Record Day For AI Stocks: Broadcom (Nasdaq: AVGO), AMD (Nasdaq: AMD) and Microsoft (Nasdaq: MSFT)

Some of the top artificial intelligence stocks rocketed higher. All after President Trump paused tariffs for the next 90 days on all countries, except China. “Most countries will be left with 10% tariffs on their exports to the United States, while China — which had retaliated against Trump’s moves — will now face tariffs of […] The post Record Day For AI Stocks: Broadcom (Nasdaq: AVGO), AMD (Nasdaq: AMD) and Microsoft (Nasdaq: MSFT) appeared first on 24/7 Wall St..

Some of the top artificial intelligence stocks rocketed higher.

All after President Trump paused tariffs for the next 90 days on all countries, except China.

“Most countries will be left with 10% tariffs on their exports to the United States, while China — which had retaliated against Trump’s moves — will now face tariffs of 125%,” said NPR.

With that, stocks went to the moon, including beaten-down AI stocks, such as:

Broadcom

Up about 18%, or $29 on the day, Broadcom (NASDAQ:AVGO) is just starting to pivot higher.

After finding strong support at around $140, AVGO is now back to $185.15. From here, we’d like to see an initial retest of $220 a share. Not only did the stock soar on tariff relief, but also on news of a $10 billion buyback program.

“The new share repurchase program reflects the board’s confidence in our strong cash flow generation and allows us to deliver value to our stockholders,” said Kirsten Spears, Broadcom’s chief financial officer.

The company added that the amount of stock repurchased would depend on factors, such as market conditions and acquisition opportunities.

Advanced Micro Devices (AMD)

Oversold shares of Advanced Micro Devices (NASDAQ:AMD) were up $18.63, or by nearly 24% — with much of that run thanks to Trump tariff relief.

Just the other day, analysts at TD Cowen cut its price target on AMD thanks to tariff-induced uncertainty on product demand. However, with today’s tariff news, some of that tension is now gone allowing AMD to recover a good deal of lost ground.

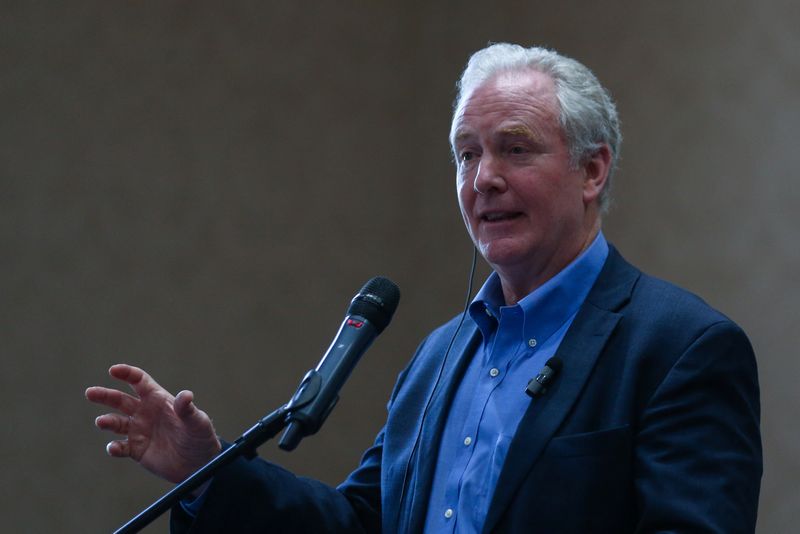

Microsoft

Microsoft (NASDAQ:MSFT) rocketed about $36, or 10% higher thanks to tariff clarity.

Helping, RBC Capital Markets analyst Rishi Jaluria recently said MSFT is one of the firm’s “top picks” noting, “We believe investors underappreciate the GenAI innovation Microsoft brings throughout the infrastructure and application layers, and view the recent underperformance of the shares as a buying opportunity.”

“Jaluria expects Microsoft to grow steadily through Fiscal Year 2026, especially since it has plans to enter new areas of growth like hyper-automation while also continuing to expand its Office software users. As a result, the analyst set a $500 price target, which is about 31% higher than the current level, and gave it an Outperform rating,” as noted by TipRanks.com.

The post Record Day For AI Stocks: Broadcom (Nasdaq: AVGO), AMD (Nasdaq: AMD) and Microsoft (Nasdaq: MSFT) appeared first on 24/7 Wall St..