See The Average Social Security Benefit By Age (62-67 Years Old)

Once upon a time, Social Security benefits, which were funds deducted from paychecks throughout one’s working lifetime, served as the retirement income for millions of Americans. It became a staple of middle American life throughout the post-WWII era until the 1970s. Trust fund reserves began to dwindle, the costs of US international wars in Vietnam […] The post See The Average Social Security Benefit By Age (62-67 Years Old) appeared first on 24/7 Wall St..

Once upon a time, Social Security benefits, which were funds deducted from paychecks throughout one’s working lifetime, served as the retirement income for millions of Americans. It became a staple of middle American life throughout the post-WWII era until the 1970s. Trust fund reserves began to dwindle, the costs of US international wars in Vietnam and massive inflation during the Carter Administration years put strains on the system.

Further abuses and misappropriation of funds for political purposes by many members of Congress over the ensuing decades have rendered Social Security potentially insolvent by 2034, according to some economists. Thankfully, the Trump Administration has deployed DOGE to audit and track down the potential trillions in fraudulent and illegal payments made over the course of those decades, so there is strong reason to believe Social Security reform will preserve it for generations to come.

That said, the tail end of the Baby Boomer generation is now approaching retirement age, so applications for Social Security benefits are first and foremost on the minds of many Americans who fall into this age demographic.

Key Points

-

Some keypoint here

-

The right cash back credit card can earn you hundreds, or thousands of dollars a year for free. Our top pick pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply now (Sponsor)

The Decision Powers of Social Security Applicants

One of the topics that many incoming Social Security applicants may not be informed about is the actual parameters and the degree of decision-making under the applicant’s control. There are 4 primary factors that determine the calculation of one’s ultimate Social Security benefit amount, which will be locked in for the remainder of the applicant’s life upon approval.

Two of them are based on decisions made during one’s working years, which are:

- Work history

- Earnings history

The other two are predicated on decisions the applicant can make before filing with the Social Security Administration:

- Full retirement age

- Claiming age

Work History and Earning History: On average, one must work at least 10 years in the US paying FICA taxes to qualify for Social Security benefits. The actual unit of measurement is a credit for every $1,810 earned (as of 2025) for a total minimum of 40 credits. The calculation is based on the applicant’s 35 highest earning, inflation adjusted gross income years. For those with less than 35 years, 0 is entered for the number of shortfall years into the total calculation. Unfortunately, freelancers and those that don’t contribute pay FICA tax on a regular basis may face this penalty to their final calculations.

