Social Security: Fact vs Fiction

A program as popular and essential as Social Security tends to be talked about a lot — in social circles, on the internet, and just about everywhere. But that doesn’t mean everything you’ll hear about Social Security is correct. It’s important to separate fact from fiction when it comes to Social Security. Here are some […] The post Social Security: Fact vs Fiction appeared first on 24/7 Wall St..

There’s a lot of misinformation about Social Security out there.

It’s important to separate fact from fiction when you’re working and when you’re getting close to claiming benefits.

Educating yourself could help you make the most of this crucial program.

4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

Key Points

A program as popular and essential as Social Security tends to be talked about a lot — in social circles, on the internet, and just about everywhere. But that doesn’t mean everything you’ll hear about Social Security is correct.

It’s important to separate fact from fiction when it comes to Social Security. Here are some things you need to know — and some things you shouldn’t believe.

1. Fact: Social Security has been around for roughly 90 years

The Social Security Act was signed into law in August of 1935. As such, the program is coming up on its 90th birthday. But that doesn’t mean the program’s rules haven’t budged since 1935. A number of changes have been implemented to make Social Security better.

2. Fiction: All workers are eligible for Social Security once they retire

You might assume that Social Security is something that’s available to everyone once they reach a certain age. But if you want to get those benefits, you have to earn them by paying into the program and accumulating 40 work credits in your lifetime. You don’t qualify for benefits simply by getting older.

3. Fact: Social Security benefits can be taxable in retirement

Many seniors are surprised to learn that their Social Security benefits are subject to taxes. Whether you get taxed on that income at the federal level depends on your total income. There are also some states that tax Social Security individually.

4. Fiction: Social Security taxes are taken out of every paycheck you earn

Social Security gets most of its funding from payroll taxes. But that doesn’t mean every dollar you earn will be taxed for Social Security purposes. There’s a wage cap set every year that determines how much income is taxed for that reason.

