Nvidia 'very vulnerable' to U.S.-China trade war, analyst warns

Nvidia's future may be in jeopardy as geopolitical tensions rise.

Shares of Nvidia (NVDA) took a beating after disclosing that it would take a $5.5 billion hit from the U.Ss government’s new controls on its semiconductor exports to China. Ed Yardeni, President, Yardeni Research, joined TheStreet to discuss the market implications.

Related: Analysts revisit Nvidia stock price targets as US restricts China chip sales

Full Video Transcript Below:

ED YARDENI: Nvidia got to be a very large component of the stock market. The so-called Magnificent Seven, which includes Nvidia, got to be 30% of the value of the S&P 500. That's obviously an extreme. But that percentage is coming down. All in all, I would say, and I know it doesn't feel like it, but compared to the past sell offs, this one hasn't been that bad. Given all the concerns that have been out there. We're still talking about a market that's down by less than 20% and that's called a correction. And the corrections usually don't last that long. And they usually lead to turnarounds. They create buying opportunities. I there's still a potential for a bear market, which would be a decline of 20% or more. Clearly, people are worrying about that, but I'm kind of in the correction camp viewing this situation as an opportunity to buy. And, you know, I think at some point here, Nvidia may very well be an opportune stock because a lot of what's going on within Nvidia has to do with tariffs. And to the extent that we're moving, we move in the right direction there. That could take the pressure off the stock. But Yeah, I think it's better if the so-called S&P 493, the ones that are not the Magnificent Seven, do better. And all in all, they've held up much better than the Magnificent Seven.

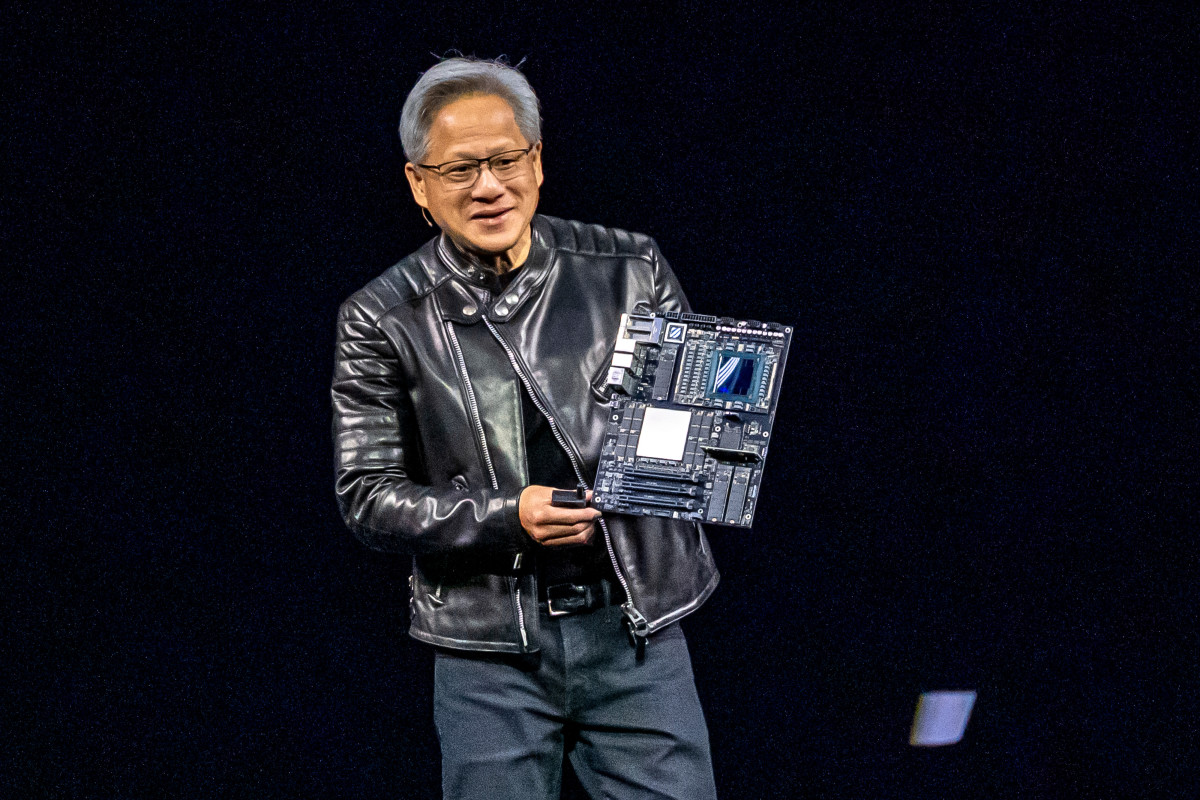

Nvidia clearly is a very impressive company, manufacturing semiconductor chips that have turned out to be very important for artificial intelligence. They can also be used to combine into supercomputers. I don't see that their leadership is going to change there. But the question is, what happens if they can't produce these chips in Taiwan, for example, because of a permanent blockade by china? So NVIDIA is still very vulnerable to geopolitical consequences of the trade war between China and the United States.