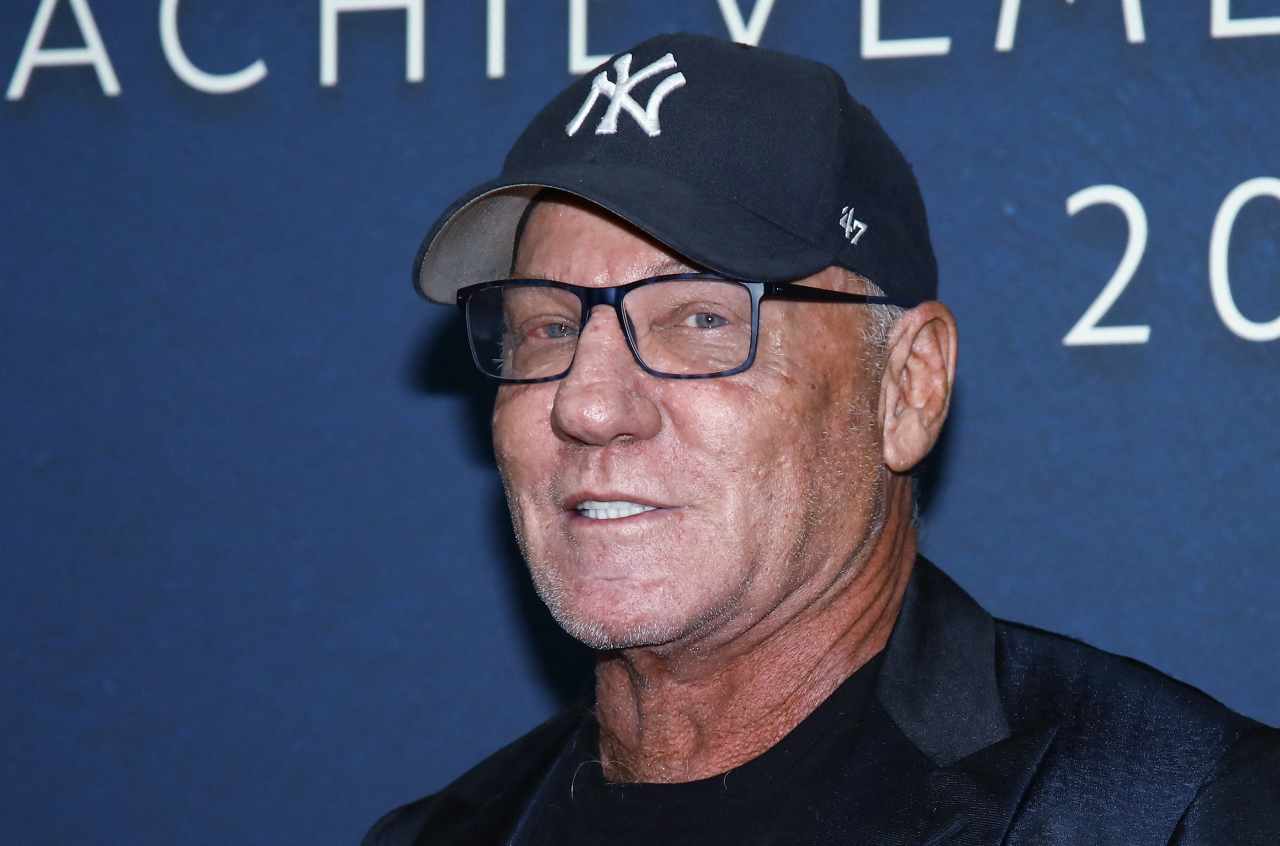

Ralph Lauren's Fiscal Q4 Revenue Jumps 8%

Ralph Lauren (NYSE:RL) reported its fiscal fourth-quarter and full-year 2025 results on May 22, with quarterly revenue growth of 8%, or 10% on a constant currency basis (exceeding the guidance range of 6% to 7%) and fiscal year revenue growth of 7% (8% in constant currency), due in part to record international performance. Adjusted operating profits grew by 24%. Management highlighted a new $1.5 billion share repurchase authorization and its recent 10% increase in the dividend, and outlined cautious but confident guidance for a fiscal 2026 that will be shaped by tariff risks and macroeconomic uncertainty. For the first time, international markets (Europe and Asia) provided the majority of Ralph Lauren's total revenue, fueling a company-wide margin expansion. Adjusted operating profit rose 24%, supported by a 260-basis-point adjusted gross margin increase to 69.2% in Q4. Europe led regional sales with 16% growth, followed by Asia (13%), while China posted greater than 20% revenue growth, maintaining a strong pace after prior quarters of double-digit percentage growth.International scale and premium brand positioning are driving structural improvements in revenue diversification and operational leverage, directly reducing dependence on more volatile North American markets and enhancing long-term earnings resilience.Continue reading

Ralph Lauren (NYSE:RL) reported its fiscal fourth-quarter and full-year 2025 results on May 22, with quarterly revenue growth of 8%, or 10% on a constant currency basis (exceeding the guidance range of 6% to 7%) and fiscal year revenue growth of 7% (8% in constant currency), due in part to record international performance. Adjusted operating profits grew by 24%. Management highlighted a new $1.5 billion share repurchase authorization and its recent 10% increase in the dividend, and outlined cautious but confident guidance for a fiscal 2026 that will be shaped by tariff risks and macroeconomic uncertainty.

For the first time, international markets (Europe and Asia) provided the majority of Ralph Lauren's total revenue, fueling a company-wide margin expansion. Adjusted operating profit rose 24%, supported by a 260-basis-point adjusted gross margin increase to 69.2% in Q4. Europe led regional sales with 16% growth, followed by Asia (13%), while China posted greater than 20% revenue growth, maintaining a strong pace after prior quarters of double-digit percentage growth.

International scale and premium brand positioning are driving structural improvements in revenue diversification and operational leverage, directly reducing dependence on more volatile North American markets and enhancing long-term earnings resilience.