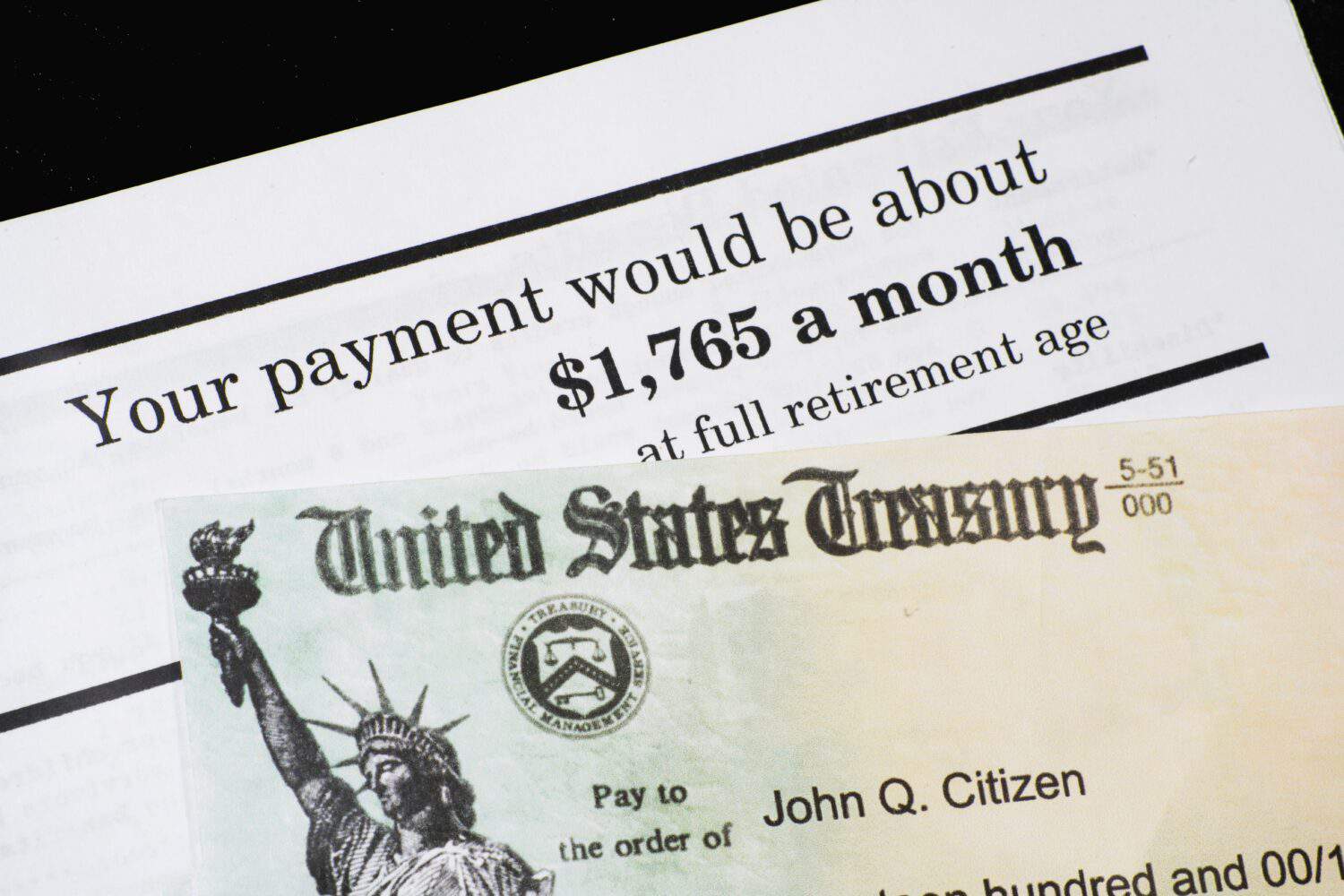

5. Fact: You can get an estimate of your monthly benefit ahead of retirement

There’s no reason to wait until you’re actually retired to see what monthly Social Security benefit you’re eligible for. All you need to do is create an account on the Social Security Administration’s website to access an estimate of your future payments. That could be instrumental in helping you plan for retirement.

6. Fiction: You can’t collect Social Security if you never worked

It’s true that many retirees earn Social Security by paying into the program. But even if you never worked, you may be able for spousal benefits. You could end up getting as much as 50% of your spouse’s benefit at their full retirement age.

7. Fact: You can claim Social Security spousal benefits if you’re divorced

Social Security spousal benefits aren’t just for people who are still married. If you’re divorced from your ex but were married for at least 10 years, you may be eligible for spousal benefits. And even if your marriage didn’t end on great terms, your former spouse can’t stop you from claiming Social Security spousal benefits on their record.

8. Fiction: You can’t work while collecting Social Security

Just because you’re getting Social Security doesn’t mean you can’t continue to work. You may want to do so for the extra income. If you haven’t reached full retirement age, though, you’ll be subject to an earnings-test limit. Going beyond it could result in having some benefits withheld.

9. Fact: Social Security won’t replace your entire paycheck

You might assume that the monthly benefit Social Security pays you in retirement will be enough to take the place of your pre-retirement earnings in full. If you earn an average income, expect Social Security to replace about 40% of your previous earnings only. You may be in for a big disappointment if you don’t save for retirement on your own.

10. Fiction: You’ll get the same Social Security benefit every month once you file

You might assume that once you claim Social Security, the same monthly payment will come your way for life. But thanks to the program’s annual cost-of-living adjustments, you can expect your benefits to change over time as inflation sets in. That should help you maintain your buying power as living costs rise.

11. Fact: Social Security is facing a financial shortfall

You may have heard that Social Security may be cutting benefits in the future, and that’s not false. The program is facing a serious revenue shortfall. And if lawmakers can’t fix it, broad benefit cuts may be implemented.

12. Fiction: You can live comfortably on Social Security alone

Many seniors who retire on Social Security alone face financial difficulties. It’s typical to need about 70% to 80% of your former paycheck to live comfortably in retirement. Since Social Security may only replace about 40%, you should plan on other income sources.

13. Fact: You can claim Social Security at different ages

Older Americans get choices when it comes to claiming Social Security. You can sign up for benefits as early as age 62, and there are financial incentives for delaying your claim until age 70. It’s best to familiarize yourself with these choices while you’re young so you can incorporate your filing age into your broad retirement income strategy.

14. Fiction: Your Social Security benefits can’t ever be garnished

You may end up reliant on Social Security in retirement, but that doesn’t mean the government can’t come after your benefits for certain reasons. If you fall behind on your taxes and don’t pay the IRS what it’s owed, it could lead to having your Social Security garnished. The same holds true if you fail to repay federal student loans.

15. Fact: Social Security pays survivor benefits

On top of paying spousal benefits, Social Security also pays survivor benefits. If you pass away before your spouse, they may be eligible for a survivor benefit worth 100% of the sum you were entitled to each month. In some cases, former spouses can get a survivor benefit, too.

16. Fiction: When you pay Social Security taxes, you’re funding your own benefits

The taxes you pay into Social Security are pooled with everyone else’s. You’re not funding your own benefits directly. And because Social Security cuts are a possibility, it’s important to save for retirement and not just fall back on those monthly checks.

17. Fact: Claiming Social Security at 62 generally reduces your monthly benefits for life

Age 62 is a popular choice for claiming Social Security since it’s the earliest age to sign up. But for the most part, filing at that age means reducing your monthly checks on a permanent basis. That could lead to an income shortfall, especially if you don’t have much retirement savings.

18. Fiction: Claiming Social Security at 70 always pays off

You can boost your monthly benefits by claiming Social Security at age 70. But that doesn’t mean this strategy is right for everyone. If you don’t end up living a very long life, filing at 70 could mean shorting yourself on the total amount of Social Security you collect.

19. Fact: The rules of Social Security taxes could change

The U.S. tax code is not set in stone, and neither are Social Security’s rules. The current wage cap that’s in place could be eliminated in the future to pump more money into Social Security. This isn’t guaranteed to happen, but it’s a change lawmakers could choose to vote in.

20. Fiction: The government is looking to get rid of Social Security

Social Security serves as a safety net for millions of older Americans, and eliminating the program could be catastrophic. There’s no reason to think lawmakers are trying to do away with Social Security. If anything, in the coming years, they’re likely to focus their attention on preventing potential benefit cuts.

The post Social Security: Fact vs Fiction appeared first on 24/7 Wall St..