Several AI leaders are considering a deal that could save Intel

Three prominent companies are reportedly considering extending a lifeline.

One of the market’s most discussed tech stocks over the past few weeks has been Intel, (INTC) .

This may seem surprising, as the former computing leader has spent years lagging behind its more innovative peers. The artificial intelligence (AI) arms race has sparked significant growth for many tech companies, effectively minting a new generation of winners, but Intel hasn’t been among them.

The tech component producer has recently been in the spotlight for positive reasons, though. Last month, INTC rose on speculation that two prominent tech names were considering purchasing parts of its business.

Now, it seems that interest in Intel is growing as more leading AI companies consider striking a deal that could help save it.

(Photo Illustration by Sheldon Cooper/SOPA Images/LightRocket via Getty Images)

AI leaders are eyeing Intel as a potential partner

As Intel has struggled over the past year, stronger tech companies have eyed it, considering potential opportunities to expand their own reach.

Recently, speculation rose that Broadcom (AVGO) might consider purchasing Intel’s chip design arm, which helped push INTC up, while Taiwan Semiconductor Manufacturing Company (TSM) reportedly discussed buying its factories.

Related: Experts sound the alarm on dangerous plan to save Intel

As TheStreet reported, some experts have raised concerns regarding the prospect of TSMC making that type of deal, as it could undermine U.S. AI chip dominance. However, Intel is now reportedly attracting different attention from industry leaders who may be considering making major purchases.

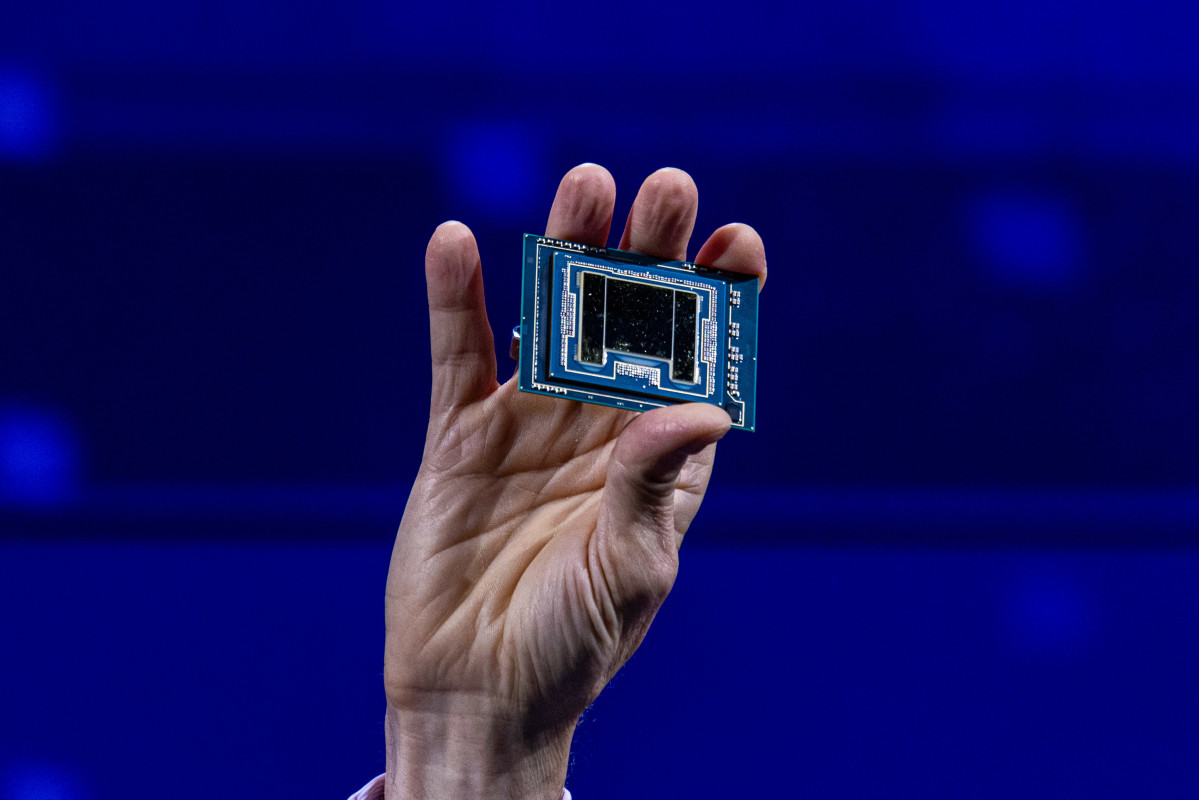

More specifically, both Broadcom and Nvidia (NVDA) , considered the market’s most dominant chip makers, have begun running manufacturing tests with Intel’s 18A process. This refers to a “series of technologies and techniques developed over years that is capable of making advanced artificial intelligence processors and other complex chips.”

However, they may not be the only AI producers considering a deal with Intel. Reuters reports that Advanced Micro Devices AMD, one of Nvidia’s most prominent competitors, is evaluating whether the 18A manufacturing process will work for its needs, although the company has not confirmed whether it is running tests yet.

"We don't comment on specific customers but continue to see strong interest and engagement on Intel 18A across our ecosystem,” states a spokesperson from Intel.

Reuters also notes that the current tests are geared toward determining the behavior and capabilities of the Intel 18A process and are not being conducted on full chip designs. TheStreet's Martin Baccardax provides further context on what this could mean for Intel.

- Anthropic CEO issues frightening warning on Chinese AI rival

- Analyst who predicted Palantir rally picks best AI software stocks

- Nvidia-backed startup could be hottest tech IPO of the year

"Successful testing could lead to valuable contracts for Intel as it executes the split of its foundry business, which has been a drag on Intel's overall valuation," he reports, "while simultaneously enhancing the worth of any stand-alone chip design company with close ties to the new fab business and likely support from Chips Act funding."

If this trend progresses, Intel could be a winning tech stock for 2025

News of the growing interest in Intel's 18A process appears to be pushing INTC stock up Monday, as speculation rises that the company may have a second act coming. However, as the test timelines remain unknown, this momentum isn’t likely to last unless a company provides a positive update.

Related: Intel stocks leaps on report tied to Nvidia and Broadcom

If Intel can reach a deal with just one of the three interested AI leaders, it could easily be a positive catalyst that sets the struggling company on a new course.

However, such a development would be bad news for someone else. The 18A manufacturing process is similar to that of Taiwan Semiconductor Manufacturing, which has enabled the company to dominate the AI chip market globally.

TSMC has not issued any statements on Intel’s potential deals with Nvidia, Broadcom, or AMD. However, as its client list includes all three companies, the Taiwanese semiconductor producer could be the biggest loser of this looming deal, regardless of which company or companies decide to work with Intel.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast