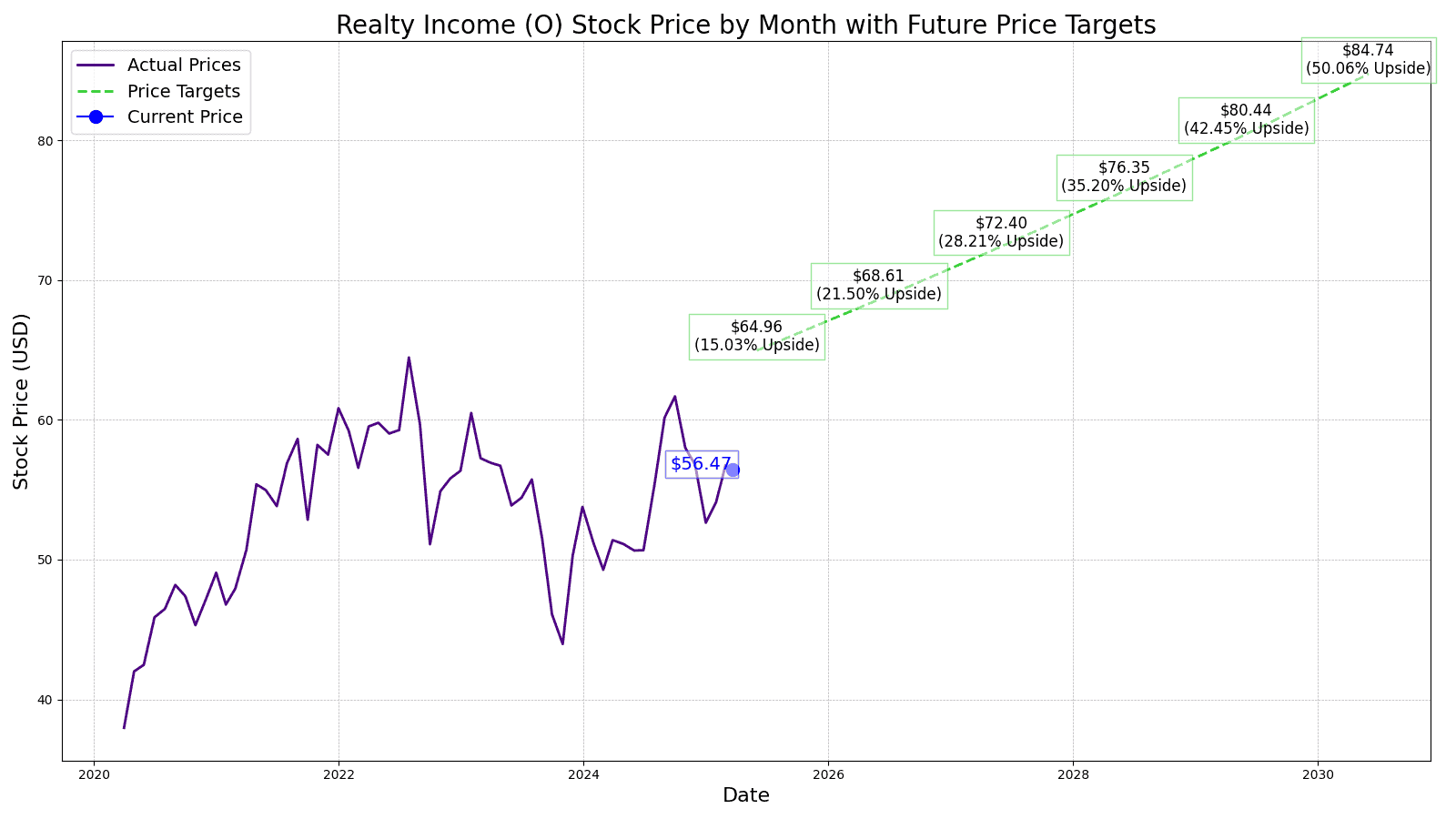

Realty Income (O) Stock Price Prediction and Forecast 2025-2030 (March 2025)

Despite having fallen -1.75% over the past month, shares of Realty Income (NYSE:O) have outperformed the market and avoided the major losses that have impacted other sectors more significantly than real estate. In fact, the real estate sector has only seen a loss of -1.55% over the past month, compared to -12.28% for consumer discretionary […] The post Realty Income (O) Stock Price Prediction and Forecast 2025-2030 (March 2025) appeared first on 24/7 Wall St..

