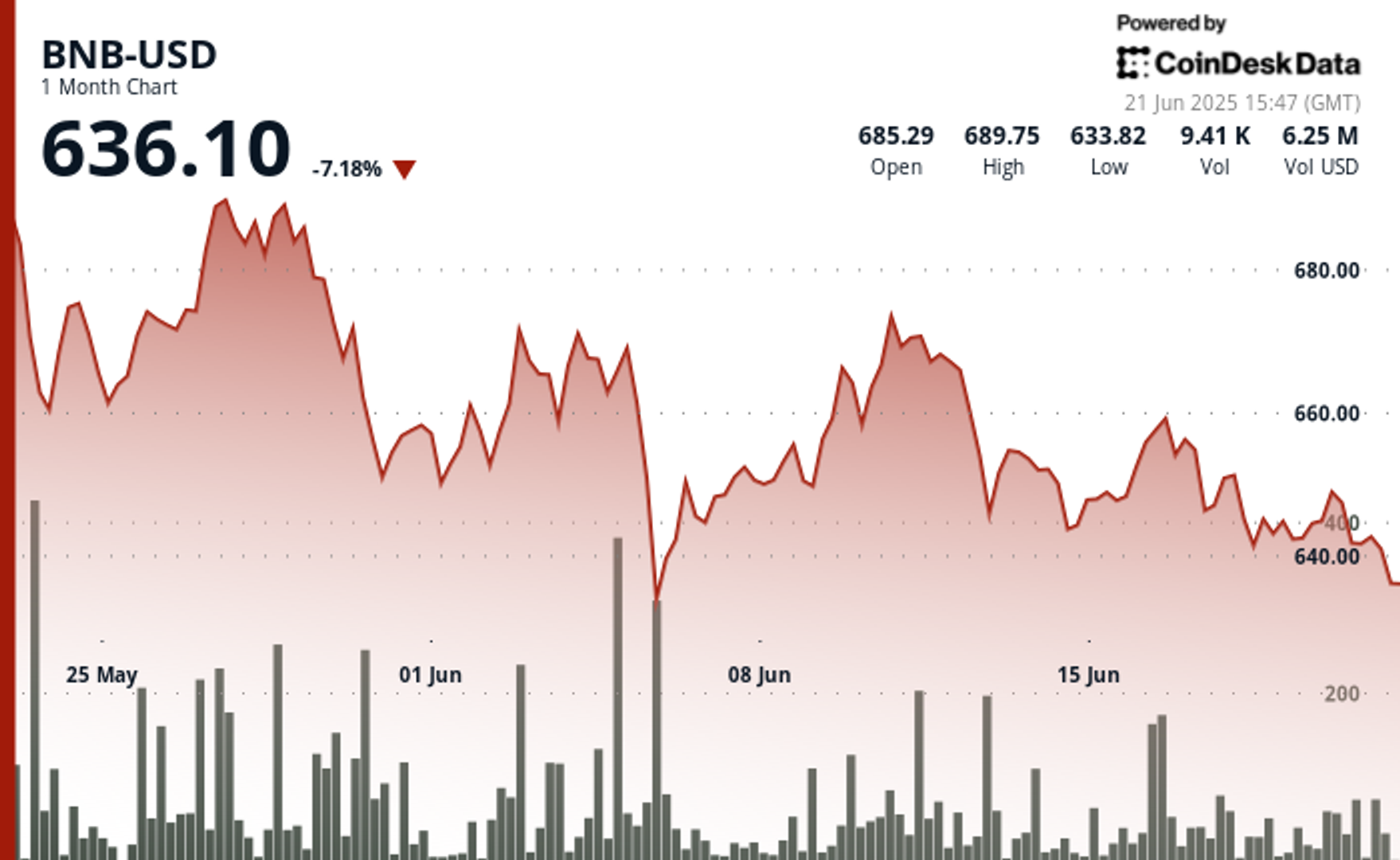

BNB Slips Below Key Support as Traders Brace for Maxwell Upgrade and Mideast Shockwaves

The drop comes ahead of the Maxwell hard fork, which is expected to bring in a number of improvements, including transaction throughput.

BNB has fallen to $635, weathering a choppy market as traders brace for the Maxwell hard fork and rising geopolitical risk in the Middle East.

The token’s resilience comes as daily transactions on the BNB Chain have surged from 8 million to 17.6 million since mid-May, according to DeFiLlama data.

Scheduled for June 30, the Maxwell fork will reduce block times from 1.5 seconds to 0.75 seconds and bring in a series of improvements. It’s expected to improve transaction throughput and user experience.

Investors are also reacting to mounting global uncertainty. Crude prices have surged more than 10% over the past week as markets weigh the possibility of the United States entering the Israel-Iran conflict.

A shutdown of Iranian oil exports or closure of the Strait of Hormuz, Reuters reports, could drive oil to $130 a barrel, analysts at Oxford Economics warned. That could potentially push U.S. inflation to 6% and derail hopes for rate cuts this year.

In that environment, risk assets like BNB can see a sell-off as investors move to risk-off positioning.

Technical Analysis Overview

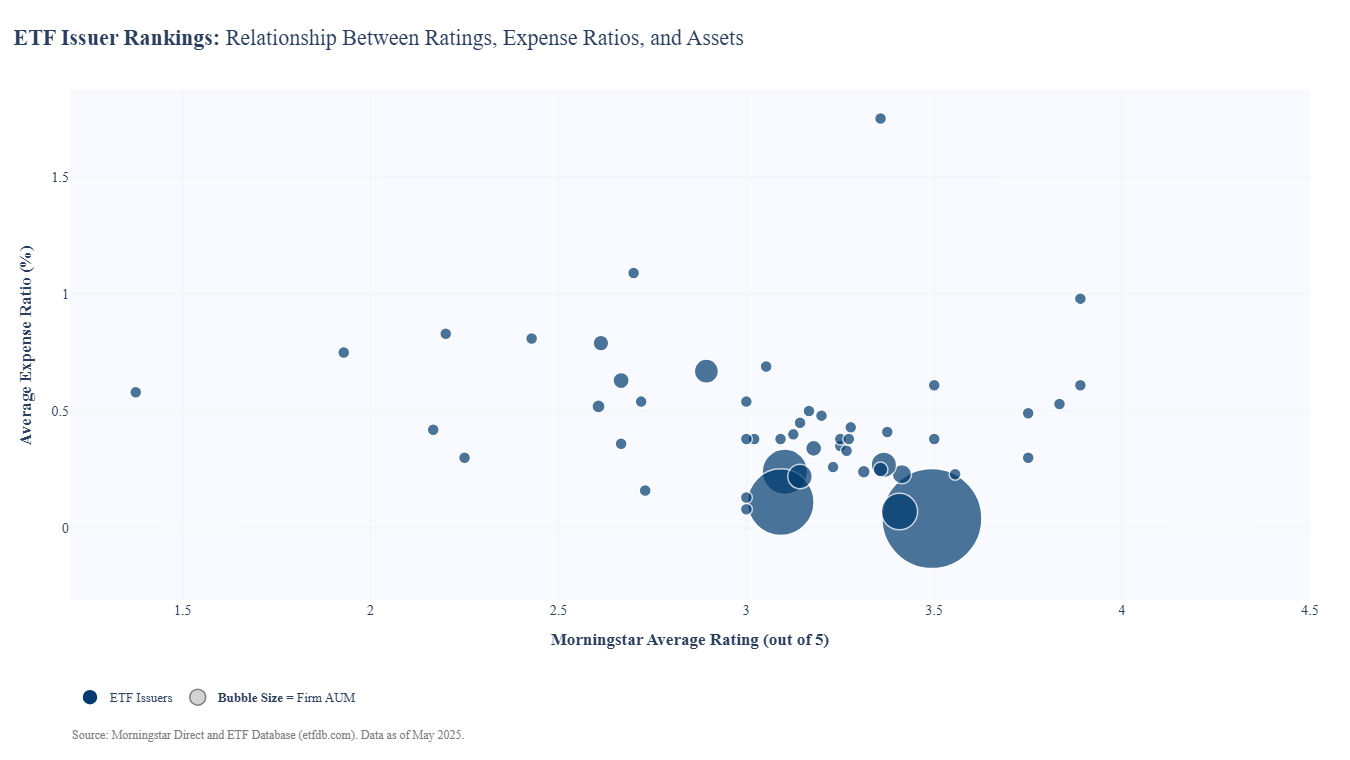

BNB is trading within a narrow range between $635 and $646, with volume confirming a solid support base at $638, as confirmed by a spike in volume.

Repeated attempts to break through resistance near $644.5–$645 failed, suggesting sellers are defending that zone, according to CoinDesk Research's technical analysis model.

A volume burst of 4,222.99 tokens earlier corresponded with a rapid drop to $638, reinforcing that area as a support level that has now been breached as volumes tapered off for the weekend

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.