Should You Buy SoFi While It's Below $15?

SoFi Technologies (NASDAQ: SOFI) stock has ping-ponged back and forth during its short time as a public company, but it made a major leap and is up 66% in the past 12 months. It's still 47% off of its all-time high and trading for less than $15. But is it ever going to get back there? Let's see if this is a huge opportunity or if investors should steer clear.Investors were enthusiastic about SoFi when it first came onto the scene because it's disrupting the huge, traditional banking industry. It's the prototypical fintech, offering standard financial products with updated technology on its all-digital banking app.It has consistently delivered strong growth, and it has reported positive and increasing net income for the past five consecutive quarters. Customers are drawn to its user-friendly interface that makes managing your money less intimidating, and it's catching on with its target market of young professionals who are starting their financial journeys. That gives it significant long-term potential as this population ages and becomes more affluent.Continue reading

SoFi Technologies (NASDAQ: SOFI) stock has ping-ponged back and forth during its short time as a public company, but it made a major leap and is up 66% in the past 12 months. It's still 47% off of its all-time high and trading for less than $15. But is it ever going to get back there? Let's see if this is a huge opportunity or if investors should steer clear.

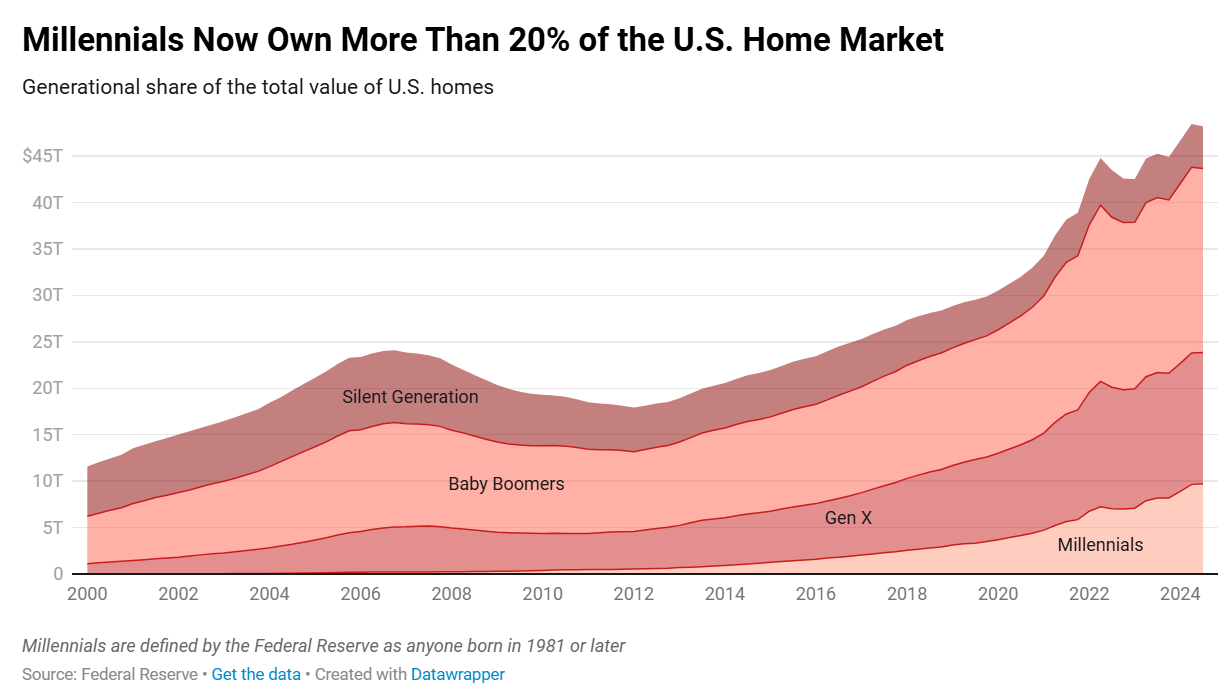

Investors were enthusiastic about SoFi when it first came onto the scene because it's disrupting the huge, traditional banking industry. It's the prototypical fintech, offering standard financial products with updated technology on its all-digital banking app.

It has consistently delivered strong growth, and it has reported positive and increasing net income for the past five consecutive quarters. Customers are drawn to its user-friendly interface that makes managing your money less intimidating, and it's catching on with its target market of young professionals who are starting their financial journeys. That gives it significant long-term potential as this population ages and becomes more affluent.