Nvidia's sales growth just isn't sustainable

The semiconductor giant's historic run may face a harsh reality check, according to this expert.

Nvidia (NVDA) reported impressive fourth quarter results with revenue exploding 78 percent, but the semiconductor giant's historic run may face a harsh reality check. Kim Forrest, Chief Investment Officer at Bokeh Capital Partners, joined TheStreet to discuss why 2025 won't deliver the "supercalifragilisticexpialidocious growth" investors have come to expect.

Related: Nvidia surprises with earnings, guidance

Full Video Transcript Below:

CONWAY GITTENS: So what are your biggest takeaways from Nvidia's fourth quarter results? Is there anything that investors are overlooking and how does it shape your outlook for the stock?

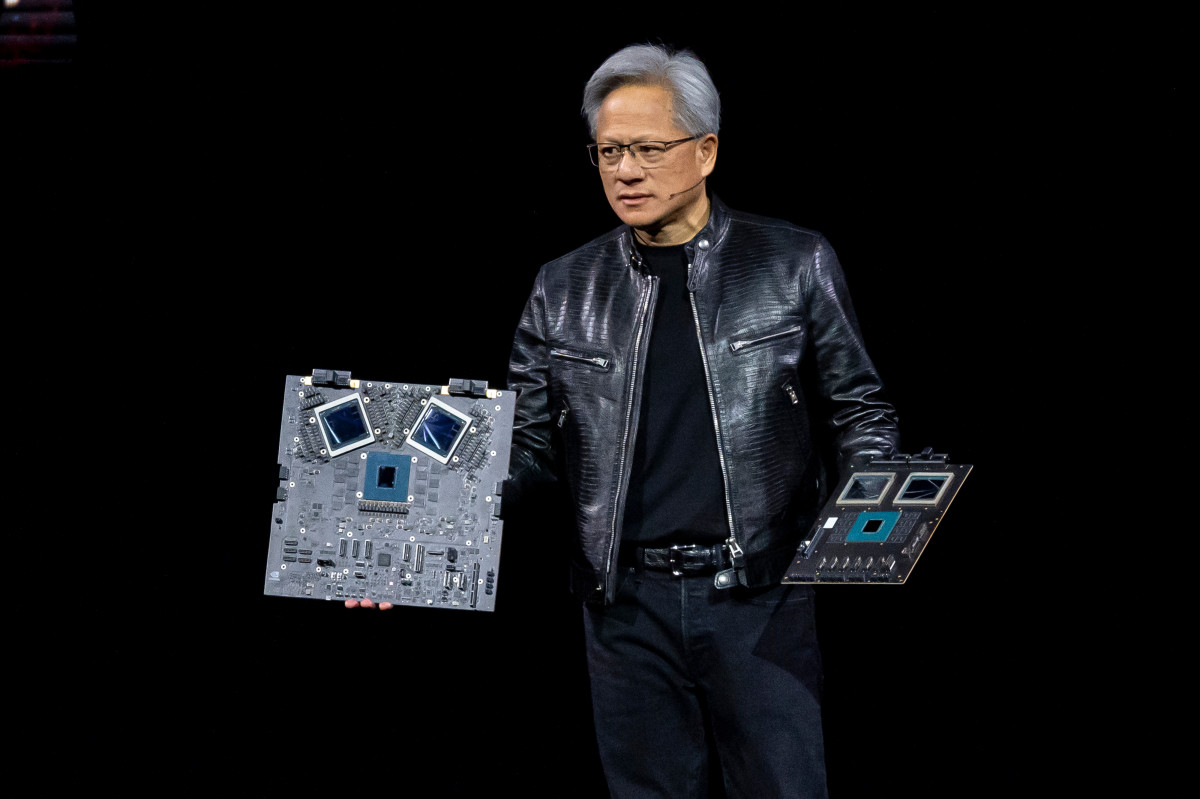

KIM FORREST: Sure well, I'm going to have a little more nuanced view on this stock. I think it is an incredible achievement that they've done for the past, let's say, 2 and 1/2 years, where they doubled their revenue and then doubled it again. Now, I think a lot of, well, retail investors may be expecting that. And I don't know that that's really logical. But what this quarter's announcement said is the demand for the product continues to be strong. They can and are delivering it. And the newest product, Blackwell is being shipped, which that was a little bit of a concern. It's a new product. And, you know, if you've been following technology for any time, you know, new products behave badly sometimes. And, you know, the overheating of that chip was a real concern. And it looks like that's not a terrible concern for the company. But looking forward, you know, I don't know that it's reasonable to expect it to double in, in the same sort of time period it has in the past.

CONWAY GITTENS: So Nvidia saw a sales growth of a whopping 78% in the fourth quarter. It also provided strong guidance. So can Nvidia continue this historic run in 2025?

KIM FORREST: I'm going to say no. And why not? Well, because this is the law of large numbers. Although the companies who are buying their products, which include OpenAI Microsoft. Right they're kind of a group. They're meta, Amazon, and Google, they have all released what they're going to spend this year, and it's pretty much in line with what they spent last year. But you have to understand this. Whenever they're talking about data centers, that's not just the actual chips and the blades and the computers, but it's also the whole infrastructure. So I think that we can expect good growth, not stupendous. Supercalifragilisticexpialidocious growth.

CONWAY GITTENS: So dig deeper into that. For me, the Q1 forecast implies about a 65% annual sales growth rate, but that's way down from the 262% the prior year. So doesn't that mean a corresponding slowdown in the trajectory of the stock?

KIM FORREST: Yes, it does. And I think that is what caused a little bit of the sell off last night too. And again a rebound. Like who out there that sells. And I keep coming back to this because I come from the world of software. And I think software and intellectual property services, we'll just put it that way. Which software kind of is they have no cost of goods sold. None you know, like one an additional copy of something costs nothing. You send it to somebody in an email, you give them permission to access it. That is the best margin in the world.

We're talking about a company that physically makes things, and they have somebody else make their product right, and they're still able to get these outrageous margins. But more than that, they are growing at like this unbelievably high rate. And I think that's interesting. But I think investors have to know that if they look backwards, that is not likely to happen unless something incredible happens in the future where there is more demand for these chips, the people who are demanding them are not growing in number. They are now executing what their strategy is. And that's what we saw in the last two years, was the number of participants in the large language AI model market grew dramatically. And it looks like that is not that cannot continue. We just don't have enough money in the world for it or quite frankly, the demand.