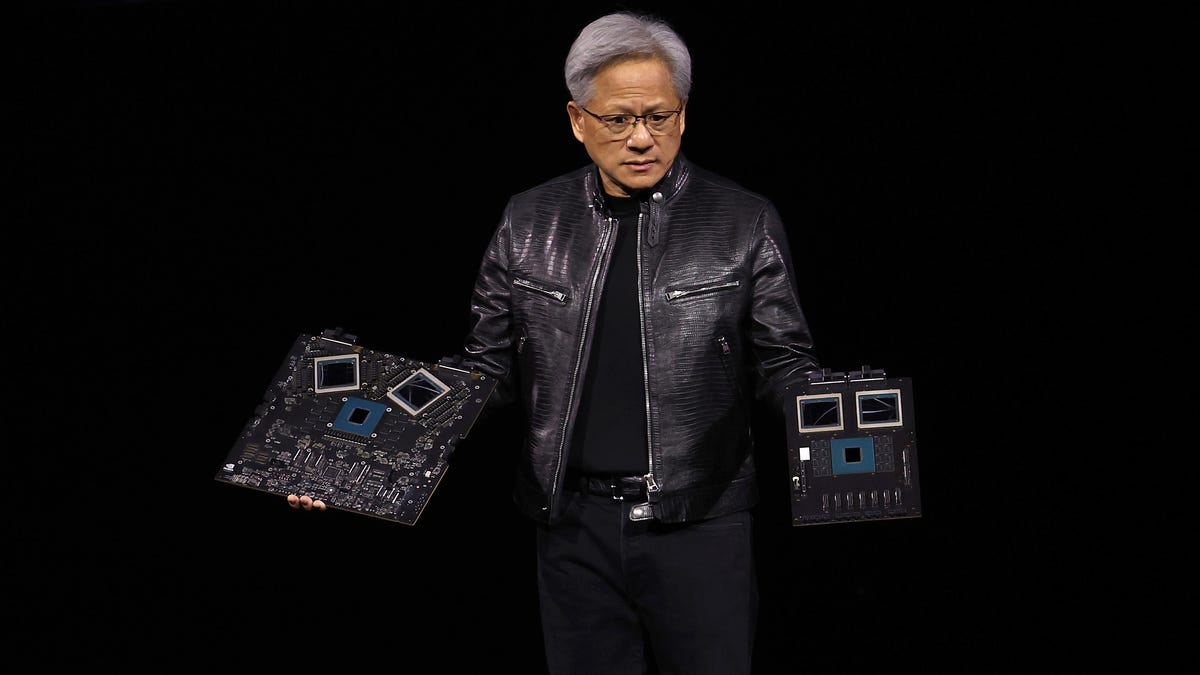

Opinion: Billionaire Stanley Druckenmiller, After Dropping This AI Giant Last Year, Could Be Coming Back to It During the Nasdaq Correction

With the S&P 500 and Nasdaq in correction territory, you may not be feeling very optimistic about investing. But now is actually an excellent time to buy stocks because many of yesterday's highfliers are today's dirt cheap deals. So, a time of market decline represents the perfect moment to get in on a quality company at a discount, with the next step being to hang on for the long term to benefit.And today, one billionaire investor in particular may be taking advantage of this market moment. Billionaire Stanley Druckenmiller has a long track record of success, delivering an average annual return of 30% over 30 years at Duquesne Capital Management without any money-losing years. He now manages $3.7 billion as head of the Duquesne family office.But last fall, Druckenmiller said he was disappointed with one of his latest investing moves. He sold an artificial intelligence (AI) stock that's soared more than 1,900% over the past five years -- and he expressed interest in getting back in on the growth story at the right valuation. Druckenmiller has likely noticed the significant drop in this player's price in recent weeks. In my opinion, he might be buying this stock for a bargain during the Nasdaq correction.Continue reading

With the S&P 500 and Nasdaq in correction territory, you may not be feeling very optimistic about investing. But now is actually an excellent time to buy stocks because many of yesterday's highfliers are today's dirt cheap deals. So, a time of market decline represents the perfect moment to get in on a quality company at a discount, with the next step being to hang on for the long term to benefit.

And today, one billionaire investor in particular may be taking advantage of this market moment. Billionaire Stanley Druckenmiller has a long track record of success, delivering an average annual return of 30% over 30 years at Duquesne Capital Management without any money-losing years. He now manages $3.7 billion as head of the Duquesne family office.

But last fall, Druckenmiller said he was disappointed with one of his latest investing moves. He sold an artificial intelligence (AI) stock that's soared more than 1,900% over the past five years -- and he expressed interest in getting back in on the growth story at the right valuation. Druckenmiller has likely noticed the significant drop in this player's price in recent weeks. In my opinion, he might be buying this stock for a bargain during the Nasdaq correction.