Despite having fallen -1.75% over the past month, shares of Realty Income (NYSE:O) have outperformed the market and avoided the major losses that have impacted other sectors more significantly than real estate. In fact, the real estate sector has only seen a loss of -1.55% over the past month, compared to -12.28% for consumer discretionary and -11.61% for tech. And while the S&P 500, broadly, is down -3.87% year-to-date, O has rewarded investors with a 6.65% gain while paying a dividend that yields 5.75%.

That dividend — which pays out monthly and has for 657 consecutive months — is a large reason investors are confident in the stock moving forward. Another reason: its expanding footprint in the European market that has seen commercial properties with long-term net lease agreements added to its +13,000-property portfolio in the U.K., Spain and other countries.

Billing itself “The Monthly Dividend Company,” the real estate investment trust (REIT) blazed a new path in the field that numerous other REITs now follow. The track record of payments for O is remarkable, and since being listed on the NYSE in 1994, the REIT has increased its dividend every quarter for 108 straight quarters.

Having raised the payout for 30 consecutive years, Realty Income is now a Dividend Aristocrat, or a stock that is part of the S&P 500 and has increased its dividend for 25 consecutive years or more. Since its IPO three decades ago, Realty Income has been a phenomenal stock to own, providing investors with an astounding 5,110% total return. In comparison, the S&P 500 has returned less than 2,200%.

The question is, where does Realty Income stock go from here. 24/7 Wall Street offers readers insights into our assumptions about the stock’s prospects, what sort of growth we see in O stock for the next several years, and our best estimates for Reality Income stock price each year through 2030.

Key Points in This Article:

- Realty Income is the premiere dividend REIT that pays shareholders monthly, and the trust’s adjusted funds from operations (AFFO) has surged since 2019.

- While a still-high interest rate environment was a headwind for the industry, the outlook markedly improves as rates return to historical levels.

- Sit back and let dividends do the heavy lifting for a simple, steady path to serious wealth creation over time. Grab a free copy of “2 Legendary High-Yield Dividend Stocks“ now.

Realty Income (O) Recent Performance

Here’s a table summarizing the performance in share price, revenues, and adjusted funds from operations (AFFO) of O stock from 2019 to 2024:

| Year | Stock Price | Revenue* | Adjusted Funds From Operations (AFFO)* |

| 2019 | $71.30 | $1.488 | $1.050 |

| 2020 | $60.20 | $1.647 | $1.172 |

| 2021 | $71.59 | $2.080 | $1.488 |

| 2022 | $63.43 | $3.343 | $2.401 |

| 2023 | $57.42 | $4.078 | $2.774 |

| 2024 | $52.60 | $5.271 | $3.621 |

*Revenue and AFFO $billions.

The REIT ended 2019 on a high note, closing out the year with a 21% total return, but like the rest of the market, the next year would be turned upside down due to the pandemic. O stock ended 2020 with a greater than 11% loss. While Realty Income would bounce back sharply in 2022 with a 24% gain, it was a rally that could not be sustained due to rapidly rising inflation and a Federal Reserve determined to tame it. The central bank’s unprecedented 11 consecutive hikes in the federal funds rate would send the REIT market into a tailspin.

