likely to join the S&P 500 in 2025

- Every major Wall Street analyst's S&P 500 forecast for 2025

Overnight in Asia, Japan's Nikkei 225 ended 0.03% higher in Tokyo, while solid gains for China tech stocks, tied to a Monday meeting with President Xi Jinping and a host of big tech bosses, helped the regional MSCI ex-Japan index to a 0.47% gain.

Related: Veteran fund manager issues dire S&P 500 warning for 2025