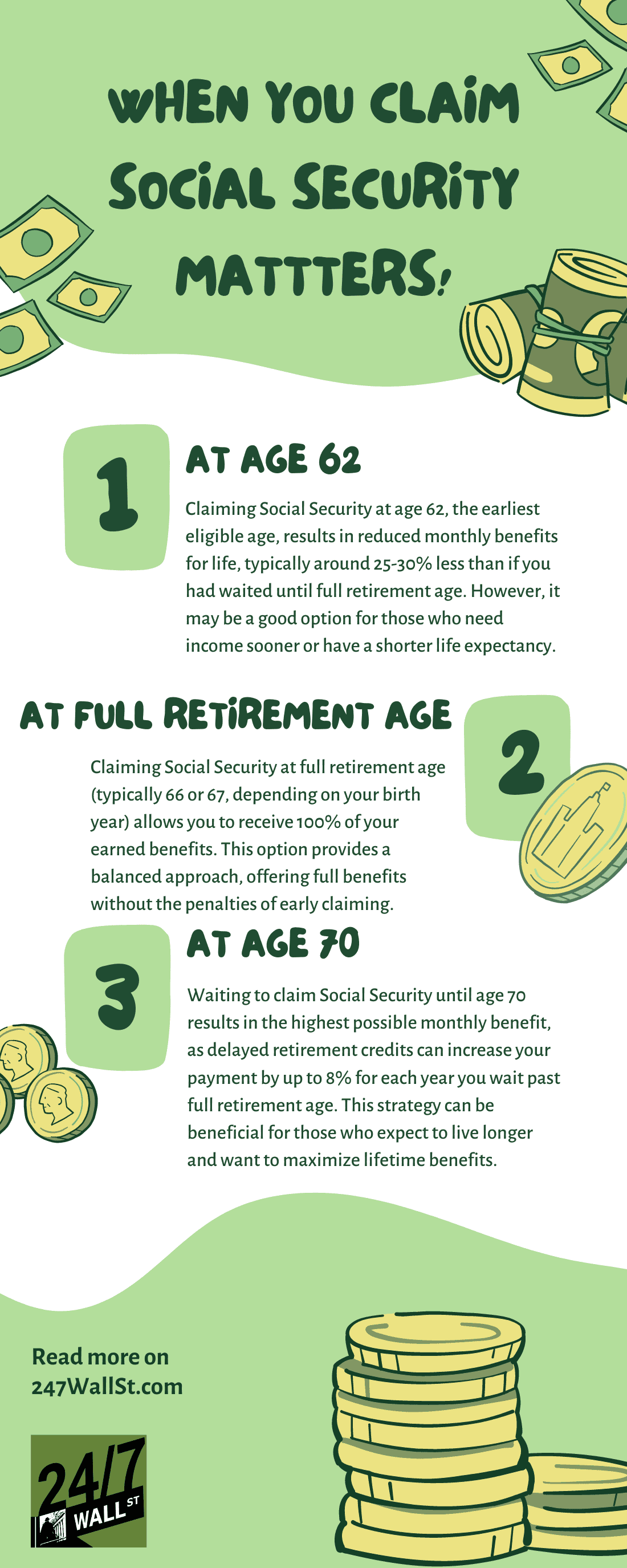

Full Retirement Age and Claiming Age: These are the two areas where pending retiree applicants can exercise some degree of control. Age 62 is the age where one can choose to apply and commence receiving benefits. However, if the applicant withholds filing, an average of 8% additional amount will be factored into the final amount up until age 67, where full retirement age is reached. Maximum benefits, which contain accrued benefits after age 67, cap at age 70, considered the optimal age.

The 5 Year Differential

Although 5 years does not seem to make a big chronological difference, the financial differential can be significant when cumulatively viewed from the perspective of a life expectancy to age 85.

Bearing in mind that the benefit amount calculated at the time of application is locked in for life (and possibly an additional 10 or more years if inherited by a spouse of child), the total cumulative benefit differentials are sizeable:

If one ostensibly decides to file at age 62 for a hypothetical $1,000 monthly benefit, it will equate to a lifetime benefit of $276,000. Comparatively, claiming at age 67 would total $308,571 on a lifetime basis, and maxing out at age 70 equals $318,857.

Overall, the total difference between starting at age 62 and age 67 is $32,571. The difference between 62 and 70 is $42,857.

The monthly difference between starting at age 62 and age 67 is $429. The difference between 62 and 70 is $771. This can represent a huge difference for meeting monthly expenses, budgeting for events like travel, or for other needs.

Considerations Beyond Death

Choosing when to start Social Security benefits is a subjective decision, and people with different health, financial and family considerations will all base their choices on their respective circumstances.

For those who are concerned that Social Security’s potential insolvency will not be resolved and want to make sure they have their foot already in the door, they may opt to file at age 62, thinking that getting something is better than nothing. Additionally, those who are facing financial hardships or are already facing health issues may want to apply as early as possible.

One thing to bear in mind is that after a Social Security beneficiary dies, the benefit can be inherited by a surviving spouse or children. The spouse can continue receiving the benefits until age 62, when he or she would file for their own benefits. If the survivor’s own benefits total a higher sum, then the inherited benefits are cancelled. Otherwise, they can choose to keep the survivor’s benefits instead of their own.

In the case of children who inherit, they would receive the benefits until they reach age 18.

When to apply for Social Securit benefits is ultimately a personal decision. Having the necessary information in hand to make the best decision possible is something every applicant is entitled to obtain in advance.

The post See The Average Social Security Benefit By Age (62-67 Years Old) appeared first on 24/7 Wall St..