That’s because REITs borrow money to invest in new real estate and the dramatically higher rates they pay hit their bottom line hard. Realty Income tried to mitigate that by hitting the equity markets. From 2013 to 2020, O’s shares outstanding rose at a fairly consistent 8.8% annually. The onset of inflation and spiraling interest rates saw the REITs stock issuance surge to a 26% compound annual growth rate from 2020 to 2023. The Fed started to lower rates this year, but as inflation flared anew, the rate-easing policy seems to be on hold.

Through it all, however, Realty Income was able to continue increasing revenue and AFFO, which has surged 244.85% since 2019. The REIT has used those funds to continue rewarding shareholders with dividend hikes.

Key Drivers of Realty Income’s Stock performance

1. Global & Industrial Expansion: The REIT’s commercial portfolio, which now includes more than 13,000 properties, is expanding its presence in Europe. Last year, it grew significantly in the U.K. and Spain, having signed a €527 million deal with Decathlon, one of the world’s leading sports brands. Additionally, it is working to expand its global industrial footprint, which accounted for just 15% of the REIT’s portfolio in 2024.

2. Quality Tenants: Although the shock to the system was significant, Realty Income was able to withstand the stress test due to the quality of its tenant base. It counts dozens of top-shelf retail outlets amongst its tenants, including Amazon (NASDAQ:AMZN), Starbucks (NASDAQ:SBUX) and Chipotle Mexican Grill (NYSE:CMG).

3. Diversification: Its three largest tenants by space leased are Dollar General (NYSE:DG), Walgreens Boots Alliance (NASDAQ:WBA) and Dollar Tree (NASDAQ:DLTR). Although the dollar stores and pharmacy chain are encountering headwinds of their own, none represents more than 3% of the total portfolio, meaning its broad diversification reduces the impact any one tenant will have. It has also expanded into industrial markets, gaming, and data centers, as well as having a growing geographical footprint.

Realty Income (O) Stock Price Forecast for 2025

The current Wall Street consensus one-year price target for Realty Income stock is $60.54, good for potential upside of 7.83% based on today’s share price. Of the 12 analysts covering Realty Income, the current rating is a “Hold” with one-year price targets as high as $65.50 per share and as low as $54.00 per share.

However, 24/7 Wall Street sets its one-year price target for Realty Income at $64.96 per share, good for potential upside of 15.03% based on today’s share price. If we compare O’s price-to-AFFO versus its peers, such as Agree Realty (NYSE:ADC) or Simon Property Group (NYSE:SPG), we see they trade at an average P/AFFO of 12.31 while O goes for 10.52.

Realty Income’s share price estimates 2026 to 2030

Valuing Realty Income’s stock price for the coming years, we will take a look at expected revenue and AFFO and give our best estimate of the market value of the company by assigning a price-to-AFFO multiple.

| Year | Revenue* | AFFO* |

| 2026 | $3.87 | $3.263 |

| 2027 | $4.652 | $3.837 |

| 2028 | $5.582 | $4.512 |

| 2029 | $6.699 | $5.307 |

| 2030 | $8.039 | $6.241 |

*Revenue and AFFO in thousands.

How Realty Income’s Next 5 Years Could Play Out

Realty Income (O) Stock Price Forecast for 2030

Although Realty Income’s stock has steadily risen as the interest rate environment improved and because it no longer needs to to issue significant amounts of stock to offset borrowing costs, the REIT has continued to increase its dividend every quarter for the past six years. Its total return handily surpasses that of the S&P 500.

For 2030, we estimate AFFO reaches $6.2 billion with a P/AFFO of around 16, still well below its 10-year average, but more in line with many of its peers. That give us a price target of $84.74 per share.

| Year | Price Target | % Change From Current Price |

| 2025 | $64.96 | 15.03% |

| 2026 | $68.61 | 21.50% |

| 2027 | $72.40 | 28.21% |

| 2028 | $76.35 | 35.20% |

| 2029 | $80.44 | 42.45% |

| 2030 | $84.74 | 50.06% |

The post Realty Income (O) Stock Price Prediction and Forecast 2025-2030 (March 2025) appeared first on 24/7 Wall St..