Stock Market Today: Stocks end mixed as tariff, growth worries grip sentiment

The S&P 500 posted another losing day amid concerns about the impact of myriad Trump policies lingered over markets.

Updated at 4:45 PM EST by Rob Lenihan

Stocks ended lower Tuesday, as investors shunned risky assets amid growing concern about the impact of President Donald Trump's tariff and cost-cutting plans on the world's biggest economy.

The Dow Jones Industrial Average gained 159.95 points, or 0.37%, to finish the session at 43,621.16, while the S&P 500 slipped 0.47%, to close at 5,955.25 and Nasdaq lost 1.35% to end the day at 19,026.39, with Nvidia leading the tech-heavy index’s descent.

The Conference Board’s Consumer Confidence Index pulled back to 98.3 in February from an upwardly-revised 105.2 in January and was below both the 102.5 consensus forecast.

“Americans are still starkly split about whether the economic outlook is improving or worsening, but the split has flipped since the election,” said Bill Adams, chief economist for Comerica Bank.

“The DOGE suspensions of government payments and layoff plans landed a big hit on the confidence of left-leaning consumers," he said.

Americans who work in the public sector, higher education, research, or the not-for-profit world are worried about their job security, he added, and are likely to be more cautious toward discretionary spending near-term.

In addition, Adams said that fears of ICE sweeps are chilling the economic climate in communities with big immigrant populations.

About 5% of American households have at least one undocumented member, and these households are concentrated in California, Texas, Florida, and the New York metro area.

"At the same time, sentiment among more conservative consumers is holding up, and still looks stronger than before the election," Adams said.

Updated at 12:27 PM EST

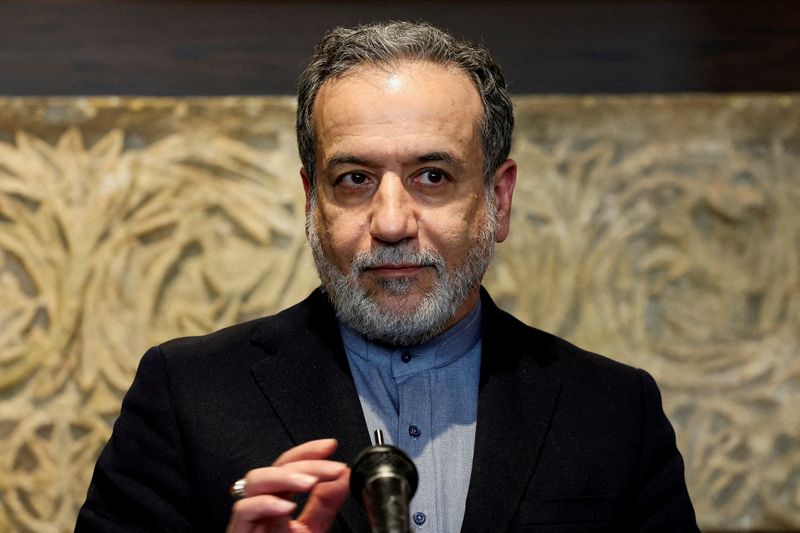

More probes

UnitedHealth (UNH) shares turned sharply lower in mid-day trading following reports of another probe into the nation's biggest health insurance group and its ties to government-funded healthcare programs.

The Wall Street Journal reported that Chuck Grassley, a Republican senator from Iowa, will launch a formal inquiry into the group's Medicare Advantage billing practices.

“We welcome the opportunity to share the facts with Senator Grassley, especially given the ongoing misinformation campaign by” UnitedHealth said in a statement to the Journal.

UnitedHealth shares were last marked 1.5% lower in mid-day trading to change hands at $454.94 each, a move that would extend the stock's year-to-date decline to around 10.1%.

SEN. GRASSLEY PROBES $UNH MEDICARE BILLING - WSJ

Senate Judiciary Chair Chuck Grassley has sent a letter to UnitedHealth Group. CEO Andrew Witty, seeking detailed information on the company’s Medicare billing practices. pic.twitter.com/OMpeTXKeot— PeloSwing